Central Government always calculate their salary every month but when a person wants to apply for recruitment of a post in Govt, he wants to know the in-hand salary every month for the level in which they will be recruited.

Table of Contents

Central Govt employees Salary Calculator 2024 to calculate salary

This Central Govt employees in hand salary calculator 2024 will help govt servants calculate salary from pay scale to find in hand salary of particular Basic pay of a Post.

How to calculate the in-hand salary ?

The in hand salary is nothing but the take home pay after deduction from Gross salary

What is the formula to calculate hand salary?

Gross Salary – Deductions = In-hand salary

The in-hand salary of the Central Government employees can be calculated using this 7th cpc salary calculator.

Monthly Salary Component in Government pay scale calculator

The monthly salary components incorporated in this Central Govt Employees in hand Salary Calculator 2022 is provided below

Basic Salary + DA+ HRA+ TA = Gross Salary

1.Basic salary for a new recruit

The first cell of the particular Level will be fixed as Basic pay to a newly recruited central government employee. [ Select the first cell in the level in which you are recruited for first year]

2.Dearness Allowance rate

Existing rate of DA [ The DA rate is 50% with effect from 1st January 2024]

3.House rent Allowance (HRA)

HRA is paid at the rate of 27%, 18% and 9% for X, Y and Z cities at present. It will be increased 30%,10% and 10% when DA reaches 50%. Like wise now DA reached 50% and the HRA Rates is increased to 30%,20% and 10% for X, Y and Z cities respectively.

What are all X,Y and Z cities ?

According to the population the cities are classified into X, Y and Z category cities.

The X Category Cities which which are entitled for 30% HRA

|

S.No

|

States/ Union Territories

|

Citites Classified as “X”

|

|

1

|

Andhra Pradesh/ Telangana

|

Hyderabad (UA)

|

|

2

|

Delhi

|

Delhi

(UA)

|

|

3

|

Gujarat

|

Ahmadabad (UA)

|

|

4

|

Karnataka

|

Bangalore/

Bengaluru (UA)

|

|

5

|

Maharashtra

|

Greater Mumbai (UA), Pune (UA)

|

|

6

|

Tamil

Nadu

|

Chennai

(UA)

|

|

7

|

West Bengal

|

Kolkata (UA)

|

The Y Category Cities which which are entitled for 20% HRA

|

S. No

|

States/ Union Territories

|

Citites Classified as “X”

|

|

1

|

Andhra Pradesh/ Telangana

|

Vijayawada (UA), Warangal (UA), Greater Visakhapatnam (M.Corpn),

Guntur (UA), Nellor (UA)

|

|

2

|

Assam

|

Guwahati

(UA)

|

|

3

|

Bihar

|

Patna (UA)

|

|

4

|

Chandigarh

|

Chandigarh

(UA)

|

|

5

|

Chhattisgarh

|

Durg-Bhilai Nagar (UA), Raipur (UA)

|

|

6

|

Gujarat

|

Rajkot

(UA), Jamnagar (UA), Bhavnagar (UA), Vadodara (UA), Surat (UA)

|

|

7

|

Haryana

|

Faridabad*(M.Corpn.), Gurgaon*(UA)

|

|

8

|

Jammu

& Kashmir

|

Srinagar

(UA), Jammu (UA)

|

|

9

|

Jharkhand

|

Jamshedpur (UA), Dhanbad (UA), Ranchi (UA), Bokaro Steel City (UA)

|

|

10

|

Karnataka

|

Belgaum

(UA), Hubli-Dharwad (M.Corpn.), Mangalore (UA), Mysore (UA), Gulbarga (UA)

|

|

11

|

Kerela

|

Kozhikode (UA), Kochi (UA), Thiruvanathapuram (UA), Thrissur (UA),

Malappuram (UA), Kannur (UA), Kollam (UA)

|

|

12

|

Madhya

Pradesh

|

Gwalior

(UA), Indore (UA), Bhopal (UA), Jabalpur (UA), Ujjain (M. Corpn)

|

|

13

|

Maharashtra

|

Amravati (M. Corpn.), Nagpur (UA), Aurangabad (UA), Nashik (UA),

Bhiwandi (UA), Solapur (M. Corpn), Kolhapur (UA), Vasai-Virar City (M.

Corpn.), Malegaon (UA), Nanded-Waghala (M. Corpn.), Sangli (UA)

|

|

14

|

Odisha

|

Cuttack

(UA), Bhubaneshwar (UA), Raurkela (UA)

|

|

15

|

Puducherry

|

Puducherry/ Pondicherry (UA)

|

|

16

|

Punjab

|

Amristar

(UA), Jalandhar (UA), Ludhiana (M. Corpn.)

|

|

17

|

Rajasthan

|

Bikaner (M. Corpn.), Jaipur (M. Corpn.), Jodhpur (UA), Kota (M.

Corpn.), Ajmer (UA)

|

|

18

|

Tamil

Nadu

|

Salem

(UA), Tiruppur (UA), Coimbatore (UA), Tiruchirappalli (UA), Madurai (UA),

Erode (UA)

|

|

19

|

Uttar Pradesh

|

Moradabad (M. Corpn.), Meerut (UA), Ghaziabad*(UA), Aligarh (UA),

Agra (UA), Bareilly (UA), Lucknow (UA), Kanpur (UA), Allahabad (UA),

Gorakhpur (UA), Varanasi (UA), Saharanpur (M. Corpn.), Noida*(CT), Firozabad

(NPP), Jhansi (UA)

|

|

20

|

Uttarakhand

|

Dehradun

(UA)

|

|

21

|

West Bengal

|

Asansol (UA), Siliguri (UA), Durgapur (UA)

|

All other cities which are not listed in X and Y cities are come under Z category. The rate of HRA is 10%

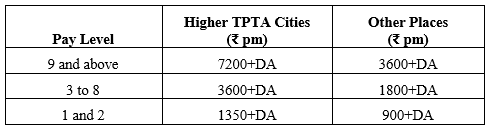

4.Travelling Allowance

Travelling Allowance is revised in 7th Pay Commission

The 7th CPC Travelling Allowance rate is below

What are all higher TPTA Cities ?

19 Cities are classified under Higher TPTA Cities.

1. Ahmedabad (UA), 2. Bengaluru (UA), 3. Chennai (UA), 4. Coimbatore (UA), 5. Delhi (UA), 6. Ghaziabad (UA), 7. Greater Mumbai (UA), 8. Hyderabad (UA), 9. Indore (UA), 10. Jaipur (UA), 11. Kanpur (UA), 12. Kochi (UA), 13. Kolkata (UA), 14. Kozhikode (UA), 15. Lucknow (UA), 16. Nagpur (UA), 17. Patna (UA), 18. Pune (UA), 19. Surat (UA)

Deductions in Central Govt Employees in hand Salary Calculator

All the mandatory deductions and other deductions if any are to be entered in this Deductions in Central Govt Employees in hand Salary Calculator to know the exact take home pay.

Only two deductions are mandatory for CG Staffs those who are appointed on or after 1.1.2004. For those who appointed before 1.1.2004, GPF and CGEGIS are mandatory

| S.No | Appointed before 1.1.2004 | Appointed on or after 1.1.2004 |

| 1 | GPF | NPS Subscription for Tyre I Account |

| 2 | CGEGIS 1980 | CGEGIS 1980 |

[Note :Other than this, Income Tax will be deducted if Annual Income is comes under IT Bracket. Also HBA deduction will be made if House Building Advance availed. ]

1.New Pension Scheme Subscription

Central Government Employees those who are appointed on or after 1.1.2004 are covered under NPS.

The Tyre I account is mandatory for NPS subscribers. The NPS Subscription is 10 % of basic pay + DA.

10 % of the salary is deducted as subscription from the salary of the govt servants and Central Government pays 14% to subscribers account as employers contribution

2.Central government employees Group Insurance Scheme

Since the Central government employees Group Insurance Scheme is not yet revised for 7th Pay Commission regime, the old rate is continued.

The CGEGIS Rates are

- Group A = Rs.120 [ Level 10 and above]

- Group B = Rs.60 [ Level 6 to Level 9]

- Group C = Rs.30 [ Level1 to Level 5]

Enter this rate at Insurance field with other Insurance deductions if any in the Central Govt employees Salary calculator given below