7th CPC Revised Pension Arrears Calculator

The Pay Commission recommendations on Pensioners have received mixed reactions. Since there are two options are given to them to choose in respect of fixation of revised pension, it seems that discrepancies can be avoided in fixing revised pensions.

Already it has been explained about the two options in our earlier post [ View the Post ]

But We have received many queries regarding number of Increment to be counted for fixation of Revised Pension.

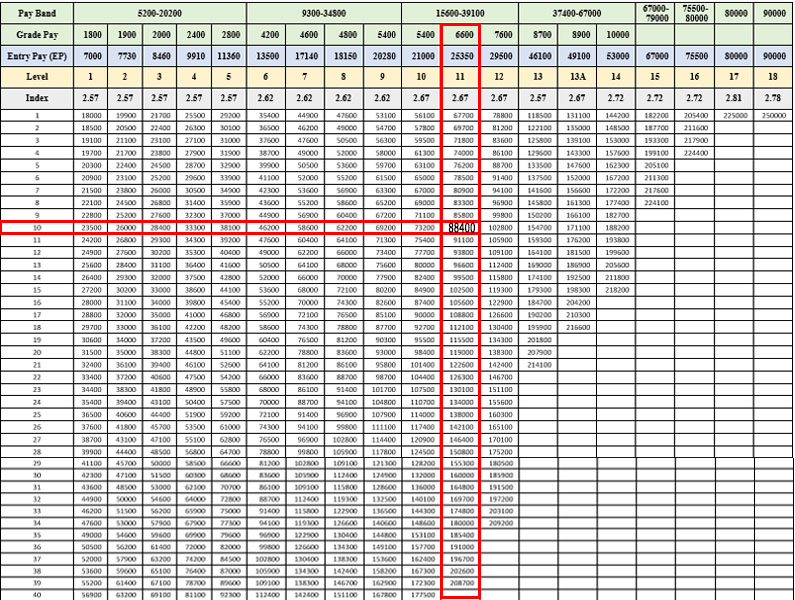

It is clearly stated in the pay commission illustrations that number of increment earned in the post held on Retirement should be counted for the purpose of fixing revised pension.[ See the illustrations ]

For example if one has retired from the post in the Grade Pay of 4200/-, number of increments earned in that particular Post/Grade pay only taken for calculation of Revised Pension.

The Pension and Arrear Calculator based on 7th CPC Recommendations has been provided here for your convenience. The revised Pension and Arrears can be calculated through this calculator.

[php snippet=2]

[Note : The pension calculator provided above is only for information purpose- not authoritative ]

Option and I and II Difference is unbelievable. There is no provision for entering increments beyond 20

what is going on here ?

While fixing pension information regarding number of increments earned can directly be available as per last pay drawn in the scale on the date of retirement shown in the PPO.Hence there should not be any difficulty in calculating pension as per Option 1.

Sir, A suggestion. Similar to Pay Matrix for existing personnel in service, A Pension Matrix may be attempted so that fixation of pension would be easier. In most of the cases revision of pension with reference increments earned in the retiring post would be opted. Except in a very few cases, most of the pensioners would be able to collect the details of the increments earned by them in the retiring post. The concerned offices in which they worked at the time of retirement would be able to furnish in writing when asked for or it can be sent Pension Office directly to enable them to fix as per the above option. On approval of the pension, the respective banks in which they drawn pension shall calculate the arrears payable.

What about those above 80 years of age. Are they entitled to 20% additional pension on revised pension ans are entitled to DA on the additional pension also? How this will be calculated. There is no specific example on this aspect.

Sir, kindly say when we railway pro-rata pensioners will get arrears

We who have retired at the last increment of our scale in Group A capacity had already been at loss right through from the retirement date.It is better if option II is straight way applied to avoid further delays.There is no guarantee on our life ahead because of age catching up.

. Among pre-2006 pensioners who retired at the scale of 6500 – 10500, their corresponding pay scale and grade pay in the sixth pay commission were determined at Rs.9300 – 34800 with grade pay at Rs. 4600 but for the purposes of pensionary benefits their grade pay were drastically reduced to 4200 thereby placing these set of pensioners at a great disadvantage. I also fall in the same category and I VOLUNTARILY RETIRED from CRPF IN THE MONTH OF JUNE, 2005 AFTER RENDERING 24 YEARS OF SERVICE FROM THE POST OF INSPECTOR. It is learnt that lot of efforts were / are being made by the Bharat Pensioners samaj with the Government to rectify this anomaly and to my knowledge government is also in agreement with the same but so far no such order seem to have been issued. The recent ORDER ISSUED FOR MINIMUM FULL MODIFIED PARITY OF PENSION OF CORRESPONDING SCALE TO ALL PRE-2006 PENSIONERS WITH 10/20 YEARS SERVICE is a big advantage for pensioners having less than 33 years service but this order to my view will not serve the purpose of rectifying reduced grade pay as above. I shall feel obliged if I could be apprised of the present state of the case.

While issuing orders on pensioners forimplementation of 7th CPC scales and pensions, mention may be made as follows:: IN CASE OF PENSIONERS

SPECIALLY THOSE RETIRED PRE 198R, IF THE RECORDS ARE AVAILABLE INDICATING THE NUMBER OF INCREMENTS DRAWN IN THE SCALE AT RETIREMENT TIME, THOSE PENSIONERS MAY BE FIXED IN THE REVISED PENSION USING THE SECOND METHOD DIRECTLY (step 2).