The First starting Pay of a Pay Matrix is Minimum Pay of Central Government Employees. The 8th Pay Commission yet to be constituted will have to go through tough task in determining the 8th CPC minimum Pay.

The essence of the subsequent calculations indicates that the minimum pay under the 8th CPC will amount to Rs.41000.

8th Pay Commission Latest News

Determination of 8th Pay Commission Minimum Pay

The estimation of 8th CPC Minimum pay for government servants is the first step towards building its pay structure. In doing so, the approach is to ascertain, by using the most logical and acceptable methodology, what the lowest ranked staff in government needs to be paid to enable him to meet the minimum expenditure needs for himself and his family in a dignified manner.

ILO definition for minimum Wage

International Labour organisation defines Minimum Wages as follows

Minimum wages have been defined as “the minimum amount of remuneration that an employer is required to pay wage earners for the work performed during a given period, which cannot be reduced by collective agreement or an individual contract”.

How is Minimum Pay arrived in 7th Pay Commission

7th Pay Commission in its report described how it arrived Minimum Pay

To estimate the minimum pay in the government, the VI CPC used the norms set by the 15th Indian Labor Conference (ILC) in 1957 to determine the need-based minimum wage for a single industrial worker. The norms set by the ILC are as below:

i. A need-based minimum wage for a single worker should cover all the needs of a worker’s family. The normative family is taken to consist of a spouse and two children below the age of 14. With the husband assigned 1 unit, wife, 0.8 unit and two children, 0.6 units each, the minimum wage needs to address 3 consumption units;

ii. The food requirement per consumption unit is shown in the Annexure to this chapter. The specifications were derived from the recommendations of Dr. Wallace Aykroyd, the noted nutritionist, which stated that an average Indian adult engaged in moderate activity should, on a daily basis, consume 2,700 calories comprising 65 grams of protein and around 45-60 grams of fat. Dr Aykroyd had further pointed out that animal proteins, such as milk, eggs, fish, liver and meat, are biologically more efficient than vegetable proteins and suggested that they should form at least one-fifth of the total protein intake;

iii. The clothing requirements should be based on per capita consumption of 18 yards per annum, which gives 72 yards per annum (5.5 meters per month) for the average worker’s family. The 15th ILC also specified the associated consumption of detergents, which can be seen in the Annexure;

iv. For housing, the rent corresponding to the minimum area provided under the government’s industrial housing schemes is to be taken. The 15th ILC kept it at 7.5 percent of the total minimum wage;

v. Fuel, lighting and other items of expenditure should constitute an additional 20 percent of the total minimum wage

After considering all relevant factors the Commission is of the view that the minimum pay in government recommended at ₹18,000 per month, w.e.f. 01.01.2016, is fair and reasonable and one which, along with other allowances and facilities, would ensure a decent standard of living for the lowest ranked employee in the Central Government..

8th CPC Minimum Pay Calculation

Now it is the time for calculation of Minimum Wage of 8th Pay Commission in line with 15th ILC norms and Dr.Aykroyd Formula mentioned above.

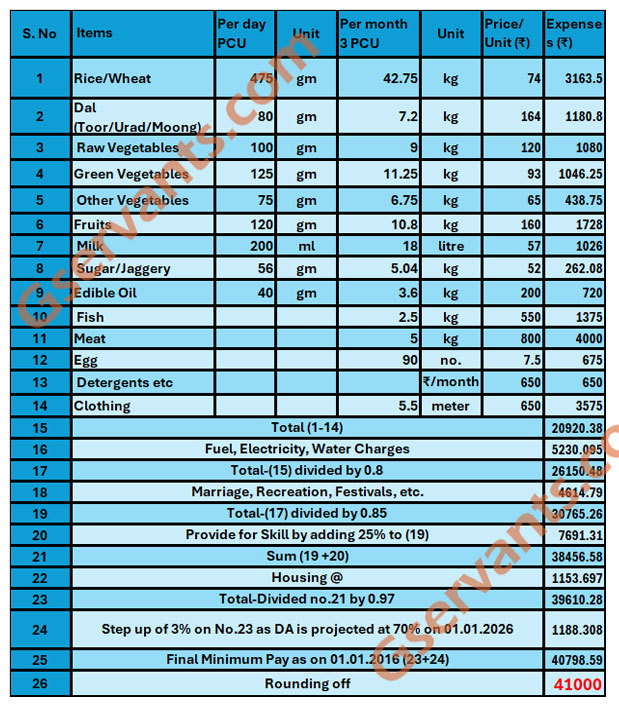

The minimum pay of 8th CPC has been estimated as per the tabulated calculations below following the steps mentioned in the 7th CPC recommendation.

Based on the calculation provided above, the total cost of Food, Clothing, and other essential items for a family of three members is approximately Rs.40798 based on current retail prices. When rounded off to the nearest hundred, this amount becomes Rs.41000. This figure could potentially serve as the minimum pay in the 8th Pay Commission.

Know Your 8th CPC Pay-Projected 8th pay Commission Pay calculator

The minimum Pay of previous Pay Commission

The Minimum Pay of 1st pay Commission to 8th Pay Commission is provided below

| Pay Commission | Fitment Factor | % Of Increase | Minimum Pay |

| I CPC (1946-47) | Rs. 55 | ||

| II CPC (1957-59) | 14.2% | Rs. 80 | |

| III CPC (1972-73) | 20.6% | Rs. 196 | |

| IV CPC (1983-86) | – | 27.6% | Rs.750 |

| V CPC (1994-97) | – | 31% | Rs.2550 |

| VI CPC (2006-08) | 1.86 | 54% | Rs.7000 |

| 7th CPC (2014-2016) | 2.57 | 14.29% | Rs.18000 |

| 8th CPC (Anticipated Values) | 2.28 | 34.1% | Rs.41000 |

8th CPC Minimum Pay Scenarios

There are three scenarios to consider when assuming the minimum pay for the 8th CPC.

- Based on the current inflation rates and consumer price index, the 8th CPC Minimum Pay will be set at Rs.41000, as indicated in the provided Table. Consequently, this will lead to a Fitment factor of 2.28 [ Read this Report] .

- The second Scenario is to arrive the Minimum Pay by using the average of Previous Pay Commission Fitment factors. The average of Fitment factors of previous pay Commissions [ Read this Article], will be around 3.00. In that case the Minimum Pay in 8th Pay Commission will be Rs.54000.

- The third Scenario is to use 7th CPC Fitment factor to arrive 8th CPC Minimum Pay. The 7th Pay Commission Fitment factor was 2.57. If we apply this Fitment factor in 8th CPC, then the minimum Pay in 8th Pay Commission will be Rs.46300/-

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates