We here illustrate the method through easy Steps to calculate your Basic Pension in 7th Pay commission Recommendation

5 Easy steps to Calculate your Basic Pension in 7th Pay Commission

There are Two options have been given to Pensioners

First They have to calculate the Two options and whichever is benefit for them They can select higher amount as their Pension

Option No.1 . The existing Pension may be Multiplied by 2.57

Option No.2 . The Pay Scale on their retirement and Number of increments they earned to be taken for calculation

In that Case they should know their Pay Scale and Basic Pay drawn on the date of their Retirement and number increments they earned

By referring the Corresponding Pay scale in successive Pay Commission, they should identify their Sixth pay commission Pay band. If they Know their corresponding Pay Band in sixth Pay commission then it will be easy for them to arrive their Basic Pension to be fixed in VII pay commission.

After calculating the Basic Pension from the above two options, they can choose whichever is beneficial for them

Calculation for arriving your 7th CPC Basic Pension is described below through 5 Easy Steps

Assume You retired at last pay drawn of ₹4,000 on 31 January, 1989 under the IV CPC regime, having drawn 9 increments in the pay scale of ₹3000-100-3500-125-4500:

Your Basic Pension as revised in VI CPC = 12,543

Calculation Option -I

Step.I

Multiply your Your Basic Pension with 2.57

Basic Pension (VI CPC) x 2.57

= 12543 x 2.57 = 32235.70 ( Paisa to be rounded off rupee)

Your basic Pension As per VII CPC = Rs.32236

Calculation Option-II

Step-II

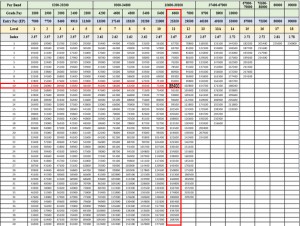

– Identify your corresponding Pay Level in Pay Matrix

– For that you should know your Pay Band in VI pay commission

[The Pay scale details will be informed you by Concerned Pension Paying Authorities when ever your basic Pension was revised as per the successive Pay commission Recommendation ]

for example for this pay scale of ₹3000-100-3500-125-4500, the corresponding Pay Scale and pay band for Fifth and Sixth CPC respectively is given below

[Visit : To see the III, IV , V CPC Pay Scale ]

In IV Pay Commission Your Pay Scale is 3000-100-3500-125-4500

In V pay Commission Your Pay scale is 10000-325-15200

In Sixth Pay Commission Your Pay Band is 15600-39100 – Grade Pay is 6600

In Seventh Pay commission your Pay Matrix Level is 11

Step -III

Minimum Pay at this level -11 is Rs. 67700

Total increment earned on your initial pay on the date of Retirement is 9

So Count nine cells from the cell assigned as Minimum Pay in that Level 11

your index number in that Particular Pay matrix Level 11 = 10

The figure in Level 11 and Index 10 = 88400

50% of this Pay will be fixed as your Basic Pension

Hence your Basic Pension will be fixed at Rs.44200/-

Step- IV

Choose whichever is higher to fix your Basic Pension

Basic Pension in Option -1 = 32236

Basic Pension in Option -2 = 44200

You can select option 2 as the fixation for Basic Pension in 7th Pay commission

Your basic Pension in 7th Pay commission = 44200/-

Must Read : 7th CPC Pension Formulations for calculating Basic Pension for Pre 2016 Pensioners

Note : 1.

Those who are retired in Sixth Pay commission regime would be aware of their increment and Pay Band details. It will be easy for them to calculate their Basic pension in VII Pay Commission using this matrix.

For others it will be very difficult to find out their Pay scale and quantum of increment details as of now. Also It will take little time for Concerned Department to verify the Pensioners records to ascertain the number of increments earned in the retiring level

Note -II

So 7th pay commission recommended that in the first instance the revised pension may be calculated using Calculation Option -I and the same may be paid as an interim measure

[ Your Present Basic Pension to be Multiplied by 2.57 = Rs .32236 ]

So Rs.32236 will be paid as Basic Pension as Interim Measure

After Checking the records of concerned individuals As per calculation Option -II

Then Rs.44200 will pe Paid as your Basic Pension

Subsequently the difference of higher amount also will be Paid as Arrears

Calculate here : 7th CPC Pension Calculator with Additional Pension

Since the existing pay bands cover specific groups of employees such as PB-1 for Group `C’ employees, PB-2 for Group `B’ employees and PB-3 onwards for Group `A’ employees, any promotion from one pay band to another is akin to movement from one group to the other. These are significant jumps in the career hierarchy in the Government of India. Rationalisation has been done to ensure that the quantum of jump, in financial terms, between these pay bands is reasonable.This has been achieved by applying ‘index of rationalisation’ from PB-2 onwards on the premise that with enhancement of levels from Pay Band 1 to 2, 2 to 3 and onwards, the role, responsibility and accountability increases at each step in the hierarchy. So to 2.72 should not be taken as Fitment factor pay Revision. Multiplication factor 2.57 is common for all Grades to revise their Pay

I am Dr B.A.Parikh. I retired on the post of vice chancellor of S.G.University, Surat, Gujarat Government. in August 1997. At that time V.C.salary was Rs 25000 fixed under 5th Pay commission. So my psnsion was fixed Rs 12500 fixed + D.A. Under 6th pay commission from 1-1-2006 the V.C. salary was Rs 75000 fixed. So my pension was fixed at Rs 37500 + D.A,

Under 7th pay commission my pension by Gujarat Government is fixed at Rs 37500 plus 2.57 times.

As per pay matrix for 7th Pay commission retired V.C. basic salary Rs 75000 falls under Level 15 where in the fixation formula is 2.72 times. I represented to Commissioner Govt of Gujarat to revise calculation of my pension under 7th Pay commission and fix it with 2.72 times instead of 2,57 times. But the office has no grasp of rules for fixation and they do not attend to my case. Please guide and advise me in this matter. B.A. Parikh I shall appreciate your response on my email. .

Sir I retired on 31.01.2012 in the pay band 15600-39100. My basic pay on dt. of retirement was Rs.36480 & grade pay was Rs. 7600. Pension was fixed Rs. 22040/-. Now multiplying 2.57 my revised pension fixed Rs. 56643. Kindly intimate my pension as per Option – II.

Sir,

I retired as senior scale officer in grade 3000-4500 in the year 1991.

I have earned 6 increments in the scale and pay was 3625/-at the time of retirement.

according to pay matrix, my grade in 6th PC would be 15600-39100 with grade pay 6600 .With 6 increments drawn in the scale my pension should have been fixed at 40450/-

but I have been fixed at 32382/-added to this 20% increase for age above 80 would have

also increased.Gross injustice has been done to me , similar to others also. Will the Government at at lest now rectify this anomaly ?

“we are talking about 7cpc but what about 6 cpc case of de linking of pension with 33 years of services

.Oder form MOD for defance officers is still pending,

while the same for civilian serving in defance and POBR have been already issued

why delay for defance officers”

this is comment by Mr agarval but i am from space department in 7th cpc also my basic pension was fixed as per 30% instead of 50% as per pre 2006 pensioners benefit. still that benefit is not implimented for all central government employs not only for defence. i also want to know when pre 2006 pensioners can get benefit of delinking of 33 years of service. still it is their in paper only?

The first option may be made applicable if its implementation is found feasible after examination by the Committee. Till then existing pension will be multiplied by 2.57 for revising Pension.If this is beneficial than Option -I, it may be considered final

Sir, could you kindly let me know what will be my actual basic pension after implementation of 7th CPC. I have retired on 31.01.2008. My basic pension at the time of retirement was fixed at Rs.15,300/-. During my active service my Gd. Pay was 6600 Pay band: 15300-39100. I got my Second ACP on 9.8.99 and accordingly I have earned the increment on the said scale upto 2007. Now at this stage what will be my basic pension. In the mean time the previous Basic Pension of Rs.15,300/- was just multiplied with factor 2.57 and was credited into my account. In addition arrears also has been credited. Is it my final pension or there is other formula to finalise the basic pension? Kindly let me know the calculation in details. Thanks

Regards

PATAL BEHARI DAS

option 2 of current CPC, the details unavailable erstwhile pensioner had been more than 15 yr passed.so what should govt do where there is benefit at above case.

I retired at the age of 58 on 1-12-1990. The pension I draw now is 14,564 (12,137/- plus 2,427/-) being 84 years of age. On the basis of the 7th CPC the minimum revised pension will be 37,429/- (14,654 X 2.57). In working out the second option, the retirement pay scale and the number of increments drawn are only considered. My last pay drawn was 3,700/- in the scale 2,200-75-2,800-100-4000, having earned 17 increments. On the basis of corresponding 6th CPC Pay Band of 15,600-39,100 and grade pay of 5,400 at Level 10, the notional Pay fixation with 17 increments in 7th CPC scale works out to 92,700/- and 50% there on is

46,350/- new pension as per option 2. As the additional 20% pension due for crossing 80 years of age is not part of this 2nd formula it needs to be added to to the new pension of .46,350/- making my pension due on 1-1-2016 as 55,620/-(46,350/-+ 9,270/-) Am I correct? PLease answer immediately

I request to refer ‘option ll’ of the pension fixation examples explained above, favorable pension Rs 42,200/-. kindly clarify, what would have happened had he (retiree) not been promoted to scale 3000_5000 :_

He would have been in entry scale of 2200-75-2800-100-4000, level 10 of 7th cpc, then

would have earned 20 increments by the same length of service on achieving the stage of Rs 4000/-.

under 7th cpc, level 10 , stage 20 the notional pay accrues to Rs 1,13,000/-(pension Rs 56,600, ie difeference of Rs 56,500-42,200/- =14,300/- in basic pension.

An undue, great penalty for doing good work, discharging more responsibility for no fault.. Such a huge anomaly never noticed earlier in any cpc’s. The figures are not totally imaginary, there would be many such affected people, specially of inspectorial/supervisory level, promoted to class 1 in last spell of their service.

who will reply. ?

Sir,

I retired as Section Officer in PB 2, GP 4600 on 31-12-2009 . My basic pension fixed at Rs. 12330 w.e.f. 1/1/2010. I have rendered a total service of 39 years 4 months as my initial date of appointment in LDC was 10-8-1970. I was promoted to the post of Assistant w.e.f. 30-6-1984(Now GP 4200 in PB 2) . I was appointed to the post of Section Officer(Gazetted) with effect from 7/2/2000 in Debts Recovery Appellate Tribunal, Ministry of Finance, till my retirement. In case I would have not promoted to the post of Section Officer, my services would have continued in PB 2 GP 4200 for 25 years. As per pay matrix now accepted by Government , my pay in S O Grade with 9 increment comes to Rs.58600. But if my services continued in lower grade of Asssistant , my pay with 25 increments comes to 74300.. Fifty percent of amount calclulateld in SO Grade would be Rs.29300 and Assisstaant Grade Rs. 37150. Now please calculale my pension and also may kindly elaborate as to how pension shall be less if retired in higher grade and more if retired in lower grade. It is pertinent to mention that some weighatage is to be given while fixing pension in the higher grade from which one retired to have parity with the person whom retired in lower grade with same length of service. This is a complex situation and person who retired with longer period of service in lower grade and lesser period of service in higher grade must be given option to have their pension fixed in lower grade if financially benefitted.

Thanks.

what about the pensioners in 7 th pay commissin

I retired from a private college in Havana as principalin march 2003,my basic pension is18100 with d a,how much i will be getting now

I retired in march 2007 as Subedar. Now my basic pension is 1 1970 with pay band 9300-34800 and grade pay 4600. I am getting 22200 as total pension after deducting commitation of around 5000. So what would be my salary in hand after deducting commutation fixed as per 7th CPC.

we are talking about 7cpc but what about 6 cpc case of de linking of pension with 33 years of services

.Oder form MOD for defance officers is still pending,

while the same for civilian serving in defance and POBR have been already issued

why delay for defance officers

As per 7th CPC recommendation, Number of Increments are earned in the Grade Pay 6600 only can be added

Dear Sir,

A person retired in Pay band of 15600-39100, Grade Pay 6600, in 2009 March. Pension fixed at 18075. He earned four increments in this grade pay. Prior to it he remained in 5400 grade pay for 7 years. As per formula 1 his pay would be 67700. How many increments would be added for arriving at his Pension using second option. As per first option his pension becomes 18075x 2.57. Are the number of increments earned to be worked out on the basis of pay last drawn at the retired level or on the basis of actual years of service rendered in 6600 grade pay after promotion from 5400 grade pay.

Would appreciate clarification on this.

Will the X-Pay be taken into consideration for calculation of Pension ? Is there any specific mention of the same in the report??

Comments on Recommendation of 7th CPC (Minus benefit for both low & middle paid employees) ….

1. Points Related to Pay/Wages

• Minimum wage is fixed as Rs. 18000/- per month & Maximum is fixed as Rs. 2, 50,000/ per month.

• Comparison ratio between Minimum & Maximum Pay is 1:11.4 (18000: 205400).

• The actual increase is only 14.29%. which is akin to two installments of the Dearness Allowance.

Comparison ratio between Minimum & Maximum Pay is 1:11.4 (18000: 205400).

Minus benefit for both low & middle paid employees after deducting the CGEIS amount as recommended by 7th CPC (copy enclosed) &then deducting the amount for NPS/ GPF from the increased amount of new basic pay.

i.e. [Increase Amount of New basic pay –New CGEIS amount as recommended by 7th CPC – 10% of New basic pay towards NPS or 6% of New basic towards GPF] = [Minus benefit]

Justification: Ref. to following illustration – 1:

The minimum wage recommended (e.g. Rs 18000/ pm) amounts to a meager increase of Rs. 2250 from the existing minimum pay of Rs. 7000 + 8750 (i.e. 125 % DA as on 1.1.2016).

From this minimum pay of Rs, 18000/-, as per the recommendation of the 7th CPC itself, Rs. 1500/- will be recovered for CGEIS and 10 % i. e. Rs.1800/- will be recovered towards New Pension Scheme from the employees recruited after 1.1.2004 and 6% towards GPF contribution from the employees recruited prior to 1.1.2004 resulting in minus benefit (i.e. 2250 -Rs. 1500 – Rs.1800 = – Rs.1050/-) for low paid employees.

Similarly, minus benefit will also observe, if we calculate for middle paid employees.

Ref. to following illustration -2 (for GP 4200/-)

The minimum wage recommended by 7thCPC for GP 4200/- is. Rs 35400/ pm.

The existing minimum pay (in 6th CPC) is Rs. 30375 [=Rs. 13500 + Rs. 16875 (i.e. 125 % DA as on 1.1.2016)], then increase in new basic pay = Rs. 5025/-

Now, the actual benefit / Increment after deduction of CGEIS amount as recommended by 7th CPC (copy enclosed here-with)&NPS (10% of New basic pay) will be Minus ( – ) Rs. 1015/- per month ( i.e. Rs. 5025 – Rs.2500 for CGEIS –Rs. 3540 for 10% NPS from New Basic Pay)

Request/ Suggestion for :

• Considering the 125% DA as on 31.12.2015 and real market values of commodities, actual hike should be more than 48%.

• Comparison between Minimum & Maximum Pay should be 1:8.

Number of increment earned in the Grade Pay 6600 will be counted in the calculation of Basic Pension in Option -II

Dear Sir, A person retired in Pay band of 15600-39100, Grade Pay 6600, in 2011 July. Pension fixed at 17855. He earned two increments in this grade pay. Prior to it he remained in 5400 grade pay for 4 years. As per formula 1 his pay would be 67700. How many increments would b added for arriving at his Pension using second option. As per first option his pension becomes 17855* 2.57.

Under VI CPC, 40 percent of incremental pension was commuted , 60 percent was added to existing pension and the corresponding commuted value of pension was paid in cash . what does the VII CPC recommend on this aspect please..

Dear V S N Swamy

Pl Refer Pay commission Report.Basic Pension should be arrived by using 2.57 for all the cases in first option

See : 7th CPC Pension Formulations for calculating Basic Pension for Pre 2016 Pensioners

I was retired on 31st January’2007. At that time my grade pay was Rs. 4800 basic Rs. 22000 /- respectively. Naturally my pension was fixed at Rs. 11000 /-. What will be my revised basic pension in revised pay (7 th CPC) recommendation.

The pay calcuation is woring

My pay Rs.16580+4200+20780,Rs.20780*2.62=54444 /-next stage Rs.55200/- but your calcation program showm Rs.53600/- i am loss Rs.844/- so plese calcation program rectifi pl.

How about the family pension structure ?

Thank You

Now It is Corrected

It is requested to whomever it may concern that all the dept be asked to fixed the pension, which may be higher by using option 1 or 2.For it I am thanking in anticipation. Jai Hind.

Any news about additional pension after crossing the age of 80 years. Does it stand or is abolished?

For pay scale ₹3000-4500 the Grade Pay in the vI CPC is ₹6600 and not ₹6000. Please correct this.

The correspondent Matrix is ₹67700.