Pension Eligibility for Government Servants in Central Government Service

The Government Servants those who are appointed on or before 31.12.2003 are eligiblie for drawing Pension under CCS (Pension) Rules 1972

Table of Contents

PENSION ELIGIBILITY

A Government servant becomes eligible for a pension under any of the following circumstances

There are two types of Pension under CCS (Pension) Rules 1972 after retirement, i.e Superannuation Pension and Retiring Pension

Superannuation Pension under Rule 35 of CCS Pension Rules 1972

a. Superannuation Pension (Rule 35) : On superannuation after completion of 10 years of service.

Retiring Pension under Rule 36

b. Retiring Pension (Rule 36): Payable on :

- Voluntary retirement after completion of qualifying service of 30 years under Rule 48 or completion of qualifying service of 20 years under Rule 48-A of CCS(Pension) Rules.

- Voluntary retirement under FR 56(k) after attaining the age of 50 years (in the case of Group A & B) / 55 years (in the case of Group C).

- Voluntary retirement after transfer to surplus cell of DoPT consequent on abolition of post held by the Government servant (Rule 29-A of CCS (Pension) Rules.

- Premature retirement, on grounds of efficiency, under Rule 48 of CCS (Pension) Rules after completion of qualifying service of 30 years and under FR 56(J) after attaining the age of 50 years (in the case of Group A & B)/ 55 years (in the case of Group C).

c. Pension on absorption (Rule 37, 37-A and 37-B): On absorption in a PSU/Autonomous Body, on selection against open advertisement or on en-bloc absorption on conversion of a Government Department into a PSU/Autonomous Body.

d.Invalid Pension (Rule 38): On a Government servant opting to retire on account of any bodily or mental infirmity which permanently incapacitates him for the service. Invalid Pension is admissible even in cases where a Government servant retires before completion of a qualifying service of ten years.

e. Compensation Pension (Rule 39): On discharge of a Government servant owing to the abolition of his permanent post.

Compulsory Retirement Pension (Rule 40): On imposition of a penalty of Compulsory

f.Retirement consequent on any departmental proceedings or on conviction by a court of law in a judicial proceedings. The amount of pension in such cases shall not be less than two-thirds of compensation pension.

g.Compassionate Allowance (Rule 41): On dismissal/removal from service in departmental/ judicial proceedings, Government servant loses his right to pension. However, in cases deserving of special consideration, competent authority may sanction a compassionate allowance not more than two thirds of compensation pension but not less than the minimum pension (i.e Rs. 9000/- per month).

Pension after Resignation

2.Resignation (other than technical resignation to join other departments/ organisation with proper permission) entails forfeiture of past service. Therefore, no pension is payable on resignation (Rule 26).

Service Gratuity in lieu of Pension

3.A Government servant is entitled to receive only Service Gratuity in lieu of Pension, if his total qualifying service is less than 10 years. This is one-time lumpsum payment in lieu of pension and is distinct from and is paid over and above the Retirement Gratuity.

Pension amount in all cases under the Central Civil Services (Pension) Rules, 1972

4. The amount of pension under the Central Civil Services (Pension) Rules, 1972 in all cases is 50 per cent of the emoluments (last pay drawn) or 50 per cent of the average emoluments (average of last 10 months’ pay), whichever is more beneficial to the retiring Government servant (Rule 49).

5. In calculating the length of qualifying service, fraction of a year equal to three months and above shall be treated as a completed one half-year and reckoned as qualifying service

Family Pension is also authorized in PPO to spouse

6. While issuing PPO to Central Government employee on retirement , family Pension is also authorized in PPO to spouse. The spouse has to submit an application along with the death certificate to the Pension paying Bank, if his/her name is indicated in PPO and having joint account with the deceased pensioner for commencement of family pension.

7.The President may withhold or withdraw a pension or a part of it, permanently or for a specified period. However, UPSC (Union Public Service Commission) shall be consulted before passing the final order.

8.In the case of Government servant who has retired on attaining the age of superannuation and against, whom any departmental or judicial proceedings are continued, a provisional pension shall be sanctioned to him till the conclusion of proceedings/order .

9.If a pensioner who immediately before his retirement was a member of Central Service Group ‘A’ wishes to accept any commercial employment before the expiry of one year from the date of his retirement, he shall obtain the previous sanction of the Government to such acceptance .

10.The Head of Office in consultation with the Accounts Officer shall, verify the service rendered by such a Government servant on completion of eighteen years and on his being left with five years of service before the date of retirement. The period of qualifying service shall be communicated to him, in Form 24.

11.The expression ‘emoluments’ means basic pay (excluding DA) which a Government servant was receiving immediately before his retirement or on the date of his death and will also include non-practising allowance granted to medical officer in lieu of private practice.

12.If a Government servant immediately before his retirement or death while in service, was on earned leave, and earned an increment which was not withheld, such increment, though not actually drawn, shall form part of his emoluments.

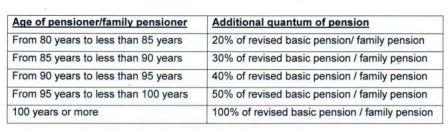

Additional Pension

13.Additional pension shall be payable to the retired Government servant after completion of eighty years of age or above. It shall be payable from first day of the calendar month in which it falls due in following manner :

Source : Pensioner Portal

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates