New entrants in Government Service are usually not availing LTC due to lack of awareness of LTC rules to New Recruits for first 8 years after appointment in Central Government Service

LTC Rules to New Recruits

Fresh recruits to the Central Government are allowed to travel to their home town along with their families on three occasions in a block of four years and to any place in India on the fourth occasion.

This facility shall be available to the fresh recruits only for the first two blocks of four years applicable after joining the Government for the first time.

How to compute the first 8 years of their LTC entitlement

The DoPT has provided 4 illustrations in its clarification OM dated 26-9-2014 [ Read the OM ] . The illustrations are reproduced below

LTC Rules to New Recruits for first 8 years – Illustrations

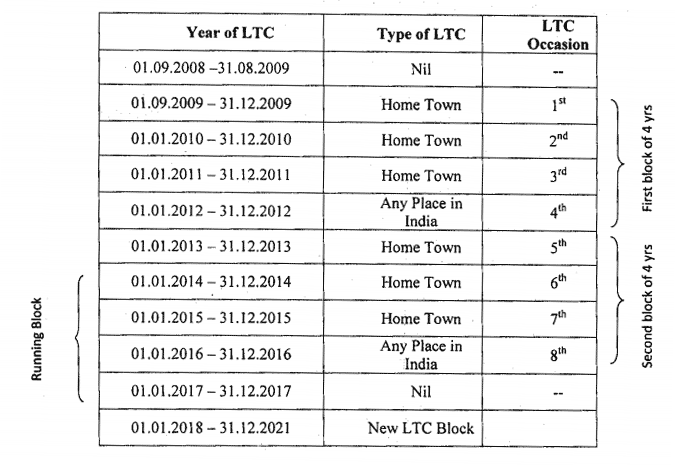

Illustrations 1

An employee joins the Government service on 1st September, 2008. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 1st September, 2009 (i.e. after the completion of one year of regular service). His entitlement for Home Town / All India would be as under:

Explanation

1.After the completion of the first eight years, when the fresh recruit gets into the middle of the running regular block of four calendar years (ex. 2014-2017) where the new LTC cycle of fresh recruit coincides with the second year of the running two year block (ex. 2017 of 2016-2017), he will not be eligible for LTC in that year (i.e. 2017).

2.It can be seen from above that LTC entitlement for a fresh recruit is calculated calendar year wise with effect from the date of completion of one year of regular service.

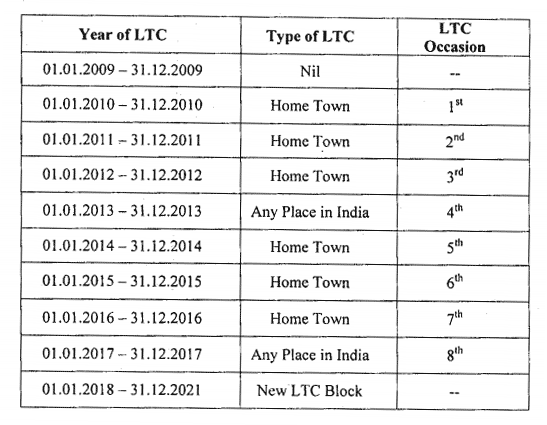

LTC Rules to New Recruits for first 8 years – Illustration 2:

An employee joins the Government service on 1st January, 2009. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 1st January, 2010 (i.e. after the completion of one year of regular service). His entitlement for Home Town / All India LTC would be as under:

Explanations:

1.A the end of the eighth year of LTC, when the new LTC cycle of a fresh recruit coincides with the beginning of a regular four year block, his entitlement in the regular block will be exercised as per the usual LTC Rules.Explanations:

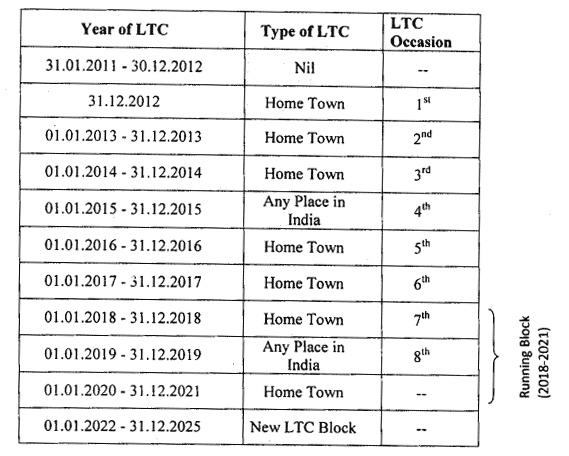

LTC Rules to New Recruits for first 8 years – Illustration 3:

An employee joins the Government service on 31st December, 2011. As per the CCS (LTC) Rules, he will become eligible for LTC with effect from 31st December, 2012 (i.e. after completion of one year of regular service). His entitlement for Home Town / All India LTC would be as under:

Explanations:

i. A fresh recruit who joins on 31st December of any year, will be eligible for LTC w.e.f. 31st December of next year. Since, 31st December is the last date of that calendar year, his first occasion of LTC ends with that year. Hence, he may avail his first home town LTC on that day only (eg. 31st December, 2012). From next year onwards he will be eligible for the remaining seven LTCs.

ii. After the completion of eight years of service, when the next LTC cycle of fresh recruit coincides with the beginning of the second two year block (eg. 2020-21) of the running four year block (2018-21), he will be eligible only for the ‘Home Town’ LTC in that block if he has availed of ‘Any Place in India’ LTC in the eighth year. In case, the fresh recruit forgoes his eighth year LTC, then he has a choice to avail either ‘Any Place in India’ or ‘Home Town’ LTC in the following two year block (i.e. in 2020-21).

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates