Interest on delayed payment of commuted value of pension : Since the pensioner continues to receive full pension till the date of payment of commuted value of pension, the question of payment of any interest on delayed payment of commutation of pension does not arise.

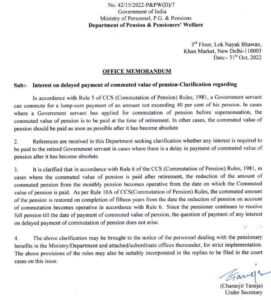

No. 42/15/2022-P&PW(D)/7

Government of India

Ministry of Personnel, P.G. & Pensions

Department of Pension & Pensioners’ Welfare

3 Floor, Lok Nayak Bhawan,

Khan Market, New Delhi-110003

Date:- 31st Oct, 2022

OFFICE MEMORANDUM

Sub:- Interest on delayed payment of commuted value of pension-Clarification regarding

In accordance with Rule 5 of CCS (Commutation of Pension) Rules, 1981, a Government servant can commute for a lump-sum payment of an amount not exceeding 40 per cent of his pension. In cases where a Government servant has applied for commutation of pension before superannuation, the commuted value of pension is to be paid at the time of retirement. In other cases, the commuted value of pension should be paid as soon as possible after it has become absolute

2. References are received in this Department seeking clarification whether any interest is required to be paid to the retired Government servant in cases where there is a delay in payment of commuted value of pension after it has become absolute.

3. It is clarified that in accordance with Rule 6 of the CCS (Commutation of Pension) Rules, 1981, in cases where the commuted value of pension is paid after retirement, the reduction of the amount of commuted pension from the monthly pension becomes operative from the date on which the Commuted value of pension is paid. As per Rule 10A of CCS(Commutation of Pension) Rules, the commuted amount of the pension is restored on completion of fifteen years from the date the reduction of pension on account of commutation becomes operative in accordance with Rule 6. Since the pensioner continues to receive full pension till the date of payment of commuted value of pension, the question of payment of any interest on delayed payment of commutation of pension does not arise.

4. The above clarification may be brought to the notice of the personnel dealing with the pensionary benefits in the Ministry/Department and attached/subordinate offices thereunder, for strict implementation. The above provisions of the rules may also be suitably incorporated in the replies to be filed in the court cases on this issue.

(Charanjit Taneja)

Under Secretary