LTC Entitlements of Fresh Recruits for the first 8 Years has explained with four Illustrations

Frequently Asked Questions on LTC entitlements of Fresh Recruit

No. 31011/7/2014-Estt.(A-IV)

Department of Personnel and Training

Establishment (A-IV)

Dated: 26th September, 2014

North Block, New Delhi

Frequently Asked Questions (FAQs) on LTC entitlements of Fresh Recruit

The 6th CPC had recommended that Fresh Recruits in the Central Government may be allowed to travel to their Home Town along with their families on three occasions in a block of four years and to any place in India on the fourth occasion. This was accepted by the Government and orders were issued vide DoPT O.M. No. 31011/4/2008-Estt.(A) dated 23rd September, 2008.

2. This Department receives a number of references seeking clarifications from various Ministry/ Departments about the year wise LTC entitlements of Fresh Recruits. Based on the same, a set of frequently asked questions have been answered as under:

Question 1. What are the LTC entitlements of a Fresh Recruit?

Answer: Fresh recruits to the Central Government are allowed to travel to their home town along with their families on three occasions in a block of four years and to any place in India on the fourth occasion. This facility shall be available to the fresh recruits only for the first two blocks of four years applicable after joining the Government for the first time.

Question 2. How are the two blocks of four years applied to the Fresh Recruit?

Answer: The first two blocks of four years shall apply with reference to the initial date of joining the Government service even though the Govt. servant may change the job within the Government subsequently. However, as per Rule 7 of CCS (LTC) Rules, 1988, the LTC entitlement of a fresh recruit will be calculated calendar year wise with effect from the date of completion of one year of regular service.

Question 3. Are the LTC blocks of four years in respect of Fresh Recruits same as the regular blocks like 2010-13, 2014-17?

Answer: No. The first two blocks of four years of fresh recruits will be personal to them. On completion of eight year of LTC, they will be treated at par with other regular LTC beneficiaries as per the prescribed blocks like 2014-17, 2018-21 etc.

Question 4. If a fresh recruit does not avail LTC facility in a particular year, can he/she avail it in the next year?

Answer: No. Carryover of LTC to the next year is not allowed in case of a fresh recruit as he is already entitled to every year LTC. Hence, if a fresh recruit does not avail of the LTC facility in any year, his LTC will deem to have lapsed with the end of that year.

Question 5. How will the LTC entitlements of a Fresh Recruit be exercised after the completion of eight years of service?

Answer: (a) After the completion of eight years of service, when the next LTC cycle of fresh recruit coincides with the beginning of the second two year block (eg. 2016-17) of the running four year block (2014-17), he will be eligible only for ‘Home Town’ LTC if he/she has availed ‘Any Place in India’ LTC in the eighth year. Cases, where the new LTC cycle of fresh recruit coincides with the second year of the running two year block (ex. 2017 of 2016-2017), he will not be eligible for LTC in that year. Refer illustrations 1 & 3 for further explanation.

(b) At the end of the eighth year of LTC, when the new LTC cycle of a fresh recruit coincides with the beginning of a regular four year block, his entitlement in the regular block will be exercised as per the usual LTC Rules. Refer illustration 2.

Question 6. How will the LTC entitlement computed in case of a fresh recruit joining the service on 31st December of any year?

Answer: A fresh recruit who joins the Government service on 31st December of any year, will be eligible for LTC w.e.f. 31st December of next year. Since, 31st December is the last date of a calendar year, his first occasion of LTC ends with that year. Hence, he may avail his first Home Town LTC on the last day of that year. From next year onwards he would be eligible for the remaining seven LTCs. Refer illustration 3.

Question 7. How will the entitlements of a fresh recruit be computed who has joined the Govt. service before 01.09.2008?

Answer: A fresh recruit who has joined Government service before 01.09.2008 (i.e before the introduction of this scheme) and has not completed his first eight years of service as on 01.09.2008 will be eligible for this concession for the remaining time-period till the completion of first eight years of his/ her service. Refer illustration 4.

Question 8. Can a fresh recruit whose Home Town and Headquarters are same, avail LTC to Home Town?

Answer: No. A fresh recruit whose Home Town and Headquarters are same, cannot avail LTC to Home Town. He may avail LTC to any place in India on the fourth and eighth occasion only. As per Rule 8 of CCS (LTC) Rules, 1988, LTC to Home Town shall be admissible irrespective of the distance between the Headquarters of the Govt. servant and his Home Town which implies that Headquarters and Home Town should be at different places.

sd/-

(B. Bandyopadhyay)

Under Secretary to the Govt. of India

Ph. (011) 23040341

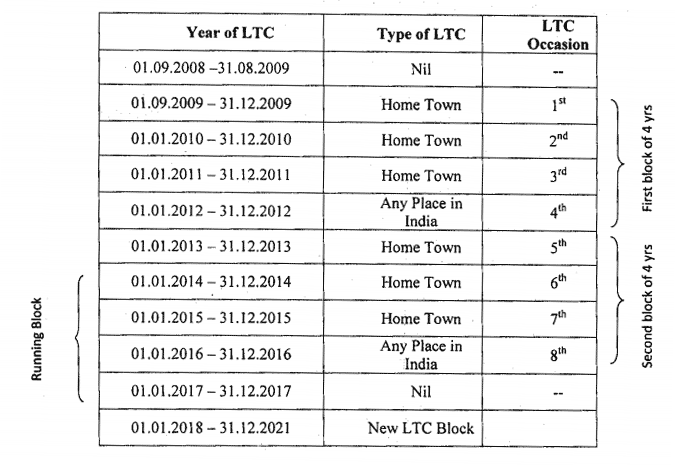

Illustration I for LTC Blcok Year to Fresh Recruits

Illustration 1:

An employee joins the Government service on 1st September, 2008. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 1st September, 2009 (i.e. after the completion of one year of regular service). His entitlement for Home Town / All India would be as under:

Explanation

1.After the completion of the first eight years, when the fresh recruit gets into the middle of the running regular block of four calendar years (ex. 2014-2017) where the new LTC cycle of fresh recruit coincides with the second year of the running two year block (ex. 2017 of 2016-2017), he will not be eligible for LTC in that year (i.e. 2017).

2.It can be seen from above that LTC entitlement for a fresh recruit is calculated calendar year wise with effect from the date of completion of one year of regular service.

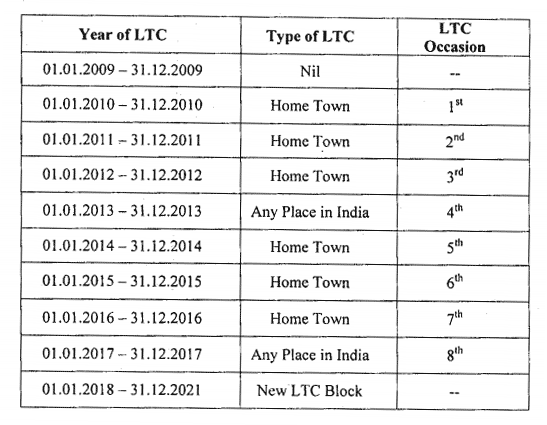

LTC Entitlement for New Recruits Illustration 2

An employee joins the Government service on 1st January, 2009. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 1st January, 2010 (i.e. after the completion of one year of regular service). His entitlement for Home Town / All India LTC would be as under:

Explanations:

1.A the end of the eighth year of LTC, when the new LTC cycle of a fresh recruit coincides with the beginning of a regular four year block, his entitlement in the regular block will be exercised as per the usual LTC Rules.Explanations:

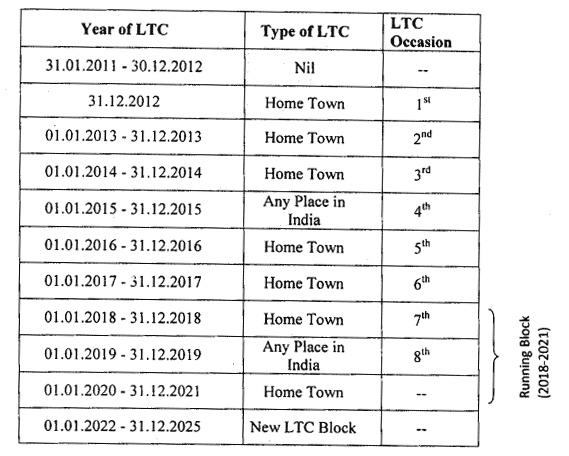

LTC Years for Home Town and Any Place in India Illustration 3

An employee joins the Government service on 31st December, 2011. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 31st December, 2012 (i.e. after completion of one year of regular service). His entitlement for Home Town / All India LTC would be as under:

Explanations:

i. A fresh recruit who joins on 31st December of any year, will be eligible for LTC w.e.f. 31st December of next year. Since, 31st December is the last date of that calendar year, his first occasion of LTC ends with that year. Hence, he may avail his first home town LTC on that day only (eg. 31st December, 2012). From next year onwards he will be eligible for the remaining seven LTCs.

ii. After the completion of eight years of service, when the next LTC cycle of fresh recruit coincides with the beginning of the second two year block (eg. 2020-21) of the running four year block (2018-21), he will be eligible only for the ‘Home Town’ LTC in that block if he has availed of ‘Any Place in India’ LTC in the eighth year. In case, the fresh recruit forgoes his eighth year LTC, then he has a choice to avail either ‘Any Place in India’ or ‘Home Town’ LTC in the following two year block (i.e. in 2020-21).

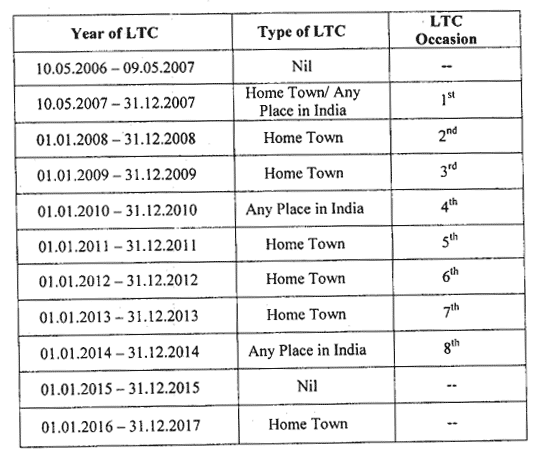

8 Years LTC to Fresh Recruits Illustration 4

An employee joins the Government service on 10th May, 2006. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 10th May, 2007 (i.e. after the completion of one year of regular service). His entitlement for Home Town / All India LTC would be as under:

Explanations:

A fresh recruit who has joined the Government service before 01.09.2008 (i.e. before the introduction of this scheme) and has not completed his first eight years of service as on 01.09.2008 will be eligible for this concession for the remaining time-period till the completion of first eight years of his/ her service.

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

Only his child is eligible as per LTC rule Position

No for first 8 years carry forward of LTC not allowed

As per the Rule Position any where in India LTC can be availed in fourth year. Since carry forward of LTC is not allowed for fresh recruits in first eight years, you can not avail in fifth year . See below the year wise LTC you are entitled to

10-8-2012 to 31.12.2012 – 1 Home town

1.1.2013 to 31.12.2013- 2nd Home Town

1.1.2014 to 31.12.2014 – 3rd Home town

1.1.2015 to 31.12.2015 – any where in India LTC

1.1.2016 to 31.12.2016 – Home town

Sir,

I joined govt service on 10/08/2011 claimed ltc in the year january 2016.

As per fresh recruit rule i must avail in the year 2015. By mistake i claimed in the year 2016 sanctioning authority also approved mistakely now i am unable to clain new ltc as my present office is not allowing me to claim. kindly advice?

Carryover of LTC to the next year is not allowed in case of a fresh recruit as he is already entitled to every year LTC

Respected Sir,

I have availed All India LTC for the grace period of block 2014-2017 in the month of June 2018.

My Date of joining is 04/11/2008

Audit recovered my whole LTC bill.

What should I do?

Kindly guide me in this regard.

If a recruiter want his LTC and in his family his father is pensioner 10k/per month and his wife is government teacher and salary 45k/per month. And his child is a student and adult.

Is his family can also avail LTC with the recruit?

If a recruit does not avail LTC facility in a particular year, can he/she avail it in the next year?

time limit for adjustment of ltc advance by d d o

I am central government employee of group B want to go on A&N against hometown LTC. I am from Rajasthan and posting as same.tell me reimbursement rule if I journey via kota delhi chennai to port blair.

As per the recent Order issued by DoPT, Journey by Air can be performed in private airlines also : See the Order

I am Govt servant and entitled for air fare, wanted to avail LTC for Shirdi,but the only SpiceJet flight is going to Shirdi, Air India is not started yet.So,can go by SpiceJet and be entitled for reimbursement for the LTC.Please tell me the CCS Rule.

Thanks

Regards

Usha Guru

Yes. Entitled Class Train fare will be reimbursed on submission of Fight Ticket

Is there any rule that only base fare of the total train ticket cost can be reimbursed, in case a non entitled government servant wants to claim it against flight ticket…?

You are Eligible for All India LTC in the first year of the Block year

Respected sir, I am a doctor in esic, joined in service in 2009,i didn’t availed LTC as a fresh recruit for 8years. Now in new LTC block i.e 2018-21 block I want to avail LTC anywhere India in January 2018, am i eligible to it or not? If not why?

Respected Sir,

I have a question. I am a Postal Assistant . I am planning to visit A & N with my husband. I heard that without our Directorate order for travel by Air to A & N advance will not be sanctioned. Whether that order is issued or not. I have the order copy DoPT of dated 26.09.2014. Can i get the order copy issued by our directorate.?