The revision of the 8th Pay Commission Salary and Fitment Factor is primarily determined by the Minimum Pay Calculation. The entire Pay matrix will be influenced by the percentage of increase in Minimum Pay

To summarize the calculations and projections given below, increasing the Minimum Pay by 34.1% and neutralizing the DA would result in a Fitment factor of 2.28 for the 8th Pay Commission, assuming the DA rate is 70% as of January 1, 2026.

Table of Contents

8th Pay Commission Salary slab

As people think that It is the right time to set up 8th Pay Commission, queries have been raised in Social Media regarding 8th Pay Commission Salary and what would be the Fitment Factor to revise the salary. However the 8th pay commission salary increase will depend on Fitment factor and Minimum Pay Increase.

8th Pay Commission Pay matrix and Fitment factor

The Fitment factor holds significant importance as it serves as a crucial formula in determining the salary and Pay Matrix of the 8th Pay Commission. Its purpose lies in the revision of the existing 7th CPC Pay to align with the 8th CPC Pay Scale.

Seventh Pay Commission had fixed 2.57 as the uniform multiplication factor to revise the Sixth CPC pay of a govt servant to 7th CPC. A new format of Pay Matrix was evolved by the seventh pay commission to make the pay fixation calculation very simple at every stage of promotion and Annual Increment.

Fitment factors 2.57, 2.62, 2.67, 2.72, 2.78 and 2.81 are used in the 7th CPC Pay Matrix

But the 7th Pay Commission has used the Fitment factors 2.57, 2.62, 2.67, 2.72, 2.78 and 2.81 in the Pay Matrix. Many wonder Why six various fitment factor used for different pay levels ? 7th Pay Commission has justified its decision to use different Fitment Formula in its report. This method was adopted to differentiate through enhancement in the pay between PB1, PB2, PB3 and PB4 pay Scales in Sixth CPC. Thus the commission thought, Rationalization of pay as per the classification of Posts in 7th CPC could be achieved. Read the Justification for Different Fitment Factors.

How 8th pay commission Fitment factor can be arrived ?

The primary determinants of the 8th CPC Fitment factor are the Minimum Pay and the Rate of Dearness Allowance. The effective date of the 8th pay commission recommendation is set for 1.1.2026. In order to establish a revised pay scale under the new pay commission, the Dearness Allowance rate up to this date will be nullified. Following this, the neutralized DA rate must be integrated with the Current Basic Pay.

a) Calculation of 8th CPC Minimum Pay

In order to determine the Fitment factor, the initial step involves calculating the revised Minimum Pay based on the prevailing Financial Condition. The Minimum Pay is computed in accordance with the 15th ILC Norms and Dr. Akroyd Formula, considering the present market price of essential commodities for a family. [Read this Post to Know the Projected Minimum 8th CPC Minimum Pay ] Subsequently, the Fitment Factor or Uniform multiplication factor can be derived through DA neutralisation.

b) Dearness Allowance rate applicable from the 1st of January, 2026

As of January 1, 2026, the Dearness Allowance (DA) is expected to increase by 20% from the upcoming installments. Currently, the rate of DA is 50% as of January 1, 2024. There are still four installments of DA to be released on July 1, 2024, January 1, 2025, July 1, 2025, and January 1, 2026. Based on these installments, it is anticipated that the rate of DA on January 1, 2026, may reach 70%.

What will be the Fitment factor in 8th Pay Commission ?

Anticipated Fitment Factor or Uniform Multiplying Factor in 8th CPC = 2.28

The cost estimated from Minimum Pay calculation is next rounded off to ₹41,000, which is the minimum pay may be recommended in 8th Pay Commission, operative from 01.01.2026. This is 2.28 times the minimum pay of ₹18,000 fixed by the government while implementing the VII CPC’s recommendations from 01.01.2016.

Accordingly, basic pay at any level on 01.01.2026 (pay in the Pay matrix) would need to be multiplied by 2.28 to fix the pay of an employee in the new pay structure. Of this multiple, 1.70 provides for merging of basic pay with DA, assumed at 70 percent on 01.01.2026, while the balance is the real increase in 8th Pay Commission. The Increase worked out to be 34.1 %

Since Rationalization of pay as per the classification of Posts has been achieved in 7th CPC, there is no need to use different Fitment factor for the Levels in 8th CPC

View the Projected 8th Pay Commission Salary calculator– Know your Pay !

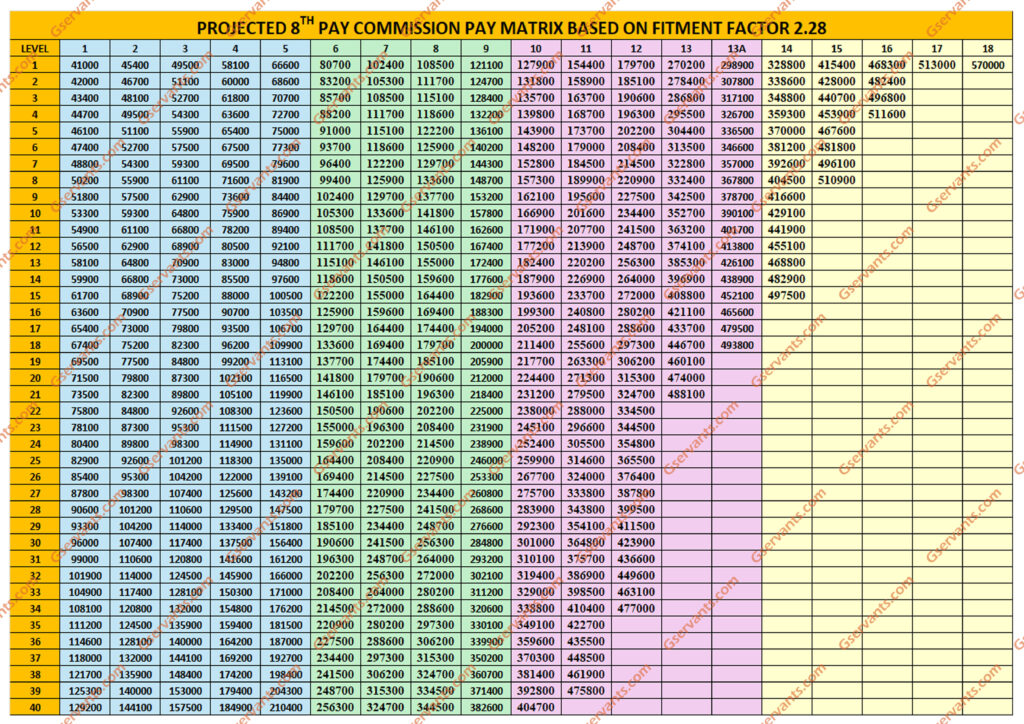

Base on the above calculation of Minimum Pay and Fitment Factor, the Pay Matrix for 8th CPC can be computed as provided below : [ View here For Detailed report on Level wise (erstwhile Pay band Wise) Pay Matrix Tables]

When will 8th pay commission come ? and What will be the 8th Pay Commission Salary and Minimum Pay ?

The implementation of the 8th Pay Commission is scheduled for January 1st, 2026. Consequently, the government is required to establish the Commission to review and adjust the pay and allowances 18 months in advance of the designated implementation date. The Minimum Pay and rate of DA as on this date will be taken into account for determining the 8th CPC Fitment factor. If we assume the rate of DA as on 1.1.2026 is 70 percent, the proposed 8th CPC multiplication Factor after neutralisation of DA will be 1.70. If the Pay commission recommends any increase in the pay revision that would be included in the 8th CPC Fitment factor. It depends on how much Minimum Pay the Pay Commission would recommend in 8th Pay revision. Accordingly 8th pay commission basic salary will be determined

What will be the 8th Pay Commission salary ?

The 8th Pay Commission salary and Fitment factor to be decided on various factors. One of which is Dr.Aykroyd formula. The Minimum Pay will be determined using the norms set by 15th Labour Conference and basic food requirements to a family as per Dr.Aykroyd recommendations. So many factors are involved in determining the Minimum Pay including consumer Price Index which is used in DA calculation.

What is Fitment factor and minimum Pay of Previous pay commissions ?

Lat us see the Fitment Factor, percentage of Increase in Minimum Pay of the previous Pay Commissions

| Pay Commission | Fitment Factor | % Of Increase | Minimum Pay |

| 2nd CPC | – | 14.2% | Rs.70 |

| 3rd CPC | – | 20.6% | Rs.196 |

| 4th CPC | – | 27.6% | Rs.750 |

| 5th CPC | – | 31% | Rs.2550 |

| 6th CPC | 1.86 | 54% | Rs.7000 |

| 7th CPC | 2.57 | 14.29% | Rs.18000 |

| 8th CPC (Anticipated Values) | 2.28 | 34.1 % | Rs.41000 |

So determining the Fitment factor involves the rate of dearness Allowance as on 01.01.2026 and the increase in Minimum Pay to be arrived by 8th Pay Commission.

If the Minimum Pay has 20% increase, after DA neutralisation the 8th pay Commission Fitment factor will be 1.96 assuming the rate of DA as on 01.01.2026 is 70%.

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates