Know Easy steps to Calculate your 7th Pay Commission New Pay Scale

7th Pay commission simplified the calculation for arriving revised Pay through new 7th CPC Pay Matrix

We here illustrated the method through easy 6 Steps to calculate our 7th CPC New Pay and Allowances to know your self

Lat us Assume you are drawing Grade Pay Rs.4200 and Pay in the Band Pay Rs.12110

To calculate your Basic Pay and Allowance follow the steps given below.

Step-I

Calculate your sixth CPC basic Pay

( Grade Pay + Band Pay) = 4200+12110= 16310

Step-II

Multiply the above figure with 7th CPC Fitment Formula 2.57

16310 x 2.57 = 41916.70 . ( Paisa to be rounded off to the nearest Rupee)

The Ans is = Rs.41917

Step-III

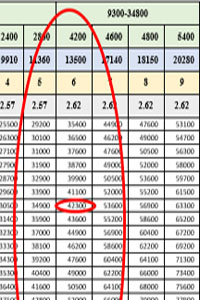

Match this Answer with Matrix Table ( Given Below) Figures assigned in Grade Pay column Rs.4200

There is no exact figure in this matrix, so the closest higher figure in the Grade Pay column can be chosen i.e is Rs. 42300

So , Rs 42300 is your New 7th CPC Basic Pay

Step-IV

Calculate your HRA [ See : 7th Pay commission recommendation on HRA]

HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively

So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% vis versa.

Let us assume now you are in 30% HRA bracket, your revised HRA is 24%

Find the 24% of the Basic Pay = 42300 x 24/100 = 10152

Your HRA is Rs.10152

Step-V

Calculate your TPTA (Transport Allowance)

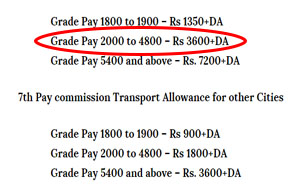

7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places

If you are living in A1 and A classified cities (See the List of 19 cities classified as A1 and A cities) you will be entitled to get higher TPTA rates

And since your Grade Pay is 4200 you fall in Second category

ie Grade Pay 2000 to 4800 – Rs 3600+DA

Your TPTA is Rs. 3600/- (DA is Nil as on 1.1.2016)

Step-VI

(Since DA will be Zero from 1.1.2016 So no need to add the DA to calculate 7th Pay and Allowances from 1.1.2016)

Add all the figures

New Basic Pay + HRA+TPTA = 42300+10152+3600 = 56052

Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.56052

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

when retiree of 31.1.2016 are benefited of 7cpc? 7Cpc declear jun 16 now it is nov 16 it is too late. Pl advise us MODJI PM OF INDIA DEF (DGQA) IS DOING NOTHING STILL THEY ARE SLEEPGING

The Matrix formula should be given effect from 1-1-2006 to rectify anomalies in various Pay Bands and the Entry Pay & Basic Pension should be refixed from 1-1-2016

The Matrix formula should be given effect from 1-1-2006 to rectify anomalies in various Pay Bands and the Entry Pay & Pension should be fixed.

Kya UP me sarkar BJP ki banegi.

5400+20200 what is my salary with fitment formula

It is totally confused.Nothing is mentioned anywhere about macp.employees are totally dissappointed and this is not expected from NDA govt.

F.M. jaitley spoke so much, but I can’t understand anything. What big they have made in 7 CPC. Big hype more confusion. Nothing is their for lower grade employees like me. It is a sin to be a lower grade employee in India?

how do you factor in the number of increments gained in a particular grade. It is being done for pensioners. If It is not considered for those in service and only for pensioners then there is an anomaly. The number of increments is vertical progression in the pay matrix or the amount multiplied by 2.57 whichhever is higher

, then there is a anomaly

After completing 20 years in group D i got internal promotion in group c on 2007 and 2000 GP. what should be my GP on and after 29 august 2008 . again i got internal promotion and got 2800 GP on july 2015.

i want to confirm that, is it not that i got 2800 GP after completing my total service 21 year on sept. 2008 and 4200 GP after competing total 30 year of my service.

I cant understand on 7th pay commission. My grade pay 4600 & basic pay 17210(9300-34800). When it correct time declared. Please help me.

I confuse about 7th pay commission.

Please details information about 6th pay c.p.c & 7th pay commission.

what is the fitment factor for grade pay of 4600 is it 2.57 or 2.62

Reports 7th pay commission

SCA Changed by 7CPC, renamed Tough Location Allowances.Central Govt. Employees posted in A & N Islands which rate will be applicable

sir , i have completed my 30 years of service during dec 2012 but due some reasons the bench mark 3.5 i am not awarded with macp i hence i am now in gp 4200 how can i get my macp i

I am an employee belong to j and k state

Their was no TA here before 7the pay commessio

What will be now

Mr.Kadai Rao Pl Check the 7th Pay commission’s illustrative examples for doing Pay fixation at http://gservants.com/2015/11/19/7th-cpc-fitment-formula-and-pay-fixation-in-the-new-pay-structure/

please contact 7cpc for clarification regarding pay fixation wheather it will upgraded or not

Plz re-check- whether Multiplication Factor is 2.57 or 2.67 for GP 5400 in 15600-39100.

Sir

Your Basic Pay is Rs.27040/-

it should be Multiplied by 2.57 = 27040 x 2.57 = 69493

In Pay Matrix, closest higher figure in Level 10 is 71100

So your revised basic Pay is Rs.71100

Checked the Calculator and it shows the above correct answer at Level 10 ,Index -9

Plz check calculator for Pay Rs.27040/- (BP 21640 + GP 5400) in Pay band 15600-39100, HRA 30% and TA 3200. It show Index as 15 with revised BP 84900/- instead of Index 10 with BP 73200/-.

I am a ldc and get the TA amount Rs.1314.and for 7cpc i will get 1350 as ta.so 36Rs.bebefitted.Is this good?And Sir now I am pregnant.For the 2 nd year 20%salary deducted.Please revise it,of specification of whose child is from 1-5 or 6yrs.they will get full salary.so please look after this matter

As per the Pay Matrix Your Basic Pay is Rs.24500

Where do Pension stands

Sir after multiple 2.57 my new pay is 9540*2.57=24518 in level 3, so what is my new pay 24500 or 25200 ?

Method of calculation fixation of payment fot pensioners.

There is Anomaly in Transport Allowance for persons whose pay is more than 7440 (excluding grade pay). At present they are drawing transport allowance of Rs.3504. As per the VII Pay commission’s report, they have placed the old GP 1800 and GP 1900 on the same scale with regard to Transport Allowance and given 1350 only.

how the new pension calculation will be done. pl inform

Mr. Chetan Pingale, the fitment you have quoted is only for arriving minimum basic pay for the respective Level (Grade pay in 6CPC). But actual fitment is 2.57 for all the categories.

Any Pay Commission will increase the perks and allowances. This is the first time they have decreased every thing and removed so many allowances. This is first time news papers also indirectly expressed that this is Pay Commission who have recommended very very less increase in perks since last 70 yrs. Pay Commission members wasted their time and Government money to make this type useless report. They might have contacted Justice Shri Krishna before making the report. All Central Government Employees should boycott this Nonsense Report.

The Pay Commission said that ‘The fitment factor of 2.57 is being proposed to be applied uniformly for all employees”

The above is used to arrive rationalised Entry Pay.

7th Pay Commission Mentioned clearly that wherever the Grade Pay upgraded to next Higher Pay, that GP should be taken for calculation otherwise the pay fixation would have been as explained in Example I

i. Take the case of an employee T in GP 4200, drawing pay of ₹20,000 in PB-2. The Basic Pay is ₹24,200 (20,000+4200). If there was to be no change in T’s level the pay fixation would have been as explained in Example I above. After multiplying by 2.57, the amount fetched viz., ₹62,194 would have been located in Level 6 and T’s pay would have been fixed in Level 6 at ₹62,200.

ii. However, assuming that the Commission has recommended that the post occupied by T should be placed one level higher in GP 4600. T’s basic pay would then be ₹24,600 (20000 + 4600). Multiplying this by 2.57 would fetch ₹63,222

calculation is not correct kindly check example 2 , page 78 of sevencpcreport available in 7cpc.india.gov.in

or kindly clarify the above note

thanks

There is order the pay grade for Rs,5400 is group A only.

Fitment Formula for Level 1 to 5 is 2.57

Fitment Formula for Level 6 to 9 is 2.62

Fitment Formula for Level 10 to 12 is 2.67

Fitment Formula for Level 13 is 2.57

Fitment Formula for Level 13A is 2.67

Fitment Formula for Level 14 to 16 is 2.72

Fitment Formula for Level 17 is 2.81

Fitment Formula for Level 18 is 2.81

Ok

Method for approximate fixation of pension may please be elaborated.