Special Compensatory Allowances subsumed under Tough Location Allowance.

No.3/1/2017-E.II(B)

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, the 19th July, 2017.

OFFICE MEMORANDUM

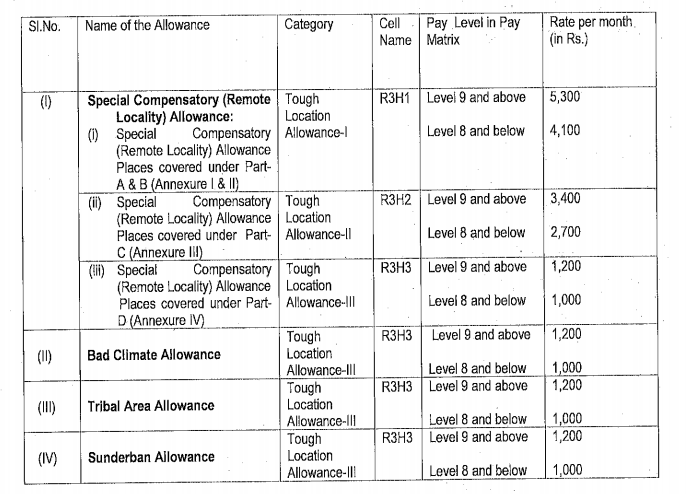

Subject:- Implementation of the recommendations of 7th Central Pay Commission – Grant of Special Compensatory Allowances subsumed under Tough Location Allowance.

Consequent upon the acceptance of the recommendations of Seventh Central Pay Commission, in supersession of the existing orders for grant of Special Compensatory Allowances viz. Special Compensatory (Remote Locality) Allowance, Bad Climate Allowance, Special Compensatory Scheduled/Tribal Area Allowance and Sunderban Allowance which have been subsumed in Tough Location Allowance, the President is pleased to decide the rates of these Special Compensatory Allowances (subsumed in Tough Location Allowance) to Central Government employees as under :

2.These rates shall increase by 25 per cent whenever the Dearness Allowance payable on the revised pay

structure goes up by 50 per cent.

3.The term ‘Pay Level’ in the revised pay structure means the ‘Level in the Pay Matrix.

4.In respect of those employees who opt to continue in their pre-revised pay structure/Pay scales, the corresponding Level in the Pay Matrix of the post occupied on 01.01.2016 as indicated in GCS (Revised Pay) Rules, 2016 would determine the allowance under these orders.

5.Sunderban Allowance categorised ‘as Tough Location Allowance-III shall be admissible to the Central Government civilian employees working in Sunderban areas South of Dampier Hodge’s line, namely, Bhagatush Khali (Rampura), Kumirmari (Bagna), Jhinga Khali, Sajnakhali, Gosaba, Amlamathi (Bidya), Canning, KuKali, Piyali, Nalgaraha, Raidighi, Bhanchi, Pathar Paratima, Bhagabatpur, Saptamukhi, Namkhana, Sikarpur, Kakdwip, Sagar, Mousini, Kalinagar, Haroa, Hingalganj, Basanti, Kuemari, Kultola, Ghusighata (Kulti) area. The allowance shall be admissible only upto the period for which the. Government of West Bengal continues to pay this allowance to its employees.

6.Scheduled/Tribal Area Allowance and Bad Climate Allowance categorised as Tough ‘Location Allowance-III shall be admissible only in those States where Scheduled/Tribal Area Allowance and Bad Climate :Allowance are admissible and shall be discontinued in those States where it has been discontinued for the State Government employees with effect from the date(s) of such discontinuance.

7.In the event of a place falling In more than one category, the higher rate of Tough Location Allowance will be applicable.

8.Tough Location Allowances shall not be admissible along with Special Duty Allowance. However, employees have the option for continuing Special Compensatory (Remote Locality) Allowance at old rates of 6th CPC, where it was admissible, along with Special Duty Allowance at revised rate of 10% of Basic Pay,

9 Employees may exercise their option to choose either Hard Area Allowance which is admissible alongwith Island Special Duty Allowance or one of the Special Compensatory Allowance, subsumed under Tough Location Allowance as mentioned in Para 1 above,

10.These orders take effect from 1st July, 2017.

11.These orders shall also apply to the civilian employees paid from the Defence Services Estimates and the expenditure will be chargeable to the relevant head of. the Defence Services Estimates. In regard to Armed Forces personnel and Railway employees, separate orders will be issued by the Ministry of Defence and Ministry of Railways, respectively.

12.In so far as the employees working in the Indian Audit and Accounts Department are concerned, these orders are issued with the concurrence of the Comptroller and Auditor General of India.

Hindi version is attached.

sd/-

(Annie George Mathew)

Joint Secretary to the Government of India

Download Order : Tough Location Allowance Rates