Income Tax Deduction from Salaries during Financial Year 2018-19

CIRCULAR NO : 01 /2019

F.No. 275/192/2018-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North Block, New Delhi

Dated the 1st January, 2019

SUBJECT: INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2018-19 UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961.

Reference is invited to Circular No. 29/2017 dated 05.12.2017 whereby the rates of deduction of income-tax from the payment of income under the head “Salaries” under Section 192 of the Income-tax Act, 1961 (hereinafter the Act‘), during the financial year 2017-18, were intimated. The present Circular contains the rates of deduction of income-tax from the payment of income chargeable under the head “Salaries” during the financial year 2018-19 and explains certain related provisions of the Act and Income-tax Rules, 1962 (hereinafter the Rules). The relevant Acts, Rules, Forms and Notifications are available at the website of the Income Tax Department- www.incometaxindia.gov.in.

- RATES OF INCOME-TAX AS PER FINANCE ACT, 2018:

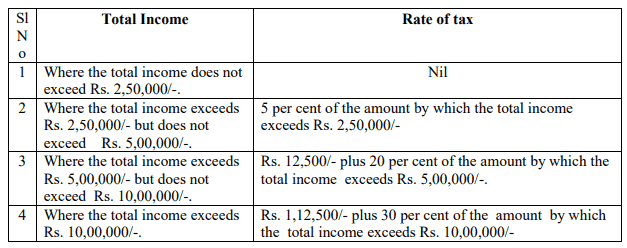

As per the Finance Act, 2018, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2018-19 (i.e. Assessment Year 2019-20) at the following rates:

2.1 Rates of tax

A. Normal Rates of tax:

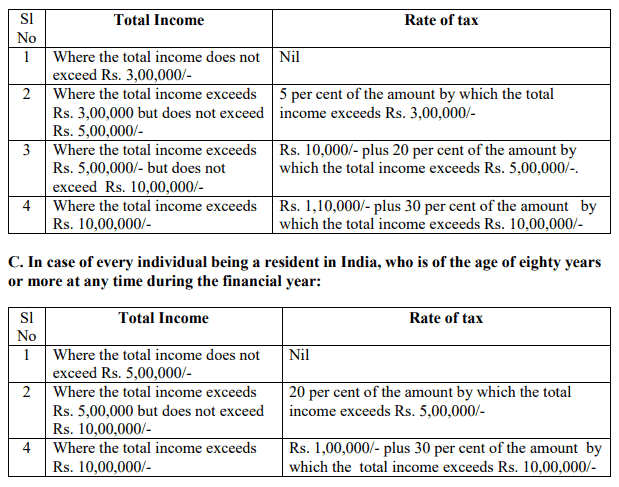

B. Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

2.2 Surcharge on Income tax:

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 or section 112A of the Act, shall be increased by a surcharge for the purpose of the Union, calculated, in the case of every individual or Hindu undivided family or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act,-

(a) having a total income exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate of ten percent of such income-tax and

(b) having a total income exceeding one crore rupees, at the rate of fifteen percent of such income-tax:

Provided that in the case of persons mentioned above having total income exceeding;-

(a) Fifty lakh rupees but not exceeding one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of fifty lakh rupees by more than the amount of income that exceeds fifty lakh rupees;

(b) one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees

2.31 Health and Education Cess

Education Cess on income-tax and Secondary and Higher Education Cess on income-tax shall be discontinued. However, a new cess, by the name “Health and Education Cess”shall be levied at the rate of four percent of income tax including surcharge wherever applicable, No marginal relief shall be available in respect of such cess.

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

Sir

Previously the full details including income tax exemptions with illustrations given