Annual Increment date falling due during leave period

Many Central Government employees wants to know about Annual Increment date falling due during leave period in the case of a Govt Servant who dies on leave. Hence DoPT Order dated 16th February 1989 has been reproduced below

Annual increment while on leave 1st July and 1st January

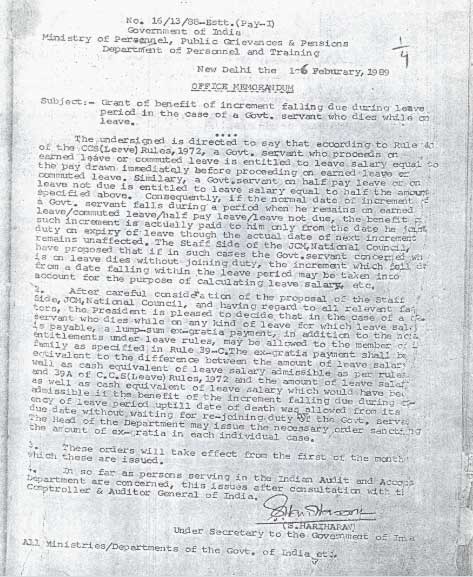

No.16/13/88-Estt (Pay)

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel and Training

New Delhi the 16th February 1989

Office Memorandum

Grant of Benefit of Increment falling due during leave period in the case of a Govt Servant who dies on leave

The under signed is directed to say that according to rule 4C of the CCS (Leave Rules) 1972 a govt servant who proceed on earned leave or commuted leave is entitled to leave salary equal to the pay drawn immediately before proceeding on earned leave or commuted leave. Similarly, a Government Servant on half pay leave or on leave not due is entitled to leave salary equal to half the amount specified above. Consequently if the normal date of increment of a govt servant falls during a period when he remains on earned leave /commuted leave /half pay leave/leave not due , the benefit of such increment is actually paid to him only from the date of he joins duty on expiry of leave though the actual date of next increment remains unaffected. The staff Side of the JCM , national Council have proposed that I in such cases the Govt servant concerned is on leave dies without joining duty , the increment which fell due from a date falling within the leave period may be taken into account for the purpose of calculating Leave salary etc.

Govt Servant who dies while on leave during which Increment date falls due

After careful consideration of the proposal of the staff Side JCM, national Council and having regard to all relevant factors, the president is pleased to decide that in the case of a Govt Servant who dies while on any kind of leave for which leave salary is payable, a lump-sum ex-gratia payment in addition to the said entitlements under leave rules, may be allowed to the member of his family as specified in Rule 39-C. The Ex Gratia payment shall be equivalent to the difference between the amount of Leave salary as well as cash equivalent of leave salary admissible as per Rules of 29C and 39A of CCS (Leave )Rules 1972 and the amount of leave salary as well as cash equivalent of leave salary which would have been admissible if the benefit of the increment falling due during pendency of leave period up till date of death was allowed from its due date without waiting for re-joining duty by the Govt Servant . the head of the departments may issue the necessary order sanctioning the amount of ex-gratia in each individual case

The Order will take effect from the first of the month from which these are issued.

In so far as persons serving in the Indian Audit and Accounts Departments are concerned, this issues after consultation with the controller & Auditor General of India

(S.Hariharan)

Under Secretary to the Government of India

Increment Date falling due during leave period Clarification

Must Read : Leave on On Increment date and its Effects