This Personal Income Tax Slab for FY 2020-21 paves the way for significant relief, especially for Middle Class Taxpayers

Personal Income Tax Slab

The Official press release published in PIB is given below

New Personal Income Tax Regime to be optional for the taxpayers

New rates entail estimated revenue forgone of Rs 40,000 Crore per year

In order to provide significant relief to the individual taxpayers and to simplify the Income-Tax law, the Union Budget proposes to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forgo certain deductions and exemptions. While presenting the Union Budget 2020-21 in Parliament today, the Union Minister for Finance & Corporate Affairs, Smt Nirmala Sitharaman said, “The new tax regime shall be optional for the tax payers.” She further said that an individual who is currently availing more deductions and exemptions under the Income Tax Act may choose to avail them and continue to pay tax in the old regime.

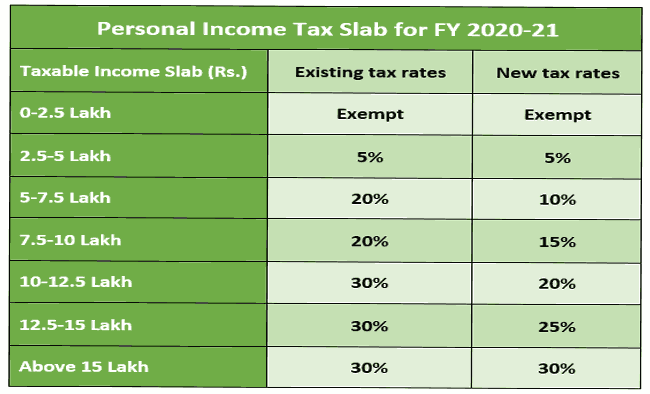

The New personal Income tax regime proposes the following tax structure:

| Taxable Income Slab (Rs.) | Existing Tax Rates | New Tax Rates |

| 0-2.5 Lakh | Exempt | Exempt |

| 2.5-5 Lakh | 5% | 5% |

| 5-7.5 Lakh | 20% | 10% |

| 7.5-10 Lakh | 20% | 15% |

| 10-12.5 Lakh | 30% | 20% |

| 12.5-15 Lakh | 30% | 25% |

| Above 15 Lakh | 30% | 30% |

In the new tax regime, substantial tax benefit will accrue to a taxpayer depending upon exemptions and deductions claimed by him. For example, a person earning Rs 15 lakh in a year and not availing any deductions etc. will pay only Rs, 1,95,000 as compared to Rs, 2,73,000 in the old regime. Thus his tax burden shall be reduced by 78,000 in the new regime. He would still be a gainer in the new regime even if he was taking deduction of Rs 1.5 lakh under various sections of Chapter VI –A of the Income Tax Act under the old regime.

The new tax regime will be optional for the taxpayers. As per the Memorandum explaining the provision in the Finance Bill, the option shall be exercised for every previous year where the individual or the HUF has no business income and in other cases the option once exercised for a previous year shall be valid for that previous year and all subsequent years. The option shall become invalid for a previous year or previous years as the case may be if the individual or HUF fails to satisfy the conditions and other provisions of the Act shall apply.

The new personal income tax rates will entail estimated revenue forgone of Rs 40,000 crore per year. Smt Sitharaman said, “We have also initiated measures to prefill the income tax return so that an individual who opts for the new regime would need no assistance from an expert to file his return and pay income tax.” The Finance Minister said that in order to simplify the income tax system, she has reviewed all the exemptions and deductions incorporated over the past several decades.”

In the Budget, around 70 of the existing exemptions and deductions of different nature (more than 100) have been proposed to be removed. Remaining exemptions and deductions will be reviewed and rationalised in the coming years with a view to further simplifying the tax system and lowering the tax rate

The rates of Personal Income Tax Slab for Financial Year 2019-20

If Income Tax Slab regime FY 2019-20 is beneficial than the new Tax Slab 2020-21, the individual will be allowed to continue the 2019-20 Income tax Slabs in 2020-21 financial Year

New Income Tax Slab 2020-21 is optional .

The Income Tax Slab for Financial Year 2019-20 is

| Income Tax Slab 2019-20 | Individuals Below the Age Of 60 Years |

| Up to Rs.2,50,000 | Nil |

| Rs.2,50,001 to 5,00,000 | 5% |

| Rs.5,00,001 to 10,00,000 | Rs.12,500 + 20% of total income exceeding Rs.5,00,000 |

| Above Rs. 10,00,000 | Rs.1,12,500 + 30% of total income exceeding Rs.10,00,000 |

Tax payers can choose either new Tax slab or Old Income tax slab for assessing the income tax for Financial year 2020-2021

New Income Tax Slab 2020-21 vs Old Income Tax Slab 2019-20

It is optional for any individual to choose either New Income Tax Slab 2020-21 or Old Income Tax Slab 2019-20.

The Comparison Chart for Old Income Tax Regime with New Income Tax Regime .

| Income Tax Slab | Old Income Tax Regime FY 2019-2020 | New Income Tax Regime FY 2020-2021 |

| Up to Rs.2,50,000 | Nil | Nil |

| Rs.2,50,001 to 5,00,000 | 5% | 5% |

| Rs.5,00,000 to 7,50,000 | Rs.12,500 + 20% of total income exceeding Rs.5,00,000 | Rs.12,500 + 10% of total income exceeding Rs.5,00,000 |

| Rs.7,50,001 to 10,00,000 | Rs.62,500 + 20% of total income exceeding Rs.7,50,000 | Rs.37,500 + 15% of total income exceeding Rs.7,50,000 |

| Above Rs. 10,00,000 to Rs.12,50,000 | Rs.1,12,500 + 30% of total income exceeding Rs.10,00,000 | Rs.75000 + 20% of total Income exceeding Rs.10 Lakh |

| Above Rs. 12,50,000 to Rs.15,00,000 | Rs.1,87,500 + 30% of total income exceeding Rs.12,50,000 | Rs.1,25,000+25% of total Income exceeding Rs.12.5 Lakh |

| Above Rs.15,00,000 | Rs.2,62,500 + 30% of total income exceeding Rs.15,00,000 | Rs.1,87,000+30% of total Income exceeding Rs.15 Lakh |

The taxable Income Shown in Old income Tax regime is after applicable deduction and exemption . But new income tax regime doesn’t allow to avail any deductions or exemptions.

Tax Exemptions which are not available if Income Tax Rates under New Tax Regime is opted

1.Standard Deduction under Section 17(2) of Income Tax Act

2.All Section 80 C Deductions which is allowed up to Rs. 1.5 lakh for savings under GPF, NPS subscription by employee, ELSS, PPF, Insurance Premium etc

3.Additional Exempiton of Rs. 50,000 for NPS contribution under Section 80 CCD(1B)

4.Medical Insurance Premium Exempted under Section 80D

5.Exemption under Section 80 DD – Medical Expenses of specially abled dependents

6.Exemption under Section 80DDB – Medical Expenses in respect of certain illnesses.

7.Exemption allowed for House Rent Allowance under Section 10

8.Tax Exemption for LTC under Section 10

9.Income Tax Exemption under Section 24 allowed in respect of Interest paid on Housing Loan

10.Section 80 G Exemption – Donation paid to Charitable Institutions

11. Section 80 Exemption – Deduction allowed on Interest paid on Education Loan