Revised Form 16 for Financial Year 2018-19

The Central Board of Direct Taxes has notified changes to Form 16 for the financial year 2018-19.

Under the new format of Form 16, Part B will contain information about the exempt allowances under section 10 namely, house rent allowance, leave travel concession, leave encashment, gratuity, etc.

CBDT revises Form 16: Key things you should know

Form 16 is the annual salary TDS (tax deducted at source ) certificate issued by an employer to employee. It consists of 2 parts, Part A and Part B. Part A contains the employer, employee and employment details such as PAN, address, summary of tax deducted and deposited quarterly, etc. Part B consists of the details of income from salary, allowances exempt and deductions claimed.

The Central Board of Direct Taxes (CBDT) has notified changes to Form 16 for the financial year 2018-19. Part B has been amended to include details about the allowances exempt under section 10 such as house rent allowance, leave travel concession, etc and deductions allowed under Chapter VI-A from section 80C to 80U of the Income Tax Act. The new format of Form 16 is made effective from May 12, 2019. Therefore, employers issuing Form 16 for the financial year 2018-19 will have to issue them in the new format.

Changes To Form 16

Under the new format of Form 16, Part B will contain information about the exempt allowances under section 10 namely, house rent allowance, leave travel concession, leave encashment, gratuity, etc.

Part B will also contain information about the deductions allowed under Chapter VI-A namely, section 80C – payments made towards life insurance premium, tuition fees for children, section 80CCD – contribution to pension scheme, section 80D – medical insurance premium, section 80E – interest paid on loan taken for higher education, section 80G – donations etc.

Impact on ITR filing

ITR-1

Salaried individuals resident in India can file their returns in ITR-1 for total income up to Rs 50 Lakh. Such individuals can report income from salary, one house property, income from other sources and agricultural income up to Rs 5,000 in the ITR-1 form.

The ITR-1 form requires broad details of the components of income from salary i.e., salary, perquisites and profits in lieu of salary. And a complete break-up of allowances exempted under section 10 and deductions under Chapter VI-A as mentioned above.

Taxpayers will be able to get this information from the Form 16 issued under the new format. If you use an online platform to file your ITR, these details can be automatically populated to your ITR, minimising your effort and helping you e-file accurately.

ITR-2

Salaried individuals who are not eligible to file their return in ITR-1 can file their return in ITR-2. Specifically, resident individuals having total income exceeding Rs 50 Lakh, Non-resident individuals and Individuals who are Director in any company or invested in unlisted equities have to file their return in ITR-2.

Salaried individuals who earn income from business or profession are required to file either ITR-3 or ITR-4.

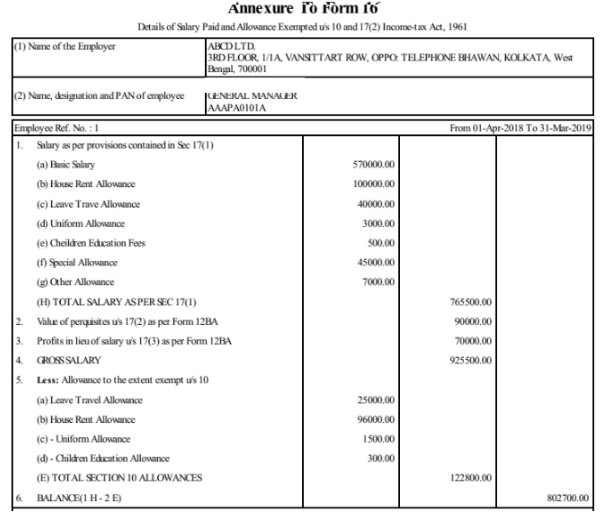

In the filing under ITR-2, taxpayers have to submit complete break-up of the details of various components of salary furnishing the specified amounts falling under salary, perquisites and profits in lieu of salary. This information can be obtained from the annexure to Form 16 provided by an employer. A screen-shot of a typical example of the annexure is provided below:

In addition to the above, the details of allowances and deductions have to be furnished similar to the disclosure required under ITR-1.

Taxpayers have to provide employer-wise details in case of salary received from more than one employer in a financial year.

As discussed here, taxpayers who will receive the new format of Form 16 must ensure their tax filing is accurate for salary-related information as per new ITR forms for the AY2019-20.

Source : CNBCTV18

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates