Labour Ministry directed its official to to exercise their option to choose between old or new income tax structure for the financial year 2020-21 (assessment year 2021-22) for the purpose of monthly income tax deduction on or before 10.7.2020

No. 24/06/2020-Cash (MS)

GOVERNMENT OF INDIA/BHARAT SARKAR

MINISTRY OF LABOUR & EMPLOYMENT

CASH SECTION (MS)

New Delhi, dated the 25th June, 2020

CIRCULAR

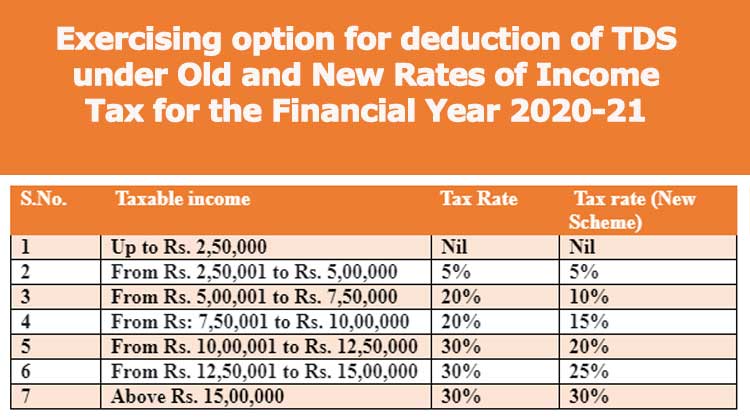

Exercising option for deduction of TDS under old and new rates of Income Tax for the Financial Year 2020-21

The Government of India has notified new tax structure w.e.f. the financial year 2020-21 (assessment year 2021-22), wherein the total taxable income shall be computed without any exemption/deduction such as Standard Deduction, HRA Exemption, loss from house property, deductions granted under the provisions of Chapter VI-A (except deduction under sub section (2) of Section 80CCD).

The Old and New Rates of Income Tax for 2020-2021

The Old and new rates of income tax are as follows:

S.No.

|

Taxable income |

Tax

Rate |

Tax rate (New Scheme) |

1 |

Up

to Rs. 2,50,000 |

Nil |

Nil |

2 |

From Rs. 2,50,001 to Rs. 5,00,000 |

5% |

5% |

3 |

From

Rs. 5,00,001 to Rs. 7,50,000 |

20% |

10% |

4 |

From Rs: 7,50,001 to Rs. 10,00,000 |

20% |

15% |

5 |

From

Rs. 10,00,001 to Rs. 12,50,000 |

30% |

20% |

6 |

From Rs. 12,50,001 to Rs. 15,00,000 |

30% |

25% |

7 |

Above

Rs. 15,00,000 |

30% |

30% |

The income tax rates prevailing in the financial year 2019-20 will continue to exist and the official has to choose between old rates and new rates for the purpose of monthly Income Tax recovery from pay and allowances. In the old tax rates, all the existing deductions and exemptions are allowed.

Last date for Exercising option for Old or New Income Tax Rates for 2020-21

Therefore, all the officials are required to exercise their option, in writing or through email to [email protected] to choose between old or new income tax structure for the financial year 2020-21 (assessment year 2021-22) for the purpose of monthly income tax deduction from pay and allowances. This option should be forwarded to Cash Section (MS) latest by 10-07-2020. If no option is received by the prescribed date, it will be presumed that the official is opting for the old tax structure and income tax recoveries will be regulated accordingly.

Calculate Income Tax Here in New and Old Rates

It may also be noted that the option so exercised will be final and cannot be modified during the present financial year.

(C.S. Rao)

Under Secretary to the Govt. of India