Annual Increment in Seventh Pay commission remains same at 3% of Basic Pay. But calculation for Annual Increment in 7th Pay Commission is not needed as such the 7th CPC Pay matrix has been evolved.

7th Pay Commission recommends 3% of the basic Pay for Annual Increment

In the pre revised Pay, the exact 3 % of the Pay band + Grade Pay would be added in the Pay band on account of Annual Increment on 1st July of every year.

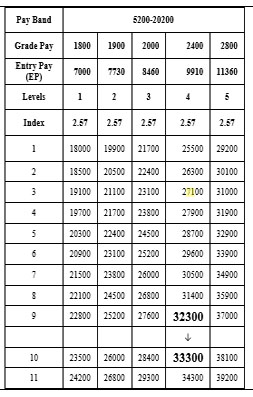

But here in 7th pay commission there is a possibility to get little more or Less than the three percent of Basic Pay. Because here our Basic Pay has to be moved one stage higher in the same Level. In Pay Matrix , each cell in that particular level is calculated such a way that it is 3% higher than the previous cell. Since the figure is rounded off to nearest hundred, exact three percent increase cannot be expected.

7th Pay Commission’s illustrative Example in Respect of Granting Annual Increment.

Suppose, Ms. ABC, who, after having been fixed in the Pay Matrix, is drawing a Basic Pay of ₹32,300 in Level 4.

When she gets an annual increment on 1st of July, she will just move one stage down in the same Level.

Hence, after increment, her pay will be ₹33,300.

Withholding Annual Increments of Non-performers after 20 Years .

The recommendation of Withholding Annual Increments of Non-performers after 20 Years will be opposed severely by Federations if the central government accept this recommendation to implement

The Criteria for Annual Increment is Minimum six Month Period of service to be done to be eligible for the Increment. Unlike in Private Sector the Performance of the individual ….[ Continue Reading ... ]

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

I am a UGC medical college professor and i hav reached the highest pay in my pay band they are not giving me any increment for last 2 and half years. They say stagnation increment is not there in 7th Pay Commission. What is the rule in my situation . I am in pay band 14TH B34000 TO 69000 my basic pay is 218000 for last 2years.

Pl clarify on the issue of. Annual increment less than 3 percent. I got 2.87 percent of annual increment. Loss of rs 27.00 + DA per month. Also next year 45.00 + DA loss.

I agree with the issues raised by padma. very valid. Will someone throw clarity on the issue of less than 3% increment which is ‘assured’ by the cell system? Also, nobody is raising the issue of changes in the fitment factor from 2.67 to 2.57 in PB3? Its a huge loss for middle level officers!

Then, y call it 3% and why not leave it open like the 6th CPC did. The illustrations are misleading as they took only convenient cases. For example, in the table given for increment, in level 5, there is a cell with 37000 as pay. Now, 3% of 37000 is 1010. So, pay after increment should be 38110, but, the immediate next cell to 37000 is 38100. On what basis is the cell of 38100 fixed? Why should the employee lose 10 rupees. If he cannot go to the next higher cell, let him get 38110, the full value of 3%. What is the harm? In this cell structure, who will benefit? If a cell is not higher by 3% from the previous cell, y call the increment as 3%? Isn’t it misleading? In the government, even one rupee matters. There is no system of writing off. If I draw ltc advance of a certain amount and actually spend, five rupees less than the advance, I have to pay back the five rupees by way of challan. That being so, why should an employee lose ten rupees on account of a meaningless cell system. Cells should have been so devised as to be necessarily 3% higher than the previous ones. This will lead to a lot of heart burn.

As per 7th cpc the Grade Pay of Rs 4800 will automatically will be changed to Rs 5400 after completion of four years. Sub Maj are being retired with Rs 4800 grade pay. The pension should be calculated with the help of Rs 5400 as in the case of civil employees.

what if a person has secured 9 increments at a particular grade and due to anomaly and difference in the pay of direct recruits and promo tees in the old pay , his new pay multiplied bu 2.57 is only about at the fourth stage in the vertical index. will he be given a salary at the vertical index of 9 to correspond with his 9 increments, This is how pension is going to be calculated. There is going to be problems in this area .

Notional increments at the time of retirement for every two years of service after attaining maximum in the pay scale prior to 1996 retirees ,whether will be treated as increments.?

7th cpc has not done correct job,which is allotted by govt. committee failed detect right pay to right job.7th cpc mainly focused on group A,B category only.7th cpc introduced more staff in supervisory category than workers.committee ignored workers and group c employee, which is backbone.as per HR management also give workers healthy and willful environment to work,not under slavery.when your stomach is full think about work ,if stomach is empty can’t think about work.it will leads to corruption also.

since so much agitation is coming from employees.unlike previous pay commissions.so govt,committe has to reconsider their report.

I have confusion about Annual increment @3% in 7CPC. For example my basic pay under L-7 is 56900/- after adding 3% increment its become 58,607/- i.e. it crosses next cell figure of Pay in matrix ( 58600/-) my question is whether it will be fixed at 58600/- or the next cell of figure 60400/-

Please let me know about the Pay Matrix and the two options give there

with easy illustrations for making the correct option at one streach.

Thank you.

Is an annual increment of 3% proposed for retirees, also to reduced the arrears load of Govt, when the pension of old retired personnel is made at par with fresh Retired personnel.

My pay grade pay is 15680multiply2.57 is 40297 the pay mtric is 40400 different is 100 only but all pay scale calculated differ is 500 more in pay matric and also annuel increment is also shown in paymatric is Lowering the 3% calculated what is this paymatric for my pay fiction

You need not to calculate 3% of basic Pay to add to your Basic Pay. On account of granting annual increment you will be moved to next cell in the Pay Matrix.

Still there is some confusion about Annual increment @3% in 7CPC. For example Basic under L-7 is 56900/- after adding 3% increment its become 58,607/- i.e. it crosses next cell figure of Pay matrix ( 58600/-) Now question is whether it will be fixed at 58600/- or the next cell of figure 60400/-