11th Bipartite Settlement Bank wage Revision-Preliminary Meeting

Indian Banks’ Association

HR & INDUSTRIAL RELATIONS

No. HR&IR/UFBU/XIBPS/2481

APRIL 11, 2017

Shri. Sanjeev K Bandish

Convenor, United Forum of Bank Unions & General Secretary,

National Confederation of Bank Employees

Post Box.No.1754

State bank Buildings

84, Rajaji Salai

Channai 600001

Dear Sir,

Meeting on next wage Revision

We are pleased to advise that a preliminary /introductory meeting of the Negotiating Committee of IBA with the representatives of constituent Workmen Unions / Officers Associations of United Forum of Bank Unions (UFBU) has been scheduled for Monday, 2nd May 2017 at 4.00 PM in the Committee Room of IBA, World Trade Centre, Cuffe Parade, Mumbai

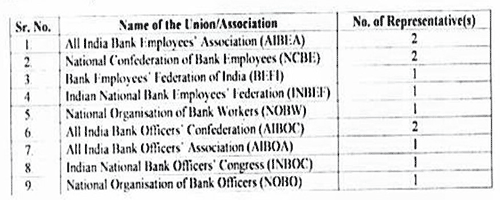

You are therefore requested to please convey suitably to the General Secretaries of constituent Workmen Unions/ Officers’ Associations of UFBU to make it convenient to attend the meeting by their authorised representative (s) as under

Yours Faithfully

V.G.Kannan

Chief Executive

Source : Indian Banks’ Association

A glaring anomoly took place in respect of officers who were in service as on 1st November 2012 but retired before the X bipartite settlement was signed in May 2015. I retired in June 2013 in scale III with all stagnation & CAIIB increments and special allowances eligible for adding to basic pay/pension.

My pension was Rs.27000 p.m. for July 2013 before salary revision which got reduced to Rs.24000 p.m. for July 2013 approximately 10% REDUCED INSTEAD OF 10% INCREASE and the situation continues. Authorities are requested to rectify and bring justice, lest the officers retired earlier to 1st Nov.2012 even in lower scale are now drawing more pension than pensioners retired from 2013, due to improper neutralisation of basic pay and allowances a d faulty D. A. formula. This needs to be addressed by IBA and UNIONS as these members also fall prey to these erraneous decisions upon retirement. I strongly hope that wise counsel would prevail upon these decision makers as the mistakes can always be corrected in bringing justice to the adversely affected persons sustaining continuous loss every month. Take my example of loss of about Rs.3000 instead of increase of about 10% I.e. another Rs.3000 per month I.e. a total loss of about RS.6000/- p.m. since July 2013. With fond hope of getting redressal of grievance – Regards