Family Pension Eligibility and Application Procedure for Central Government Employees in Pension Rules 2021

Family Pension Eligibility and Application Procedure

(1) Where a Government servant dies,-

(i) after completion of one year of continuous service; or

(ii) before completion of one year of continuous service, provided the deceased Government servant

concerned immediately prior to his appointment to the service or post was examined by the appropriate medical authority and declared fit by that authority for Government service; or

(iii) after retirement from service and was on the date of death in receipt of a pension, or compassionate

allowance, referred to in these rules, the family of the deceased shall be entitled to a family pension from the date following the date of death of the Government servant or the retired Government servant, as the case may be.

Explanation – Continuous Service Means Service rendered in a temporary or permanent capacity in a pensionable establishment and does not include period of suspension, if any and period of service, if any, rendered before attaining the age of eighteen years.

(2)(a)(i) Subject to sub-clause (ii) and sub-clause (iii), the amount of family pension shall be determined at a uniform rate of thirty per cent of pay subject to a minimum of nine thousand rupees per month and a maximum of seventy-five thousand rupees per month.

ii) Where a Government servant dies while in service, the rate of family pension payable to the family shall be equal to fifty per cent of the pay and the amount so admissible shall be payable from the date following the date of death of the Government servant for a period of ten years.

(iii) In the event of death of a Government servant after retirement, the family pension as determined under sub clause (ii) shall be payable for a period of seven years, or for a period up to the date on which the retired deceased Government servant would have attained the age of sixty seven years had he survived, whichever is less:

Provided that in no case the amount of family pension determined under this sub-clause shall exceed the

pension authorised on retirement or dismissal from Government service:

Provided further that where the amount of pension authorised on retirement or dismissal is less than the amount of family pension admissible under sub-clause (i), the amount of family pension determined under this sub-clause shall be limited to the amount of family pension admissible under sub-clause (i).

(iv) The amount of family pension payable under sub-clause (ii) or sub-clause (iii) shall be subject to a minimum of nine thousand rupees per mensem and a maximum of one lakh twenty five thousand rupees per mensem.

Explanation.-1. Pay for the purpose of sub-clause (i) and sub-clause (ii) means (i) emoluments as referred to in rule 31 or (ii) average emoluments as referred to in rule 32, whichever is more.

Explanation.-2. For the purpose of sub-clause (iii), pension authorised on retirement includes the part of the pension which the retired Government servant may have commuted before death.

Explanation.-3. For the purpose of sub- includes the pension authorised on compulsory retirement and compassionate allowance sanctioned on dismissal or removal from Government service.

(b) After the expiry of the period referred to in sub-clause (ii) and sub-clause (iii) of clause (a), the family, in receipt of family pension under those sub-clauses, shall be entitled to family pension at the rate admissible under sub-clause (i) of clause (a).

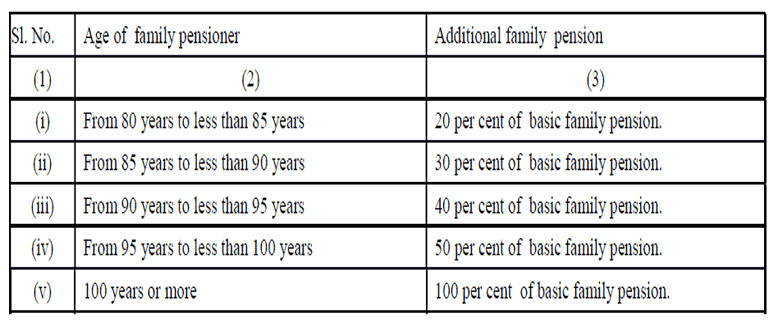

Additional family pension payable to the family pensioner after completion of age of eighty years

(3)(a) In addition to family pension admissible in accordance with sub-rule (2), additional family pension shall be payable to the family pensioner after completion of age of eighty years in the following manner:-

(b) The additional family pension shall be payable from first day of the calendar month in which it falls due.

Illustration: A family pensioner born on 20th August, 1942 shall be eligible for additional family pension at the rate of twenty percent of the basic family pension with effect from 1st August, 2022. A family pensioner born on 1st August, 1942 shall also be eligible for additional family pension at the rate of twenty percent of the basic family pension with effect from 1st August, 2022.

(4) The amount of family pension admissible under sub-rule (2) and additional family pension admissible under sub rule (3), where applicable, shall be fixed at monthly rates and shall be expressed in whole rupees and where the family pension or the additional family pension contains a fraction of a rupee, it shall be rounded off to the next higher rupee:

Read More about Family Pension Rules 2021

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates