Demand for Increase in the rate of additional pension and family pension to the pre-2016 pensioners as also reducing the age the eligibility for its receipt from the existing 80 years raised before 7th pay commission

The existing rates of additional pension and additional family pension are appropriate: 7th CPC

Though the demands were raised for increasing the rate of additional Pension, every body particularly those who are at the verge of attaining the age of 75 years, expected that age entitlement for additional pension will be reduced

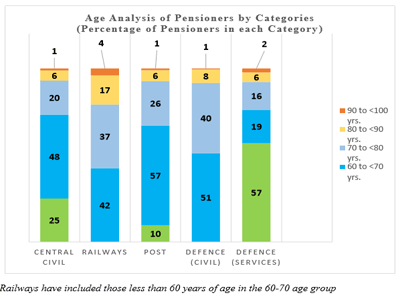

Because the total percentage of pensioners from 80 Years to 100 Years age Bracket is just 10% of the Total 52lk Pensioners.

80 Years to 90 Years = 8.6 %

90 Years to 100 Years = 1.8%

It is justifiable demand that at the age of 75 years they are very much in need of extra care in respect of health and wealth. This demand would have been considered favourably by the 7th Pay commission.

But as the routine the commission sought the views of the government in this regard.

READ ALSO : Easy steps to Calculate your Basic Pension in 7th Pay Commission

Department of Pension and Pensioners Welfare stated that the additional pension for old pensioners of the age of 80 years and above has been allowed as per the recommendations of VI CPC.

Recommendations on increasing additional pension

However the commission said that it felt that the same should be allowed from 75 years onwards. Since the Ministry of Defence has not supported this proposal, The Commission was changed its view that the existing rates of additional pension and additional family pension are appropriate.

NCJCM should act upon this demand of veterans and necessary pressure to be given to the government by them to get this done for our senior most citizens

The additional pension with advancing age came into force based on the recommendations of the VI CPC.

The rates as applicable for the additional pension are as under:

· 80 years to <85 years: 20% of basic pension

· 85 years to <90 years: 30% of basic pension

· 90 years to <95 years: 40% of basic pension

· 95 years to <100 years: 50% of basic pension

· 100 years and more: 100% of basic pension

7th CPC Recommendation on Enhancing Fixed Medical Allowance for pre 2016 Pensioners

Demands have been received to increase the rate of this allowance to ₹2,000 pm. But the 7th Pay commission recommended the following…[ Continue Reading...]

This is regarding additional pension. Hardly 20% pensioners survive beyond 80 years of age. There is no justice to senior citizens if only 20% get the benefit of some rules. Union leaders should take up this matter with the govt. The need of more medical air does not come up only when a pensioner reach the ages of 80 years. In my opinion, additional pension should be given5% at age of 65, 10% at the age of 70 years and so on till 80 years of age. It is mentioned here that Himachal Pradesh govt has sanctioned vide Memo No. Fin(Pen) A (3)-1/09 dated 23-4-2014 pension allowance(not additional pension) at the rate of 5%, 10%, 15% of the basic pension at the age of 65, 70, and 75 and on attaining the age of 80, 20% additional pension (not allowance) as in central govt rules. All central govt retirees as well as retirees’ organisations and union leaders should write to govt.

Because of the rationalisation the affected employees are those retired/retiring on 30th June. There is no noticeable benefit otherwise because of this change. It is therefore justiciable either date of promotion has to be the DNI or June retirees should be given an increment. It seems a genuine discrepancy which needs correction.

REMEDIAL ACTION SHOULD BE TAKEN BY UNION LEADERS WHILE DISCUSSING WITH THE GOVT TO SOLVE THE ANOMALIES REGARDING FIXATION OF PENSION UNDER 7th PAY COMMISSION. A GOVERNMENT SERVANT IS ENTITLED FOR AN INCREMENT IF HE SERVE ONE COMPLETE YEAR AS PER THE FUNDAMENTAL RULES. IF A PERSON WHO DRAW HIS INCREMENT ON 1.7.2006 AND RETIRES ON 30.6.2007 IS NOT ABLE TO DRAW HIS INCREMENT AS HE IS NOT IN SERVICE ON 1.7.2007. THIS IS AN INJUSTICE TO THE EMPLOYEE AND THIS ANOMALY IS DIRECTLY DUE TO RATIONALIZATION OF DATE OF INCREMENTS OF EMPLOYEES.MY REQUEST IS THAT ONE MORE INCREMENT SHOULD BE ADDED IN THE PAY TO SUCH EMPLOYEE WHILE CALCULATING HIS/HER PENSION UNDER 6th & 7th PAY COMMISSION.