CGEGIS was Modified by 7th CPC to give High Risk Cover, but Govt ignored

The 7th CPC recommendation of CGEGIS is ignored by all

Apart from Pay Matrix there is one more thing we need to appreciate 7th Pay Commission for its recommendations. The recommendations on living benefits are only debated much in discussions. But the 7th CPC has put human face and showed its magnanimity while recommending CGEGIS for Central Government Employees with high risk cover.

SEE :7th CPC Recommendation on CGEGIS

Spending 1500 Rupees every month for overcoming the uncertainty in life to save the family is not at all a matter of concern for Group C Government servants. Because the family of a Group C Employee gets 15 Lakh Rupees at the unfortunate loss of its breadwinners life.

But the central government simply ignored this recommendation [READ : CGEGIS – Government Decision on 7th CPC recommendation ] and no federations hasn’t say anything about that. It shows its lack of clear vision in every aspects of life beyond service conditions.

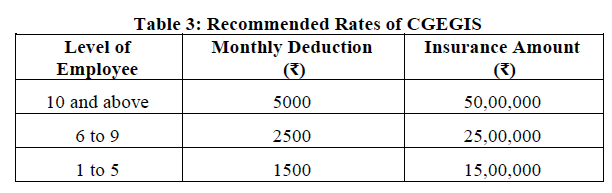

7th CPC Recommended the following Risk Cover with Premium Return Benefits on Retirement.

In case of Group C Employee’s death, the family will be Paid Rs.15 Lakhs

If It happens to Group B Employee, the family will get Rs.25 lakhs

For Group A it will be Rs.50Lakh

At present a family of Group C employee cannot get Rs.1500000 from Terminal benefits in case of an employee’s death. There are lot of families are suffering without sufficient income as the Pension benefits are not at par with Money required to live a decent life. After 2004, All the Central Government Servants are covered under NPS. As of now no one knows how much the family will get in case of death of a Government Servant covered under NPS.

The Federation must keep in mind all aspects mentioned above and should insists the Government to accept the recommendations of 7th CPC on CGEGIS

READ : 7th CPC Recommendation on CGEGIS is not accepted by Govt

In reality, under NPS, this kind of death of employee, basic sum assured financial coverage should be there, as many such private pension schemes are there in the market. Government floated NPS should have better coverage than Pvt schemes.Aarti

When 7th CPC was out, there were widespread hue and cry regarding high rate of deduction on account of CGEGIS and comparisons were made with risk cover given by insurance companies. Now, when govt has not accepted (rather lets say differed for further review), there is again hue and cry in the street.

I dont understand what govt should do!

Very genuine point sir. And must be implemented.

How much employees death during service ? Less than 1% employees during service. If Govt employees death during service; employment will given by Govt to dependent. During service Govt employee are facing many liabilities. Therefore higher contribution is not significant. A stong

Strategy was created by between pay commission committee and Private Insurance companies. Totally not acceptable.

Govt cleverly not accepted because of the nominal pay hike, otherwise employees should pay from their pocket,