Withdrawal limit on Exit from NPS : As per PFRDA (Exit and Withdrawal) (Amendment) Regulations, 2021 dt 14th June 2021, the provisions related to lump sum withdrawal from NPS have been modified for the benefit of Subscribers

PENSION FUND REGULATORY

AND DEVELOPMENT AUTHORITY

B-14/A, Chhatrapati Shivaji Bhawan,

Qutub Institutional Area,

Katwaria Sarai, New Delhi-110016

Circular

PFRDA/2021/41/SUP-ASP/06

September 21, 2021

To,

Central Record Keeping Agencies (CRAs)

& NPS Stakeholders for information

Subject: Enhancement of Lump sum Withdrawal limit on Exit from NPS

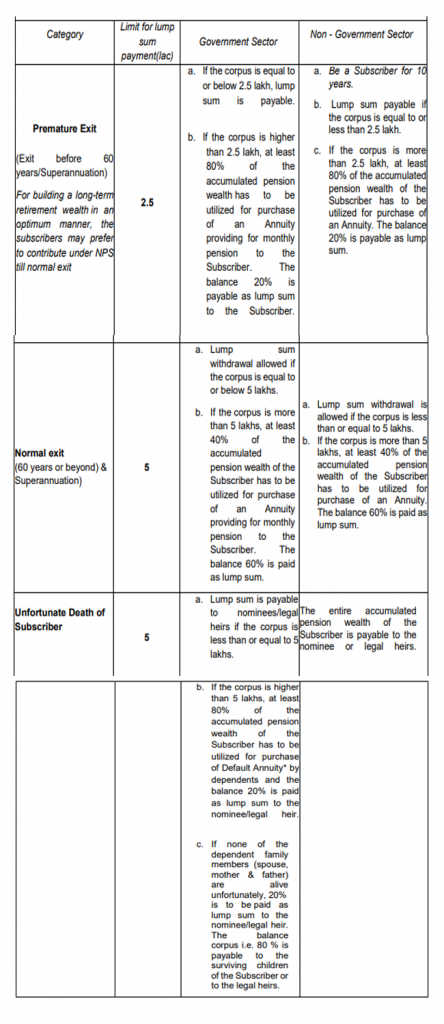

The exit/withdrawal norms of the Subscribers are defined by PFRDA (Exits and Withdrawals under NPS) Regulations, 2015 and its amendments. As per regulatory mandate, there are certain predefined conditions which fulfill the norms of exit viz premature exit, normal exit and exit due to unfortunate death of the Subscriber.

- The provisions of exit regulations require the Subscribers during exit, to utilize a certain percentage upto which their corpus can be withdrawn as lump sum and the balance is to be utilized to buy annuity from the Annuity Service Providers (ASP) empaneled by PFRDA. There are certain instances wherein the corpus in the PRAN paid to the Subscriber or the beneficiary by way of lump sum without mandating them to buy annuity. However, there is no restriction for any Subscriber to buy annuity from the corpus partly or fully.

- The annuity calculator is being provided for the benefit of Subscribers in the respective websites of CRAs and the links are https://enps.kfintech.com/annuity & https://cra-nsdl.com/CRAOnline/aspQuote.html.

- As per PFRDA (Exit and Withdrawal) (Amendment) Regulations, 2021 dt 14th June 2021, the provisions related to lump sum withdrawal have been modified for the benefit of Subscribers as provided below.

Norms for Lump sum payment of corpus (On-boarded NPS 18-60 years)

*Default Annuity Scheme provides for Annuity for life of the Subscriber and the spouse with provision for return of purchase price of the Annuity. Upon the demise of such annuitants, the Annuity be re-issued to the family members. After the coverage of the family members, the purchase price shall be returned to the surviving children of the Subscriber and in the absence of children, the legal heirs of the Subscriber, as may be applicable.

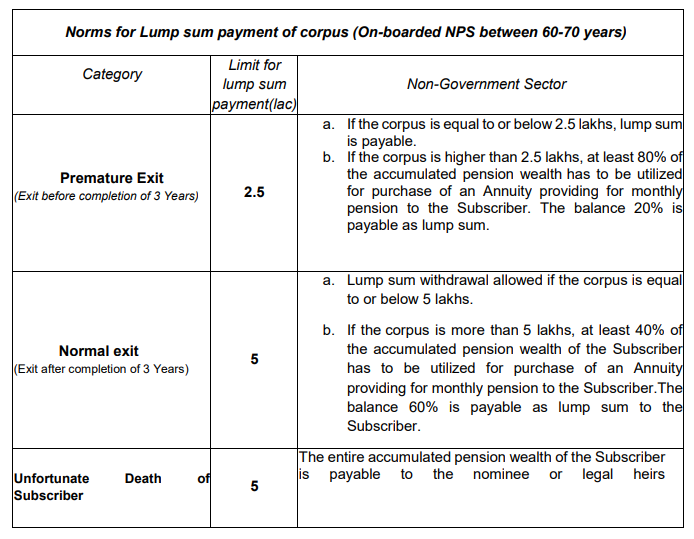

- Subscribers who join NPS beyond 60 years:

The exit before 3 years shall be treated as ‘premature exit‘ and those withdrawals beyond 3 years is the ‘normal exit‘. For premature exit, the permissible limit for lump sum is 2.5 lacs and 5 lacs under normal exit without the need for annuitization. In case of unfortunate death of those subscribers, the entire corpus shall be paid to the nominee/legal heirs.

- CRAs need to effectively disseminate the information and create awareness among those Subscribers who are nearing their exit/superannuation through SMS, Educational videos, FAQ, Email communication and creative contents, as deemed fit.

This Circular is issued under Section 14 of PFRDA Act 2013 and is available at PFRDA’s website (www.pfrda.org.in) under the Regulatory framework in “Circular” section

K Mohan Gandhi

(Chief General Manager)

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates