Stakeholders Responsibilities in National Pension System is explained in the Guidelines issued by MOHUA in respect of NPS in Central Government set-up

NPS in Central Government – Roles and Responsibilities of stakeholders

Government of India

M/o Housing & Urban Affairs

Office of the Chief controller of Accounts

Accounts section, 314-A

Nirman Bhawan, New Delhi — 110011

F. No. Pr.AO(Accounts)/MOHUA/NPS/2024-25/136

Date : 10.06.2024

OFFICE MEMORANDUM

Subject : Guidelines for the stakeholders in National Pension System (NPS) in Central Govt. Set — up.

The undersigned is directed to convey the Guidelines to its stakeholders in National Pension System (NPS) in Central Government Set — up. The issue related to NPS like delay in PRAN generation, Delay in uploading of subscriptions, Functioning of Online PRAN Generation Module (OPGM), Pending grievances, Partial withdrawal requests etc. were discussed and a requirement was felt to sensitize all stakeholders (Subscriber/DDO/CDDOs/PAOs) over the various issue related to NPS.

During the deliberation, some checkpoints at each level were discussed to streamline the NPS Contribution and timely remittances. All the stakeholders (Subscriber/DDO/CDDOs/PAOs) are requested to refer and adhere to the same. Role & Responsibilities of each stakeholders are placed at Annexure — I.

This issues with the approval of the Competent Authority.

(Sunita Malhotra)

Sr. Accounts Officer

Accounts section (Pr. AO, O/o CCA)

Ministry of Housing & Urban Affairs.

NPS in Central Government : Stakeholders Responsibilities in National Pension System

Annexure

Roles and Responsibilities of stakeholders in National Pension System-NPS in Central Government.

1.Subscriber :-

A Govt. servant to whom these rules apply shall immediately on joining service submits an application in ‘CSRF – Subscriber Registration Form’ along with an option form referred to in rule 10. to the Head of Office for registration to the National Pension System.

Documents required to be submitted for registration in NPS

- Proof of identity (any one of below):

- Copy of Passport /Ration Card /Bank Passbook /Voter Card /PAN Card /Aadhaar Card

- Proof of Address (any one of below)

- Copy of Passport /Ration Card /Bank Passbook /Voter Card /PAN Card /Aadhaar Card.

- Cancelled Cheque.

- Copy of PAN Card (Mandatory).

2.Head of Office:-

On receipt of Application under sub-rule (1)’ will ensure:-

(i) The application is completed in all respect. countersign it indicating the date of receipt and send it to the Drawing and Disbursing Officer (DDO) within three working days of joining of Govt. Servant. The Head of Office shall keep a copy of the application form for record as per rule 4(2).

(ii) Once PRAN account is opened by NPS. the Head of Office shall intimate the Permanent Retirement Account Number to the Subscriber and shall record the PRAN in the Common Subscriber Registration Form (CSRF) in the service book.

3. Drawing and Disbursing Officer (DDO):-

(i) Is responsible to forward the application of individual subscriber to the Pay and Accounts Officer (PAO) or Cheque Drawing and Disbursing Officer (CDDO). as the case may be within three working days from the date of receipt of the application from the Head of Office as per rule 4(3).

(ii) Shall communicate the Permanent Retirement Account Number (PRAN) to the Head of Office. as and when received the same from Pay and Accounts Officer or Cheque and Drawing and Disbursing Officer

4. Pay and Accounts Officer/Cheque Drawing & Disbursing Officer(As the case may be):-

Offline PRAN Generation:

- Shall process the application received from DDO and forward it to Central Record Keeping Agency (NSDL) within 3 working days from the date of receipt of application from the DDO under Rule 4(4).

- The Pay and Accounts Officer/CDDO shall also forward duly signed application copy to the Central Record Keeping Agency for records.

Online PRAN Generation will be carried out by the Nodal Offices by login to NSDI.-CRA Portal (https: www.npscra.nsdl.co.in/software-downloads.php) using either the Front-end mode (screen based) or by Batch-upload mode (uploading of file). The Nodal Office is required to forward the physical documents to CRA within 90 days of PRAN generation otherwise the account will be frozen.

A brief overview of processes to be followed is provided below:

i) Front end mode:

- Online PRAN Registration is a Maker — Checker activity. Capturing the details and verification will have to be done by the Nodal Officer using maker and checker id’s.

- Maker User of Nodal Office will capture the Subscriber details. Separate tabs have been provided to capture Personal Details. Bank Details. Nominee Details and for upload of Photograph/Signature.

- Nodal Office will scan Photograph/Signature and upload in the CRA System.

- Checker user will verify the details entered by maker and authorize the request in the CRA System.

- PRAN will be allotted which will be part of the “Subscriber List’ downloaded from CRA Svstem by the Nodal Office.

ii) Batch upload mode:

- The Nodal Offices will enter the Subscriber details from the verified form in the Back-Office/internal system.

- Photograph and Signature needs to be scanned and uploaded in Back-office/internal system.

- The Nodal Office needs to generate a registration file and validate the file through File Validation Utility (FVU) provided by CRA (the utility can be downloaded from the link: https: www.npscra.nsdl.co.in/software-downloads.php After successful verification. the file needs to be uploaded in the CRA System.

- PRAN will be allotted which needs to be part of the ‘Subscriber List’ downloaded from CRA System by the Nodal Office.

Central Record Keeping Agency(CRA):- on receipt of Application-

(i) Shall complete the registration process and allocate the Permanent Retirement Account Number (PRAN) in r/o each Government Servant in the form specified by the Authority as per the turn- around time specified by the Authority under Rule 4(5).

(ii) After Completion of the Registration process , CRA shall communicate the PRAN to the Pay and Accounts Ofticer/CDDO as the case may be and also forward the PRAN kit to the subscriber in accordance with the process and turn-around time laid by the Authority as per Rule 4(5).

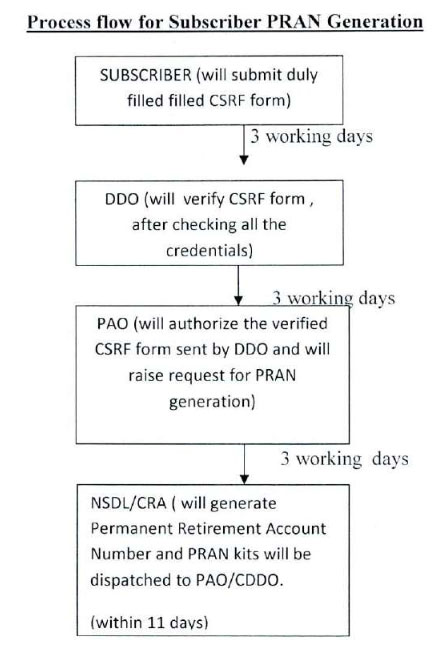

6. Process Flow:-

The Authorities mentioned above shall ensure that there is no delay in the process of registration of the Government Servant in the Nation Pension System (NPS) and crediting of first contribution in his Individual Pension Account within Twenty (20) Days of the date of submission of the application under sub-rule(1) or by the last date of the month in which Govt. Servant joined whichever is later’ As delay in crediting the contribution beyond the prescribed timeline due to factors not attributable to the Subscriber, shall attract penal interest {Rule 6(10)}.

NPS in Central Government –Process flow for Subscriber PRAN Generation

7. Every case of delay in registration of the subscriber in the National Pension System or commencement of contribution under Rule 4 or deduction and crediting of monthly contribution of the subscriber under Rule 6 or crediting of monthly contribution by the Government in the Individual Pension Account of the Subscriber under Rule 7 shall be examined by the Head of Department or Chief Controller of Accounts for fixation of responsibility.

8. If the Head of Department or Chief Controller of Accounts is satisfied that the delay is caused on account of administrative lapse. the delinquent official or officials shall be liable to pay the amount of pecuniary loss to the Government on account of payment of interest.

9. Checklist and monitoring (for NPS Subscriber):-

(i) Dully filled Common Subscriber Registration Form(CSRF) to be submitted by the subscriber. complete in all respect including photographs. proof of identity. proof of Address. Cancelled cheque. Copy of PAN Card.

(ii) Collection of PRAN Kit from respective PAO/CDDO.

(iii)Keeping a follow up of timely credit of Monthly NPS Subscription as per Salary Slip.

(iv)Staving up-to date by logging in either on Website or Mobile App (NPS by Protean).

(v) In case of delay in NPS contribution credit. Subscriber may contact concerned PAO/CDDO.

NPS in Central Government – Frequently Asked Questions:-

- Conversion of Non IRA to IRA:-

Non-IRA active PRANSs need to be converted to IRA by submitting physical application form (Form CSRF) by the respective Nodal Office to the CRA Facilitation Centre (CRA-FC) after due verification and authorization with mandatory details. documents (as mentioned on CSR) and correct PPAN of the employee to be mentioned on CSRF (in Section-13. of CSRI — Ver.2.0) being submitted by non-IRA Subscribers for IRA compliance. This will avoid generation of duplicate PRAN.

Nodal Office will submit Subscriber Registration Form (CSRF — Ver. 2.0) to the nearest CRA-Facilitation Center (CRA-FC location available on: https://npscra.nsdl.co.in/cra-fc.php)

- Maintenance of Subscribers Details:-

Subscribers registered under NPS have an option to update certain details like mobile number email ID etc. in the CRA System using the I-PIN provided to them by CRA. However. Subscribers can also request for change of details through their associated Nodal Office by submitting a Subscriber Detail Change Request form (Form S2) to the concerned Nodal Office.

The request for change in Signature and/or Photograph can be carried out through CRA-FCs Whereas, all other changes like change in personal details, nomination details, demographic details, etc. should be carried out by the concerned Nodal Office through the NPSCAN system by using the User ID and I-PIN allotted by CRA. CRA has allotted two different User IDs and I-PIN to the Nodal Office which will enable them to carry out the changes. Both the IDs can be used as Maker/ Authorizer but the same ID cannot be used as Maker and Authorizer tor the same transaction. Some request types however do not need Authorization.

Matrix showing the activity:

| Type of Request | Maker | Authorizer |

| Change in Subscribers’ personal details(Core Data) | Yes | Required |

| Change in Subscribers’ personal details (Other than Core Data) | Yes | Not Required |

| Change in Subscriber Address | Yes | Required |

| Change in Subscribers· Nomination Details | Yes | Required |

| Change in Subscribers’ Bank Details | Yes | Required |

| Change in Subscribers’ Employment Details | Yes | Required |

| Reprint of PRAN Card | Yes | Required |

- What options are available for exit from NPS for Subscriber at the time of superannuation?

Following options are available to NPS Subscribers:

i) To start Pension: If Subscriber does not wish to continue/defer NPS account. he/she can exit from NPS. He/she can initiate exit request online and as per NPS exit guidelines. will start receiving pension.

ii) When Nodal office/Subscriber will be able to initiate online withdrawal request for retired Subscriber?

Claim ID will be generated by the CRA six months before the Date of Retirement. Once the claim ID is generated. subscriber/Nodal office will be able to initiate the online Withdrawal request In CRA system. Withdrawal request will be processed once the nodal office verifies (initiated by Subscriber) and authorizes the Withdrawal request after Subscriber attains his/her Date of Retirement.

iii) What are the guidelines for withdrawal duc to death of Government Subscriber?

As per Rule 10 of CCS (Implementation of NPS) Rules 2021 Government servant covered under NPS (immediately after joining the service) exercise an option in Form I for availing benefits under the NPS or under the CCS rules 1972. in case of his death and CCS (Extraordinary Pension) Rules 1939 in case of his discharge on invalidation of Government servant during the service.

- Central Grievance Management System (CGMS):

All Nodal Offices and other NPS intermediaries have been provided with a unified platform – Central Grievance Management System (CGMS) for registration and resolution of grievances in a time bound manner. Subscriber/Nodal Office can access CRA System and register their grievance’s in CGMS against any interfacing entity.

CGMS has following features:

(i) A system generated unique token number is given to Entities/Subscribers raising a grievance in CGMS.

(ii) Email alert is sent to the registered email ID of the concerned Entity about the grievance raised.

(iii) For all such grievances against any Entity. the concerned Entity has a provision to enter resolution remarks of the grievance in CGMS.

(iv) Entities/Subscribers raising grievance can check the status of grievance at CRA website (www.cra-nsdl.com) or through the Call Centre by mentioning the Token number.

(v) CRA has provided a Dashboard to the Monitoring Offices for monitoring of pending grievances.

(vi) CGMS also has an automatic escalation mechanism for monitoring the status of the open grievances.

(vii) Pop up alert for the Nodal Office displaying count of Grievances pending for more than 30 days (if any). giving an option to the Nodal Office to resolve them immediately.

(viii) Call Centre at toll free telephone number 1-800-222080 (by using T-PIN) .

- Subscriber Shifting Request:

1) Shifting from one nodal office to another within the Central Government/ a State Govt. :

In case a subscriber shifts within the Central Government or a State Government i.e. from one PrAO/DTA/PAO/DTO/DDO to another PrAO/DTA/PAO/DTO/DDO then the subscriber need not submit any separate request. The shifting automatically takes place in the CRA system as and when a contribution file containing the ‘Regular’ contribution records for the concerned subscriber uploaded by the new nodal office is matched and booked in CRA system.

ii) Shifting from one State Government to Central Government / another State Government and Vice versa:

Submission of physical form for shifting by subscriber:= The subscriber will submit a form for shifting as per prescribed format to the target PAO/ DTO through the corresponding DDO along with a copy of the PRAN card. The subscriber shifting request forms can be obtained from the PAO/DTO/DDO office or downloaded trom the CRA website. The PAO/DTO will process the request In CRA system and retain the document at their end for future use. Acceptance of request and capturing of the request in CRA system

The PAO/DTO will check the following:

- All relevant fields in the form are filled properly.

- PRAN mentioned in the form is valid and active

- Copy of the PRAN card is attached.

PAO/DTO user has to log into CRA system (https://www.npscra.nsdl.co.in/software-downloads.php) with the second IPIN provided to the office. PAO/DTO user will search for shifting requests pending for verification in CRA system by choosing the transaction type (shifting), PAO/DTO will then verify the request details against physical form.

Abbreviations Used:

- NPS – National Pension System.

- PRAN – Permanent Retirement Account Number.

- CRA – Central Record Keeping Agency.

- CSRF – Common Subscriber Registration Forms.

- IRA – Individual Retirement Account.

- PAO – Pay & Accounts Officer.

- CDDO- Cheque Drawing and Disbursing Officer.

- FVU – File Validation Utility.

Important Links:

- https://www.npscra.nsdl.co.in

- https://www.cra-nsdl.com/CRA

- https://www.enps.nsdi.com

- Toll-Free — 1800-222-080

View /Download the Stake Holders of NPS in Central Government