Standard Deduction for tax calculation

Income Tax Act Amendments for Salaried Employees-Standard Deduction for tax calculation

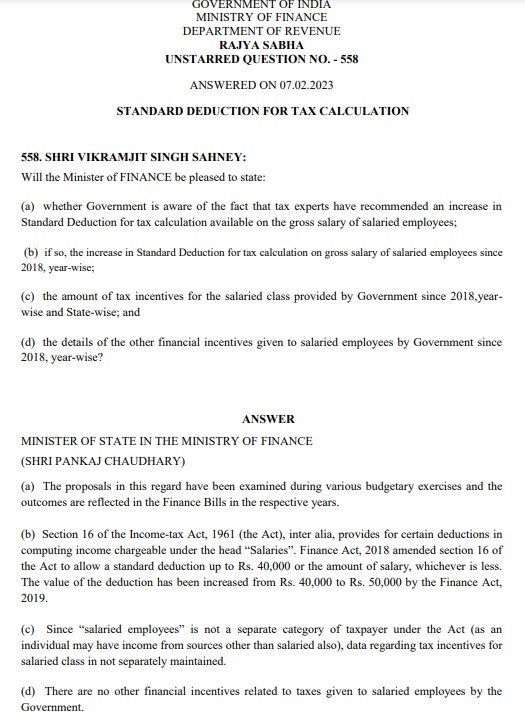

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED QUESTION NO. – 558

ANSWERED ON 07.02.2023

STANDARD DEDUCTION FOR TAX CALCULATION

- SHRI VIKRAMJIT SINGH SAHNEY:

Will the Minister of FINANCE be pleased to state:

(a) whether Government is aware of the fact that tax experts have recommended an increase in Standard Deduction for tax calculation available on the gross salary of salaried employees;

(b) if so, the increase in Standard Deduction for tax calculation on gross salary of salaried employees since 2018, year-wise;

(c) the amount of tax incentives for the salaried class provided by Government since 2018,year-wise and State-wise; and

(d) the details of the other financial incentives given to salaried employees by Government since 2018, year-wise?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF FINANCE

(SHRI PANKAJ CHAUDHARY)

(a) The proposals in this regard have been examined during various budgetary exercises and the outcomes are reflected in the Finance Bills in the respective years.

(b) Section 16 of the Income-tax Act, 1961 (the Act), inter alia, provides for certain deductions in computing income chargeable under the head “Salaries”. Finance Act, 2018 amended section 16 of the Act to allow a standard deduction up to Rs. 40,000 or the amount of salary, whichever is less. The value of the deduction has been increased from Rs. 40,000 to Rs. 50,000 by the Finance Act, 2019.

(c) Since “salaried employees” is not a separate category of taxpayer under the Act (as an individual may have income from sources other than salaried also), data regarding tax incentives for salaried class in not separately maintained.

(d) There are no other financial incentives related to taxes given to salaried employees by the Government.