A Government servant appointed on or before 31.12.2003, after completing a qualifying service of not less than ten years, shall become eligible for grant of a pension subject to a minimum Rs.9000/- per month and maximum Rs.1,25,000/- per month:

Regulation of pension and gratuity

Amount of Pension calculated at 50 percent of emoluments

(1) A Government servant, who retires under rule 33, rule 34, rule 35, rule 36, rule 37, rule 38 or rule 39, after completing a qualifying service of not less than ten years, shall become eligible for grant of a pension calculated at fifty per cent of emoluments or average emoluments, whichever is more beneficial to him, subject to a minimum of nine thousand rupees per month and maximum of one lakh twenty-five thousand rupees per month:

Provided that a Government servant who retires under rule 39 before completing a qualifying service of ten years but fulfils the conditions mentioned in sub-rule (9) of rule 39, shall also be eligible for an invalid pension calculated at fifty per cent of emoluments or average emoluments, whichever is more beneficial to him and the condition of completion of minimum qualifying service of ten years shall not be applicable for grant of pension in his case.

(2) A Government servant, who retires under any of the rules referred to in sub-rule (1) but has not become eligible for grant of pension in accordance with that sub-rule, shall be eligible for grant of a service gratuity.

The amount of service gratuity in such cases shall be calculated at the rate of half month’s emoluments for every completed six monthly period of qualifying service.

(3) In case the emoluments of a Government servant have been reduced during the last ten months of his service, average emoluments as referred to in rule 32 shall be treated as emoluments for the purpose of sub-rule (2) and the dearness allowance admissible on the date of retirement shall also be treated as part of emoluments.

(4)(a) Where a Government servant is compulsorily retired from service after completing a qualifying service of not less than ten years and has become eligible for grant of compulsory retirement pension under rule 40, the amount of compulsory retirement pension shall be such portion or percentage of the superannuation pension calculated under sub-rule (1), as the competent authority may sanction under rule 40.

(b) A Government servant, who is compulsorily retired from service before completing a qualifying service of ten years, shall be eligible for grant of a compulsory retirement service gratuity under rule 40 and the amount of service gratuity in such cases shall be such portion or percentage of the superannuation service gratuity calculated under sub rule (2), as the competent authority may sanction under rule 40.

(5)(a) Where a Government servant is dismissed or removed from service after having completed a qualifying service of not less than ten years and is sanctioned a compassionate allowance under rule 41, the amount of compassionate allowance shall be such portion or percentage of the pension which would have been admissible to him if he had retired on superannuation pension, as the competent authority may sanction under rule 41.

(b) A Government servant, who is dismissed or removed from service before completing a qualifying service of ten years and is sanctioned a compassionate allowance under Rule 41, the amount of compassionate allowance in such cases shall be such portion or percentage of the service gratuity which would have been admissible to him if he had retired on superannuation service gratuity, as the competent authority may sanction under rule 41.

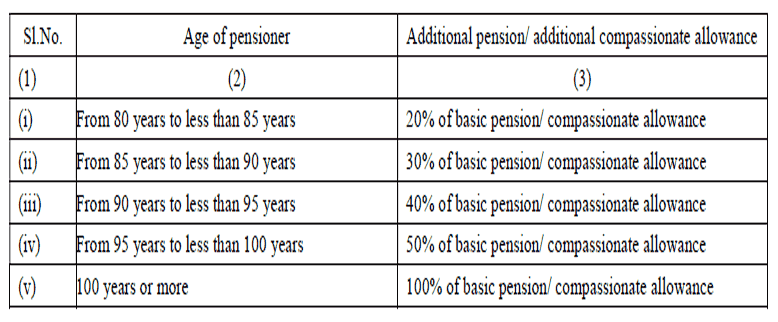

(6) After completion of eighty years of age or above by a retired Government servant, in addition to a pension or a compassionate allowance admissible under this rule, additional pension or additional compassionate allowance shall be payable to the retired Government servant in the following manner, namely:-

(b) The additional pension or additional compassionate allowance shall be payable from first day of the calendar month in which it falls due.

Illustration: A pensioner born on 20th August, 1942 shall be eligible for additional pension at the rate of twenty percent of the basic pension with effect from 1st August, 2022. A pensioner born on 1st August, 1942 shall also be eligible for additional pension at the rate of twenty percent of the basic pension with effect from 1 st August, 2022.

Calculation of Qualifying Service for Pension and Gratuity

(7) In calculating the length of qualifying service, fraction of a year equal to three months and above shall be treated as a completed six monthly period and reckoned as qualifying service.

(8) In the case of a Government servant who has rendered a qualifying service of nine years and nine months or more but less than ten years, his qualifying service for the purpose of this rule shall be ten years and he shall be eligible for pension in accordance with sub-rule (1).

Read about Retirement Gratuity and Death gratuity

(9) The amount of pension or service gratuity or compassionate allowance or additional pension or additional compassionate allowance finally determined under this rule, shall be expressed in whole rupees and where it contains a fraction of a rupee, each such amount shall be rounded off to the next higher rupee separately for arriving at the final amount payable to the retired Government servant.

(10) In cases where pension is discontinued in the middle of a calendar month, the amount of pension payable for the fraction of that month shall also be rounded off to the next higher rupee.

Source : CCS Pension Rules 2021