NPS Withdrawal Types

What types of Withdrawals are allowed under the National Pension System?

As per Pension Fund Regulatory & Development Authority (PFRDA) Exit Rules, following NPS Withdrawal Types are allowed:

a) Upon Normal Superannuation – At least 40% of the accumulated pension wealth of the subscriber has to be utilized for purchase of annuity providing for monthly pension of the subscriber and the balance is paid as lump sum to the subscriber.

In case the total corpus in the account is less than Rs. 2 Lakhs as on the Date of Retirement (Government sector)/attaining the age of 60 (Non-Government sector), the subscriber (other than Swavalamban subscribers) can avail the option of complete Withdrawal.

b) Upon Death – The entire accumulated pension wealth (100%) would be paid to the nominee/legal heir of the subscriber and there would not be any purchase of annuity/monthly pension.

c) Exit from NPS Before the age of Normal Superannuation – At least 80% of the accumulated pension wealth of the subscriber should be utilized for purchase of an annuity providing the monthly pension of the subscriber and the balance is paid as a lump sum to the subscriber.

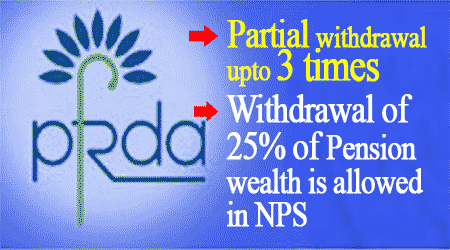

Read : 3 times Partial withdrawal upto 25 percent of Pension wealth is allowed in NPS

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates