7th Pay Commission Minimum Pay Scale

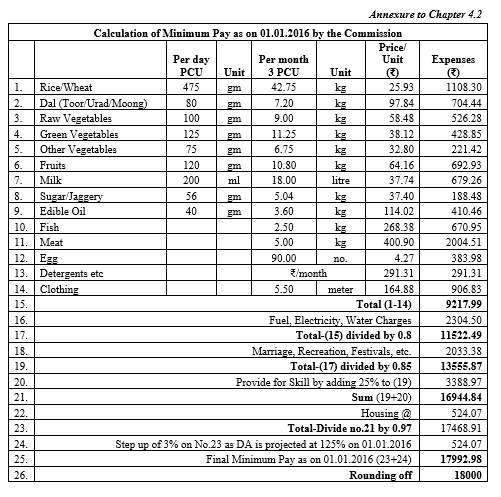

The Commission has estimated the minimum pay (the calculations for which have been tabulated in the Annexure) through the following steps:

Step 1: The food, clothing and detergent products listed and their respective quantities specified by the 15th ILC have been adopted. These quantities indicate the monthly consumption of the listed products by a family comprising three consumption units. [For e.g. for the product ‘Dal’ the quantity specified for daily consumption is 80 grams per consumption unit per day. The monthly consumption of Dal by a consumption unit thus works out to 2.4 kg (80 x 30). Accordingly the monthly consumption of Dal by a family comprising 3 units is 7.2 kgs (2.4 x 3).]

Step 2: The quantities have been multiplied by their respective product prices to arrive at product wise cost. The price adopted for each product is the average of prices of various items that are included in the product. The price of an item is the average of its prices prevailing in each month from July, 2014-June, 2015. [At monthly family consumption of 7.2 kg the Commission has estimated the monthly expenditure on Dal at ₹704.44 after calculating the price of Dal at ₹97.84 per kg. The price of Dal has been calculated as the average of prices of Toor, Urad and Moong Dal items specified under the product Dal and whose prices have been determined at ₹87.86, ₹109.66 and ₹96.00 respectively. The prices of these three Dal items are the twelve monthly average prices for the period July, 2014–June, 2015.] The prices of all items have been sourced from Labor Bureau, Shimla. These prices are used in the calculation of the CPI (IW) and subsequently the calculation of Dearness Allowance. In the current exercise the prices of all items are for the period July 2014-June 2015 and have been used in the calculation of DA at 119 percent operative from 01.07.2015.

READ ALSO : 7th Pay Commission Gross Pay vs Net Pay : Grade wise comparison by NFIR

Step 3: The cost of food, clothing and detergent products obtained from Step 2 has been divided by 0.8 to arrive at a total, of which 20 percent provides for fuel and lighting expenses. This addresses the fifth component under para 4.2.3. The fourth component on housing under para 4.2.3 has not been addressed at this stage as its quantification at the final stage of pay estimation is considered more appropriate by the Commission.

Step 4: The cost estimated from Step 3 is divided by 0.85 to arrive at a total, of which 15 percent is towards recreation, ceremonies and festivities. The prescribed provision of 25 percent to cover education, recreation, ceremonies, festivals and medical expenses has been moderated to 15 percent because expenses on educational and medical necessities are being separately provided for through relevant allowances and facilities and thus need not be provided here. This partially addresses the first of the two components outside the 15th ILC norms.

Step 5: The cost estimated from Step 4 is increased by 25 percent to account for the skill factor, following the reasoning that there is no unskilled staff in the government after the merger of Group D staff in Group `C’. This addresses the second of the two components outside the 15th ILC norms.

Step 6: The cost estimated from Step 5 is divided by 0.97 to arrive at a total, of which 3 percent provides for housing expenses. This is done in view of the observation that license fees for government accommodation is about 3 percent of the total pay. This addresses the fourth component stated under para 3 but partially so, as the 15th ILC norms had fixed the housing provision at 7.5 percent.

Step 7: The cost estimated from Step 6 is as on 1 July, 2015 when the DA was 119 percent. The DA is assumed to be 125 percent as on 1 January, 2016, the day from which the Commission expects its recommendations to be implemented by the government. Accordingly the cost estimated from Step 6 has been increased by 3 percent (2.25/2.19 = 1.027 or nearly 3%).

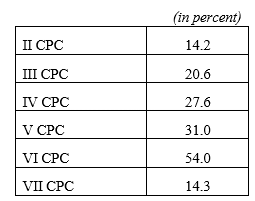

4.2.9 The cost estimated from Step 7 is next rounded off to ₹18,000, which is the minimum pay being recommended by the Commission, operative from 01.01.2016. This is 2.57 times the minimum pay of ₹7,000 fixed by the government while implementing the VI CPC’s recommendations from 01.01.2006. Accordingly, basic pay at any level on 01.01.2016 (pay in the pay band + grade pay) would need to be multiplied by 2.57 to fix the pay of an employee in the new pay structure. Of this multiple, 2.25 provides for merging of basic pay with DA, assumed at 125 percent on 01.01.2016, while the balance is the real increase being recommended by the Commission. The real increase works out to 14.2 percent (2.57÷2.25 = 1.1429). The following table shows the real increase given by each CPC/Government over the previously set minimum pay:

VII CPC 14.3 4.2.10 The real pay in government is protected by providing Dearness Allowance (DA), which is that percentage of pay by which the CPI (IW)16 increases over a fixed base value. 16 CPI (IW) is Consumer Price Index for Industrial Workers maintained by Labour Bureau, Shimla.

Consequently the absolute amount of DA keeps on growing with every point increase in CPI (IW). On the other hand the real value of the industrial minimum wage is protected by providing Variable Dearness Allowance (VDA), which is a fixed amount of money given per point increase in CPI (IW) as notified by the Chief Labour Commissioner (central sphere) from time to time. Consequently, over a period of time, the minimum pay + DA in government becomes larger than the minimum wage + VDA in the private sector even though the basic minimum wage in both the sectors is calculated on the basis of the 15th ILC norms. As on 01.01.2015 the minimum pay in government was ₹14,910 whereas minimum wage for a skilled worker was in the range of ₹9,000–₹11,000 per month.

4.2.11 Besides DA, government provides house rent, transport, location and function specific allowances besides Leave Travel Allowance (LTA) which, along with the basic pay, constitute the gross pay of a government employee. If one were to only take HRA at 30 percent of the basic pay and transport allowance at ₹400+DA, as are admissible in A1/A class cities, together with educational allowances for two children at the rate of ₹1,500 per month, the gross pay further increases to ₹20,870 (20870 = 14910 +2100+860+3000) as on 01.01.2015. In addition government gives a host of other benefits that can be measured under the CTG (Cost to Government of an employee) concept. From these numbers it is clear that benefits given to the lowest ranked government employees, whether monetized or not, are significantly higher than the minimum basic pay and also much higher than the emoluments of skilled industrial workers.

4.2.12 To obtain a comparative picture of the salaries paid in the government with that in the private sector enterprises the Commission engaged the Indian Institute of Management, Ahmedabad to conduct a study. According to the study the total emoluments of a General Helper, who is the lowest ranked employee in the government is ₹22,579, more than two times the emoluments of a General Helper in the private sector organizations surveyed at ₹8,000₹9,500.

4.2.13 After considering all relevant factors the Commission is of the view that the minimum pay in government recommended at ₹18,000 per month, w.e.f. 01.01.2016, is fair and reasonable and one which, along with other allowances and facilities, would ensure a decent standard of living for the lowest ranked employee in the Central Government.

is this is justice. the minimum pay justification is a great injustice to the lowest category of this 7 CPC

beneficiary group.minimum pay must be 26000/- How they can save with this small amount.the chart provided here is unbelievable. my red salute to the person for preparing this chart.