Fixation of Basic pension as per 7th CPC Pension formulation

The Commission recommends the following pension formulation for civil employees including CAPF personnel, who have retired before 01.01.2016:

i) All the civilian personnel including CAPF who retired prior to 01.01.2016 (expected date of implementation of the Seventh CPC recommendations) shall first be fixed in the Pay Matrix being recommended by this Commission, on the basis of the Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the matrix. This amount shall be raised, to arrive at the notional pay of the retiree, by adding the number of increments he/she had earned in that level while in service, at the rate of three percent. Fifty percent of the total amount so arrived at shall be the revised pension.

ii) The second calculation to be carried out is as follows. The pension, as had been fixed at the time of implementation of the VI CPC recommendations, shall be multiplied by 2.57 to arrive at an alternate value for the revised pension.

iii) Pensioners may be given the option of choosing whichever formulation is beneficial to them.

It is recognised that the fixation of pension as per formulation in

(i) above may take a little time since the records of each pensioner will have to be checked to ascertain the number of increments earned in the retiring level. It is therefore recommended that in the first instance the revised pension may be calculated as at

(ii) above and the same may be paid as an interim measure. In the event calculation as per (i) above yields a higher amount the difference may be paid subsequently.

Illustration on fixation of pension based on recommendations of the Seventh CPC.

See : Latest Salary Calculator

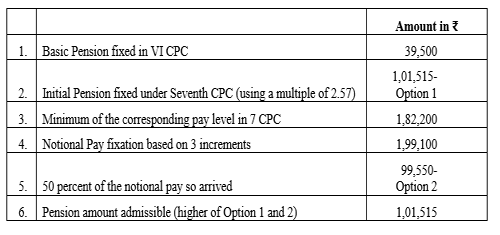

Case I

Pensioner ‘A’ retired at last pay drawn of ₹79,000 on 30 May, 2015 under the VI CPC regime, having drawn three increments in the scale ₹67,000 to 79,000:

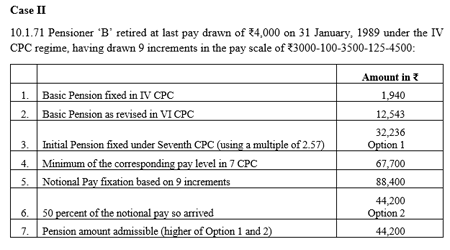

Case II

Pensioner ‘B’ retired at last pay drawn of ₹4,000 on 31 January, 1989 under the IV CPC regime, having drawn 9 increments in the pay scale of ₹3000-100-3500-125-4500:

Calculate Your Basic Pension : Easy steps to Calculate your Basic Pension in 7th Pay Commission

After seeing comments, I feel old pensioners are confused and uncertainties of pension fixing, already 2.5 yrs have passed effective date ie 2016.old pensioners helpless that is how govt is playing with people.

It is not an easy formula for calculating basic pension for pre-2016 pensioners. The complicate calculation of pension may deprive many who had retired long back. In this respect all Head of the Department should be supplied with a Ready reconer for calculation pre-16 pensioners without rising any doubt

Dwarika Prasad retd chief engineer

caicultion will be done by including 40% but in final figure this commuted portion will be

deducted if it is within 15 yrs and restore after copletion of 15th yrs.

There is no problem for records of pensioners retired after Jan 1996 as their pensions are being fixed as per court directive by Sang am C D A and others which can be used.

what about defence pensions?

It isnothing but unsympathetic attitude of the govt. towards old aged pensioners. Question of feasibility does not arise. All records are available with the concerned office of the pensioner. Even otherwise it may be in 1 or 2% cases that record may not be available due to abnormal circumstances which can be reconstituted. But due to this 98% of pensioners may not be allowed to suffer. Govt. who is the safeguard of the rights of pensioners should act in favour of pensioners. It is moral duty of the govt. to see that poor pensioner do not suffer.

There is no need for feasibility committee set up GoI to give its report when cabinet has already accepted Option- I as per CPC report. Only a time consuming exercise to increase the aged senior citizens!

what will happen to cases where pension fixed on 1-10-96 and followed in the fixation on 1-1-2006 on the basis of 10 months average emoluments which is below the 50% of last pay drawn

I also agree that as per pay matrix for calculating revised pension multiplication factor is 2.72 for level 14 (GP 10000) while it is shown 2.57 in example in general creates anomaly and the juniors get higher pension than seniors but retired in 2015 a year earlier to pay scale revision in 2016. The anomaly committee must rectify the issue please.

A)Commutation will not be in picture

B)Difference in pension=Basic pay*2.57-(basic pay+119% of basic pay)

B)Example of my calculation as per basic pay 23745

23745*2.57-(23745+119% of 23745)=61025-(23745+28257)=61025-

52002=9023

C)Arrears from 1.1.2016=9023-6% 0f 23745 =9023-1425=7598 per month(6% da is already given)

D)% increase=7598*100/23745+119% of 23745=14.61%

NOTE:CALCULATION IS AS PER MY UNDER STANDING

ANY MORE SUGGESTION IS WELCOME

What to do, when PPO is not mentioned 50% of BP as per OM dated 30.8.2008, BP is paid less since 1.1.2006, after requesting to PCDA(P), and HOO and CPPC, and PDA Central Bank of India, Jamnagar. I am not able to even calculate approximate pension due to this.

as per pay matrix for calculating revised pension multiplication factor is 2.67 for level 13.5 while it is shown 2.57 in example in general please clarify.

The pension amount will be reduced by the amount of commutation paid.

It is not clear what will happen to 40% of basic Pension pre-payment at the time of retirement (less than 15 years back). How options I & II will take care of this situation.