Order for Pension Fixation on Notional Pay in Pay Matrix

No.38/37/2016-P&PW(A)

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi

Dated, the 12th May, 2017

Office Memorandum

Sub:- Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission – Revision of pension of pre-2016 pensioners/family pensioners, etc.

The undersigned is directed to say that the 7th Central Pay Commission (7th CPC). in its Report, recommended two formulations for revision of pension of pre-2016 pensioners. A Resolution No.38/37/2016-P&PW (A) dated 04.08.2016 was issued by this Department indicating the decisions taken by the Government on the various recommendations of the 7th CPC on pensionary matters. [Click to view the orders issued on 4.8.2016]

2. Based on the decisions taken by the Government on the recommendations of the 7th CPC, orders for revision of pension of pre-2016 pensioners/family pensioners in accordance with second Formulation were issued vide this Department’s OM No. 38/37/2016-P&PW (A) (ii) dated 04.08.2016. It was provided in this OM. that the revised pension/family pension w.e.t. 1.1.2016 of pre-2016 pensioners/family pensioners shall be determined by multiplying the pension/family pension as had been fixed at the time of implementation of the recommendations of the 6th CPC, by 2.57.

3. In accordance with the decision mentioned in this Department’s Resolution No. 38/37/2016-P&PW (A) dated 04.08.2016 and OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016, the feasibility of the first option recommended by 7th CPC has been examined by a Committee headed by Secretary, Department of Pension Pensioners’ Welfare.

4. The aforesaid Committee has submitted its Report and the recommendations made by the Committee have been considered by the Government. Accordingly, it has been decided that the revised pension/family pension w.e.f 01.01.2016 in respect of all Central civil pensioners/family pensioners, including CAPF’s, who retired/died prior to 01.01.2016, may be revised by notionally fixing their pay in the pay matrix recommended by the 7th CPC in the level corresponding to the pay in the pay scale/pay band and grade pay at which they retired/died.

This will be done by notional pay fixation under each intervening Pay Commission based on the Formula for revision of pay. White fixing pay on notional basis, the pay fixation formulae approved by the Government and other relevant instructions on the subject in force at the relevant time shall be strictly followed. 50% of the notional pay as on 01.01.2016 shall be the revised pension and 30% of this notional pay shall be the revised family pension wef. 1.1.2016 as per the first Formulation.

In the case of family pensioners who were entitled to family pension at enhanced rate, the revised family pension shall be 50% of the notional pay as on 01.01.2016 and shall be payable till the period up to which family pension at enhanced rate is admissible as per rules. The amount of revised pension/family pension so arrived at shall be rounded off to next higher rupee.

5. It has also been decided that higher of the two Formulations is the pension/family pension already revised in accordance with this Department’s OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016 or the revised pension/family pension as worked out in accordance with para 4 above, shall be granted to pre-2016 central civil pensioners as revised pension/family pension w.e.f. 01.01.2016. In cases where pension/family pension being paid w.e.f. 1.1.2016 in accordance with this Department’s OM No. 38/37/2016~P&PW(A) (ii) dated 04.08.2016 happens to be more than pension/family pension as worked out in accordance with para 4 above, the pension/family pension already being paid shall be treated as revised pension/family pension w.e.f. 1.1.2016.

6. Instructions were issued vide this Department’s OM No. 45/86/97-P&PW(A) (iii) dated 10.02.1998 for revision of pension! family pension in respect of Government servants who retired or died before 01.01.1986, by notional fixation of their pay in the scale of pay introduced with effect from 01.01.1986. The notional pay so worked out as on 01.01.1986 was treated as average emoluments/last pay for the purpose of calculation of notional pension/family pension as on 01.01.1986. The notional pension/family pension so arrived at was further revised with effect from 01.01.1996 and was paid in accordance with the instructions issued for revision of pension/family pension of pre-1996 pensioners/family pensioners in implementation of the recommendations of the 5th Central Pay Commission.

7. Accordingly, for the purpose of calculation of notional pay w.e.f. 1.1.2016 of those Government servants who retired or died before 01.01.1986, the pay scale and the notional pay as on 1.1.1986, as arrived at in terms of the instructions issued vide this Department’s OM 45/86/97~P&PW(A) dated 10.02.1998, will be treated as the pay scale and the pay of the concerned Government servant as on 1.1.1986. in the case of those Government servants who retired or died on or after 01.01.1986 but before 1.1.2016 the actual pay and the pay scale from which they retired or died would be taken into consideration for the purpose of calculation of the notional pay as on 1.1.2016 in accordance with para 4 above.

8. The minimum pension with effect from 01.01.2016 will be Rs. 9000/- per month (excluding the element of additional pension to old pensioners). The upper ceiling on pension/family pension will be 50% and 30% respectively of the highest pay in the Government (The highest pay in the Government is Rs. 250,000 with

effect from 01.01.2016).

9. The pension/family pension as worked out in accordance with provisions of Para 4 and 5 above shall be treated as ‘Basic Pension’ with effect from 01.01.2016. The revised pension/family pension includes dearness relief sanctioned from 1.1.2016 and shall qualify for grant of Dearness Relief sanctioned thereafter.

10. The existing instructions regarding regulation of dearness relief to employed/re-employed pensioners/family pensioners, as contained in Department of Pension & Pensioners Welfare OM. No. 45/73/97-P&PW(G) dated 02.07.1999, as amended from time to time, shall continue to apply.

11. These orders would not be applicable for the purpose of revision of pension of those pensioners who were drawing compulsory retirement pension under Rule 40 of the CCS (Pension) Rules or compassionate allowance under Rule 41 of the CCS (Pension) Rules. The pensioners in these categories would continue to be entitled to revised pension in accordance with the instructions contained in this Department’s OM. No. 38/37/2016~P&PW(A)(ii) dated 4.8.2016.

12. The pension of the pensioners who are drawing monthly pension from the Government on permanent absorption in public sector undertakings/autonomous bodies will also be revised in accordance with these orders. However, separate orders will be issued for revision of pension of those pensioners who had earlier

drawn one time lump sum terminal benefits on absorption in public sector undertakings, etc. and are drawing one-third restored pension as per the instructions issued by this Department from time to time.

13. in cases where, on permanent absorption in public sector undertakings/autonomous bodies, the terms of absorption and/or the rules permit grant of family pension under the CCS (Pension) Rules, 1972 or the corresponding rules applicable to Railway employees/members of All India Services, the family pension being drawn by family pensioners will be updated in accordance with these orders.

14. Since the consolidated pension will be inclusive of commuted portion of pension, if any, the commuted portion will be deducted from the said amount while making monthly disbursements.

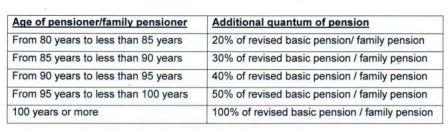

15. The quantum of age-related pension/family pension available to the old pensioners/ family pensioners shall continue to be as follows-

The amount of additional pension will be shown distinctly in the pension payment order. For example, in case where a pensioner is more than 80 years of age and his/her revised pension is Rs.10,000 pm, the pension will be shown as (i) Basic pension = Rs.10,000 and (ii) Additional pension = Rs.2,000 pm. The pension on his/her attaining the age of 85 years will be shown as (i).Basic Pension = Rs.10,000 and (ii) additional pension = Rs.3,000 pm. Dearness relief will be admissible on the additional pension available to the old pensioners also.

16. A few examples of calculation of pension/family pension in the manner prescribed above are given in Annexure-I to this OM.

17. No arrears on account of revision of Pension/Family pension on notional fixation of pay will be admissible for the period prior to 1.1.2016. The arrears on account of revision of pension/family pension in terms of these orders would be admissible with effect from 01.01.2016. For calculation of arrears becoming due on the revision of pension/ family pension on the basis of this O.M., the arrears of pension and the revised pension/family pension already paid on revision of pension/family pension in accordance with the instructions contained in this Department’s OM No. 38/37/2016-P&PW(A) (ii) dated 04.08.2016 shall be adjusted.

18. it shall be the responsibility of the Head of Department and Pay and Accounts Office attached to that office from which the Government servant had retired or was working last before his death to revise the pension! family pension of Pre-2016 pensioners/family pensioners with effect from 01.01.2016 in accordance with these orders and to issue a revised pension payment authority. The Pension Sanctioning Authority would impress upon the concerned Head of Office for fixation of pay on notional basis at the earliest and issue revised authority at the earliest. The revised authority will be issued under the existing PPO number and would travel to the Pension Disbursing Authority through the same channel through which the original PPO had travelled.

19. These orders shall apply to all pensioners/family pensioners who were drawing pension/family pension before 1.1.2016 under the Central Civil Services (Pension) Rules, 1972, and the corresponding rules applicable to Railway pensioners and pensioners of All India Services, including officers of the Indian Civil Service retired from service on or after 111973. A pensioner/family pensioner who became entitled to pension/family pension with effect from 01.01.2016 consequent on retirement/death of Government servant on 31.12.2015, would also be covered by these orders. Separate orders will be issued by the Ministry of Defence in regard to Armed Forces pensioners/family pensioners.

20 These orders do not apply to retired High Court and Supreme Court Judges and other Constitutional/Statutory Authorities whose pension etc. is governed by separate rules/orders.

21 These orders issue with the concurrence of Ministry of Finance (Department of Expenditure) vide their ID. No. 30~1l33(c)/2016-IC dated 11.05.2017 and ID. No.30-1133(c)/2016-IC dated 12.05.2017.

22. In their application to the persons belonging to the Indian Audit and Accounts Department, these orders issue in consultation with the Comptroller and Auditor General of India.

23. Ministry of Agriculture etc. are requested to bring the contents of these orders to the notice of Heads of Department/Controller of Accounts. Pay and Accounts Officers, and Attached and Subordinate Offices under them on top priority basis. All Ministries/Departments are requested to accord top priority to the work of revision of pension of ore-2016 pensioners/family pensioners and issue the revised Pension Payment Authority in respect of all ore-2016 pensioners,

24. Hindi version will follow.

sd/-

(Harjit Singh)

Director

Click to See : Example Pension Fixation

Authority: Pensioners Portal

Sir pl urgently help me in these following points:-

1. From 02/07/2016 to 11/03/2011 regularised as EOL. 2. In EOL order not bifurcated as on medical leave or inability due to unforeseen circumstances. 3. So 4 increament with macp order was with held.4. Pay was revised from 2016 fr 22(i) granting notational increament on 2007 but missed on 2008 ,2009,2010 2011 .was paid from 2012 in the same increament of 2017 adding 1 increament (means with commutative effect).

A) Can i eligible for grant of 4 notational increament .

Now tell me what to do as I am left for 6 months to retire. With Quoting dopt order no and a calculation steps to solve that. What to do…. thanks sir

Sir,

Everything has been taken into account for revising the pension based on the notional pay in the VIIth CPC pay scales. The contention of Mr. RBKV Ramanan is not correct.

Respected all with regards,

It is mentioned that a retired employee who served in pay scale 9300-34800 gp 4600 drawn basic pay before promotion Rs. 20700 at least 11 increments and promoted to pay scale 15600-39100 gp 5400 group A grade pay Rs.22300 but he not drawn any increment in promotional grade. How his pay notionally be fixed and but re- sources of his long service he get where everywhere mentioned the pay will be fixed at the minimum. So I feel Pay commission prepared b y the Honble Justice Mathurji is totally deffer ed and neglected by the Jaithlyji Govt indirectly and crowned to pension committee. Please clarify if any body has sence of humor. Pensioners in the grade -3 are on starvation and hope Modi Govt will not win the election in 2019 if it is not corrected mind every body. Director Mr. Harjit Singh please clarify his position, tomorrow is your number for retirement?

Jaihind JaiBhart

Kindly confirm the above mentioned OM is also applicable in case of pen sioners of autonomous bodies (ICAR)? If so kindly confirn. We AB pensioners are still waiting implementation of 7 cpc as also DR wef 1/7/2016. P.b.Nair

Please refer the proceeding of the meeting of standing committee meeting of the National Council JCM held on 03/05/2017. The discussion on action taken report item No.19 is a very important burning issue. As the annual increment date of 01/07/2017 is approaching this issue is getting very crucial stage. Actually, most of the employees are now drawing revised pay with anomaly it should be considered sympathetically.

They must be allowed to opt for pay fixation as an one time measure. Their pay can be calculated notionally in pre-revised pay and revised pay on the next increment date of 01/07/2017 and the employee may be allowed to opt for the beneficial one for him. There is no need to pay arrear as this is for pay fixation only on the next increment date 01/07/2017 after the notification date 25/07/2017. Then only the anomalies of the affected employees will be alleviated. It is requested that Our hon’ble Secreatary may kindly look in to the matter and do the needful to the benefit of our employees. With regards. Thank you.

reply

Leave a Reply

Has the Central government finally taken a decision to extend the benefit of revision of pension/family pension as per the recommendations of the 7th CPC and decisions taken by the government thereon subsequently for the pensioners/family pensioners in Central autonomous bodies, keeping in view the fact that we are drawing pension/family pension as per CCS (Pension) Rules?

There is something wrong. The 4th case given in Examples under Annexure 1 on page 6 is at variance with the example given by the 7th CPC on page 396 in para 10.1.70 (Case 1). But, both were talking about the same Pensioner A, who retired on a pay of 79,000 (and pension of 39,500) in the scale 67000-79000 on 31.5.2015.

The 7th CPC took only 3 increments to move from 67000 to 79000 in 6th CPC scales, but the Order of 12.5.2017 is taking 5 increments.

The 7th CPC declared that pension calculated using a multiple of 2.57 is actually higher than that obtained through “notional pay and earned increments” option, viz. 1,01,515 against 99,550.

On the contrary, the 4th case in the order of 12.5.2017 decrees that the reverse is true, viz. 1,02,550 against 1,01,515.

Has the Govt. corrected or modified 7th CPC calculations? If so, why have we not been informed? Will the Director Mr. Harjit Singh please clarify?

The revision of pension order dated 12 May 2017 has not included the DP element on pay/ basic pension @ 40%, which has further reduced the real benefits under the modified formula. Pensioners Associations should take note on this. Press forimplementation of first option of 7 CPC to overcome anomalies in the revision. Good luck.

Good