7th CPC Disability and War Injury Pension

Disability Pension

The orders regulating grant of disability pension in the case of defence forces personnel are detailed in view of the circumstances in which they operate. Disability pension is granted in two broad categories-

(a) Non Battle cases and

(b) War Injury cases.

Armed forces personnel retired with disability attributable to or aggravated by such service and assessed at 20 percent or more are awarded disability pension. Those invalided out with any disability attributable to or aggravated by such service are also awarded disability pension.

The regime of disability element for non-battle cases has, over time, moved from fixed slab rates to one based on percentage of reckonable emoluments. This shift was recommended by the VI CPC.

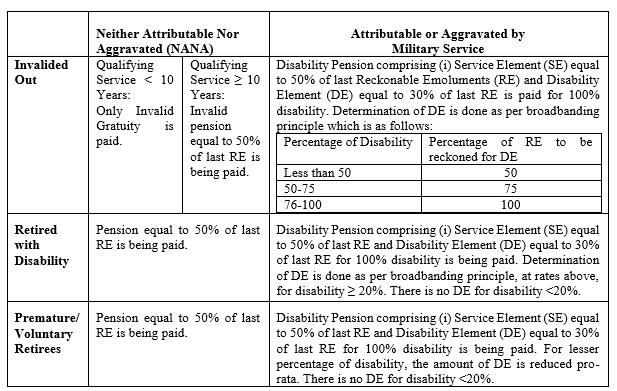

Non Battle Cases: In Non Battle cases there are two categories–(i) Cases Attributable/ Aggravated to service and (ii) Cases Neither Attributable/ Nor Aggravatable to service. The manner in which these cases are being currently regulated is as under:

READ : Definition of Disability Pension for Commissioned Officers

War Injury Cases: Currently in War Injury cases there are two distinct categories- (i) those invalided out and (ii) those retained in service. In case of those invalided out the pension paid is 50 percent of reckonable emoluments, subject to a minimum of ₹7,020. This is in addition to 100 percent of reckonable emoluments for those with 100 percent disability and on pro rata basis for those with lesser disability. For personnel suffering war injury but who are retained in service, the pension paid out is 50 percent of reckonable emoluments in addition to 60 percent of reckonable emoluments for those with 100 percent disability and on pro rata basis for those with lesser disability.

The principal demands made before the Seventh CPC in respect of disability pensions as applicable for defence forces personnel were:

i. In the case of disability pension, an upward revision from the existing rate of 30 percent to 50 percent of last pay drawn, in cases of 100 percent disability.[Continue ]

ii. Enhancing the cover of Disability.[ Continue to read 7th CPC recommendation of this ]

iii. Additional old age pension should be applicable for disability/ war injury pension.[ Continue ..]

iv. All cases of invalidment due to disability Neither Attributable Nor Aggravated (NANA) to service, be awarded Disability Pension.[ READ MORE.]

v. Enhancement in the rate of war injury pension where individual is retained in service[ READ ].

vi. Ex-gratia lump sum compensation to invalided out defence personnel.[ READ MORE]

vii. Ex-gratia award for 100 percent disability be made equal to the stipend being paid to Cadets.[READ MORE ]

viii. The need to empanel well established civil prosthetic centres so as to make facilities for good quality repairs and replacement of artificial limbs easily accessible.[ READ MORE ]

ix. Ex-gratia lump sum compensation [READ MORE]

READ : Method of Calculation of Disability where two types of IDs are involved

I was retired on 30 Apr 2015 as acp sub maj and got 20% disability pension ie @ 1590 /pm how much amount will given in 7 th pay commission to me pm Info on ph no 7068249496