Retirement Gratuity and Death Gratuity

1) a) A Government Servant who has completed 5 years qualifying service and has become eligible for service gratuity or pension under Rule 44 shall, on his retirement, be granted retirement gratuity equal to one-fourth of his emoluments for each completed six monthly period of qualifying service, subject to a maximum of 16½ times the emoluments.

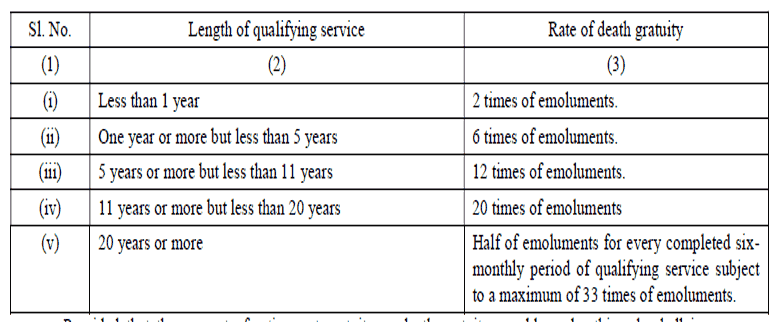

(b) If a Government servant dies while in service, the death gratuity shall be paid to his family in the manner indicated in sub-rule (1) of Rule 47 at the rates given in the Table below, namely:-

Gratuity Maximum limit 20 Lakh Rupees

Provided that the amount of retirement gratuity or death gratuity payable under this rule shall in no case exceed twenty lakh rupees:

Provided further that where the amount of retirement or death gratuity, as finally calculated, contains a fraction of a rupee, it shall be rounded off to the next higher rupee.

(2) The provision of clause (b) of sub-rule (1) shall also be applicable in the case of death of a Government servant by suicide.

(3) In case a Government servant, who, on retirement, became eligible for a service gratuity or pension, dies within five years from the date of his retirement from service including compulsory retirement as a penalty and the sums actually received by him at the time of his death on account of such gratuity or pension, together with the retirement gratuity admissible under sub-rule (1) and the commuted value of any portion of pension commuted by him are less than the amount equal to 12 times of his emoluments, a residuary gratuity equal to the deficiency may be granted to his family in the manner indicated in sub-rule (1) of rule 47.

Read about Family Pension Eligibility and Procedure

(4) In calculating the length of qualifying service under this rule, fraction of a year equal to three months and above shall be treated as a completed six monthly period and reckoned as qualifying service.

(5) In the case of a Government servant who has rendered a qualifying service of four years and nine months or more but less than five years, his qualifying service for the purpose of this rule shall be five years and he shall be eligible for retirement gratuity in accordance with clause (a) of sub-rule (1).

(6) The emoluments for the purpose of gratuity admissible under this rule shall be reckoned in accordance with rule 31:

Provided that if the emoluments of a Government servant have been reduced during the last ten months of his service, average emoluments as referred to in rule 32 shall be treated as emoluments.

Provided further that the dearness allowance admissible on the date of retirement or death, as the case may be, shall also be treated as emoluments for the purpose of this rule.

Explanation.- For the purposes of this rule and rules 46, 47, 48 and means,-

(i) wife or wives including judicially separated wife or wives in the case of a male Government servant;

(ii) husband, including judicially separated husband in the case of a female Government servant;

(iii) sons including stepsons and adopted sons;

(iv) unmarried daughters including stepdaughters and adopted daughters;

(v) widowed or divorced daughters including stepdaughters and adopted daughters;

(vi) father including adoptive parents in the case of individuals whose personal law permits adoption;

(vii) mother including adoptive parents in the case of individuals whose personal law permits adoption;

(viii) brothers including stepbrothers who are suffering from any disorder or disability of mind including the mentally retarded or physically crippled or disabled without any limit of age and brothers, including stepbrothers, below the age of eighteen years, in other cases;

(ix) unmarried sisters, widowed sisters and divorced sisters including stepsisters;

(x) married daughters; and

(xi) children of a pre-deceased son.