The rates of deduction of income-tax from the payment of income under the head “Salaries” under Section 192 of the Income-tax Act. 1961 during the financial year 2019-20

F.No. 275/19212020-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North Block. New Delhi

Dated the 3th December 2020

SUBJECT: INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2020-21 UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961.

Reference is invited to Circular No. 4/2020 dated 16.01.2020 whereby the rates of deduction of income-tax from the payment of income under the head “Salaries” under Section 192 of the Income-tax Act. 1961 (hereinafter ‘the Act). during the financial year 2019-20. were intimated. The present Circular contains the rates of deduction of income-tax from the payment of income chargeable under the head “Salaries” during the financial year 2020-21 and explains certain related provisions of the Act and Income-tax Rules, 1962 (hereinafter the Rules). All the sections and rules referred arc of Income-tax Act. 1961 and Income-tax Rules, 1962 respectively unless otherwise specified. The relevant Acts, Rules, Forms and Notifications are available at the website of the Income Tax Department www.incometaxindia.gov.in

- RATES OF INCOME-TAX AS PER FINANCE ACT, 2020:

As per the Finance Act, 2020, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2020-21 (i.e. Assessment Year 2021-22) at the following rates:

2.1 Rates of Tax

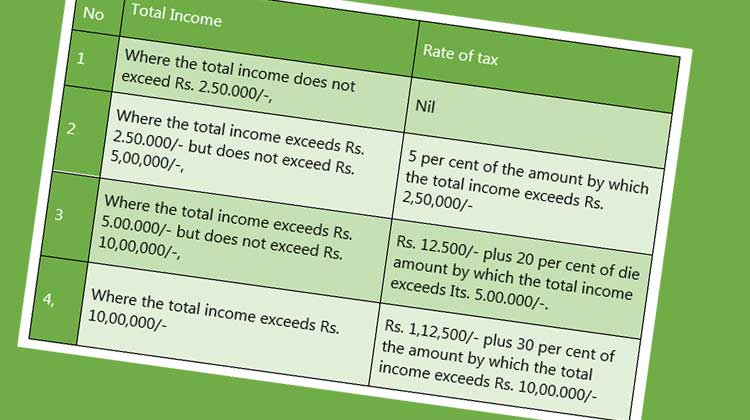

A. Normal Rates of Tax

SI No | Total Income | Rate of tax |

1 | Where the total income does not exceed

Rs. 2.50.000/-, | Nil |

2 | Where the total income exceeds Rs.

2.50.000/- but does not exceed Rs. 5,00,000/-, | 5 per cent of the amount by which the

total income exceeds Rs. 2,50,000/- |

3 | Where the total income exceeds Rs.

5.00.000/- but does not exceed Rs. 10,00,000/-, | Rs. 12.500/- plus 20 per cent of die

amount by which the total income exceeds Its. 5.00.000/-. |

4, | Where the total income exceeds Rs.

10,00,000/- | Rs. 1,12,500/- plus 30 per cent of the

amount by which the total income exceeds Rs. 10,00.000/- |

B. Rates of tax for every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

SI No | Total Income | Rate of tax |

1 | Where

the total income does not exceed Rs. 3.00,000/- | Nil |

2 | Where

the total income exceeds Its. 3,00.000 but does not exceed Its. 5,00,000/- | 5

per cent of the amount by which the total income exceeds Rs. 3,00,000/- |

3 | Where the total income exceeds Its.

5,00.000/- but does not exceed Rs. 10,00,000/- | Rs.

10,0001- plus 20 per cent of the amount by which the total income exceeds Rs.

5.00.000/-. |

4 | Where the total income exceeds Its.

10.00.000/- | Rs.

1.10.000/- plus 30 per cent of the amount by which the total income exceeds

Rs. 10.00.000/- |