In the Memorandum submitted to 7th pay commission, the NCJCM demanded the pay commission that the minimum Pay should be fixed at Rs.26000/-.

Minimum Pay should be Rs.26000-NCJCMs Justification.

Detailed information with statistical data has been provided in the report for justifying the demand to fix Minimum wage at Rs.26000/-. It appears that NCJCM is firm on its claim for minimum wage. In the Meeting held recently with NCJCM , the 7th pay commission confronted with the price quoted for essential commodities by NCJCM. Hence the NCJCM asked its affiliates to obtain price list from all the Metros to establish their claim on price is correct, so that the minimum wage can be arrived as per Dr. Dr. Aykhrod formula to Rs.26000/-. The Chapter V of the NCJCM’s Memorandum submitted to 7th pay commission describes the need and reasons for minimum wage to be assigned at Rs.26000.

Chapter V

Minimum Wage

All the Pay Commissions were of the firm opinion that wages cannot be determined on any single principle but has to be based upon a combination of all the enunciated principles or those principles are to be factored into the process of quantification. Since the Government as an employer had not been able to grant the need based minimum wage to its own employees till date we are of the firm opinion that the 7th CPC must endeavour to compute the wage structure on 15th ILC norms. We suggested two other principles to be factored into the quantification of pay beyond the minimum level. We enumerate hereunder the factors to be taken into account:

(1) The Need-Based Minimum Wage concept to compute pay at the minimum level.

(2) The intrinsic value of the job content of each grade and post at the intermediary level to be assessed by an expert committee. Pending finalization of such a study, the Commission may maintain the presently existing vertical and horizontal relativities.

(3) To take into account the outside rates to determine the pay package at senior levels of bureaucracy but maintain the ratio between the minimum and maximum at 1 : 8 (MTS to Secretary to Govt. of India).

5.2. We make the above suggestions as just and reasonable on the following grounds:

(1) The Fair Wage Committee has held that an industry which is incapable of paying minimum wage has no right to exist.

(2) 88% of Central Government Employees are industrial or operational workers.

(3) The need based minimum wage concept formulated by Dr. Aykroyd and approved by 15th ILC was considered the most important principle in computing salary of Government employment especially of lower level functionaries, by the 2nd, 3rd, 4th and 6th CPC.

(4) It is only the fear of a heavy financial implication and the incapacity of the Indian economy at the relevant point of time, to meet the extra expenses that the 2nd, 3rd and 4th CPCs were constrained to alter the formula itself, detrimental to the interest of employees, basing their conclusion on the opinion of certain nutritional experts. The legitimacy provided to Dr. Aykroyd formula by the 15th ILC (in which the representative of Labour, Employers and Government participated) was not available for any other conceptual frame work proposed by any other “experts”. The 4th Pay Commission cited the per capita net national product increase over the years to justify lower minimum wage than what could have been as per the ILC norms. It could be seen that the earlier Pay Commissions had adopted a different principle other than the Dr. Aykroyd formula due to financial constraints.

(5) Despite elaborately detailing the concept of living wage and the purport and relevance of the amendment to the preamble of the Indian Constitution, the 4th CPC did not compute the pay structure on the basis of need based minimum wage formula. They stated that since the increase in the per capita net national product is an indication of the health of economy, they may be unable to fix the minimum wage at an amount higher than Rs.750/-.

(6) There had been no indication in the terms of reference by which the 5th CPC could have examined the need based minimum wage concept evolved by the 15th ILC. Still they dwelt upon the said concept in detail in their report. In fact they advocated that the 25% addition suggested by the Supreme Court to enable the worker to meet the expenses, viz., children education, medical requirements, social obligation connected with festivals, marriages, etc. must be added to arrive at the minimum wage. However, while computing the minimum wage, they discarded the theory of Need based Minimum wage. They adopted the percentage increase over ten years of the per capita net national product as the sole criterion to determine the minimum pay. (In other words they advocated the constant relative income criterion as the most equitable norm for fixing the minimum wage of the Central Govt. employees.). In order to arrive at the minimum pay, the Commission thus added 30.9% over the emoluments of a lowest paid employee as on 1.1.1996

(7) The 6th CPC adopted the 15th ILC norms to compute the minimum wage but made several changes to the concept Viz., the retail prices of the commodities which goes into the reckoning was altered; the stipulated 10% for housing and 25% for social obligations, medical, children education, etc. were discarded on the specious plea that separate allowances had been granted. 15th ILC had factored 7.5% as housing component in the computation of minimum wage. The question of incorporating the cost of requirement for medical, education and other social obligation was the subject matter of litigation before the Supreme Court. The Hon’ble Court directed that 25% of the minimum wage so computed must be added as a factor for the above requirement of a worker, which had not been taken into account in the ILC norms.

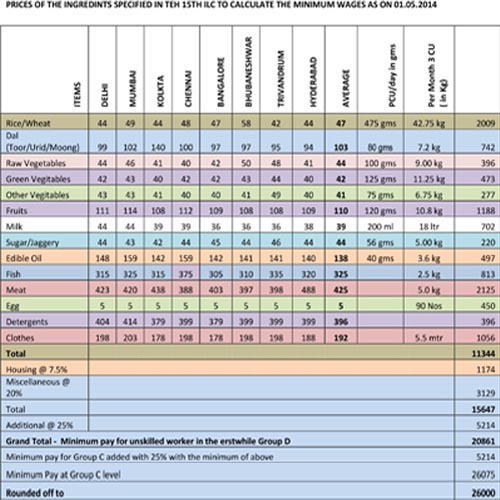

5.3 The contention of the 6th CPC that since children education allowance, Medical and house rent allowances are specially granted to the Central Govt. employees, the same must be taken out of the reckoning is not only wrong but also amounts to contradiction of a stand taken by the Highest judiciary of the country- Supreme Court. The 6th CPC has failed to take note of the fact that the allowances, be it HRA, Children Education allowance or Medial, granted are awfully insufficient to meet the requisite expenses. Had it not been the case, the 3rd CPC also ought to have taken the similar stand adopted by the 6th CPC. The computation appearing in page No. 60, Chapter 6 (3rd CPC report) establishes our view in the matter. We have given in Table (5.1) the computation of minimum wage as per 15th ILC norms. The retail prices of the commodities/articles are the average of the retail prices ruling as on 1.1.2006 at the following cities:

1, New Delhi. 2. Mumbai, 3 Chennai, 4., Kolkata , 5. Hyderabad, 6. Bhubaneswar, 7. Trivandrum and 8. Bangalore.

5.4 The minimum wage as per our computation works out to Rs.20,861/-. This must be the minimum wage for the unskilled worker as per the ILC norms. In Central Government employment presently there are no unskilled labour. The lowest level of employment is multiskilled worker/employee. The minimum educational qualification prescribed is either ITI or matriculation (10th Standard). The percentage increase of the wages of a skilled worker to that of an unskilled worker on an average had been more than 25% all throughout (2440-3050=610 i.e. 25% of Rs. 2440) We have therefore added 25% to arrive at the minimum pay for the lowest employee in Government service, which comes to Rs. 26,075/- , i.e. Rs. 26,000/- when rounded off. While computing the minimum wage, we have gone strictly as per the norms prescribed by the 15th ILC. However, we must state that the three units norm for the family prescribed by Dr. Aykroyd in the present situation is far below the requirement. The family consists of not only husband, wife and two children but invariably includes the parents of the head of the family. In Indian conditions, they totally depend upon the earning employee. If we factor two more units for the family concept, the minimum wage so worked out will increase by two third. In quantum terms, the pay at the lowest level of the Central Government will then be Rs. 43,330.

Table 5.1

PRICES OF THE INGREDINTS SPECIFIED IN TEH 15TH ILC TO CALCULATE THE MINIMUM WAGES AS ON 01.05.2014

20% of the net minimum miscellaneous charges towards fuel, electricity, water charges, etc

Housing at the rate of 7.5% of net minimum

Addition Expenditure at the rate of 25% includes expenditure towards education, marriage etc of the children, Medical treatment, recreation, festivals etc. as per the Supreme Court decision in 1991.

5.5. Incidentally, we may mention that the minimum wages at the level of an unskilled worker as per recent wage agreement in Coal India Ltd. is Rs.29697/-. as per details given hereunder

(Table 5.2.)

| Basic Pay | Rs. 15, 712 | |

| Dearness allowance | 29.6% | |

| Special allowance | 4.0% | |

| Special DA. | 1.795% | |

| Attendance bonus | 10% | |

| Total: | 49.395% | Rs. 7132.46 |

| Total salary: | Rs.22844.46 | |

| At the MTS level | 22.844.46 x 125% | Rs.28555.58 |

5.6 The per-capita Net National Product increase at factor cost between – (2004-05 – 2011-12) years as per the Economic Survey for 2012-13 presented to Parliament is 57.55..%. The exact figures for the years 2012-13 and 2013-14 is not available from official websites. These figures are needed to arrive at a percentage of increase for the last 10 years. On the basis of the present data, the increase registered in quantum terms will work out to Rs. 22857, which is more than the minimum wage computed as per the 15th ILC norms.

(Table 5. 3)

| A. | Per Capita NNP at constant price for 2004-05 | Rs. 24,143 |

| B. | Per capita NNP at constant price for 2011-12 | Rs. 38,037 |

| C. | The increase registered over 8 years. | Rs. 13,894 |

| D. | Percentage increase over 2004-05 | 57.54877 |

| E. | Emoluments as on 1.1.2014 | Rs. 14,000 |

| F. | 57.55% of Rs. 14,000. | Rs. 8,057 |

| G | Wage to be fixed as on1.1.14 | Rs. 22057 |

5.7. For the reasons stated in the preceding paragraphs and more specifically for the reason that the Government has presently the capacity to pay as detailed in Chapter III of this memorandum, we request the 7th CPC to recommend the minimum pay to be assigned to the lowest level of Group C functionary in Government of India service at Rs. 26,000/-