Item — 5 – REMOVAL OF ANOMALIES IN PAY MATRIX — PAY OF OFFICIALS DRAWING DIFFERENT GRADE PAY (HIGHER AND LOWER) ARE FIXED AT THE SAME STAGE IN DIFFERENT PAY LEVEL OF 7TH CPC PAY MATRIX

Anomalies in Pay Matrix

The Pay of officials drawing different grade pay is fixed in the same stage in different pay level of 7th CPC Pay Matrix.

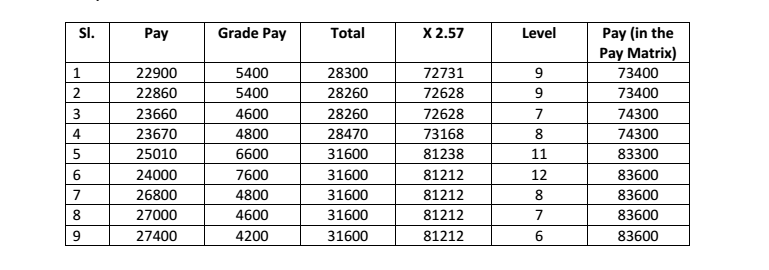

The above table is depicting the pay fixation as per the Pay Matrix. The following anomalies may be noted.

Revised Pay of an employee who has drawn 28300 (SL-I) higher basic pay in the pre-revised scale is fixed at the same stage (74300) than the employees who have drawn lower basic pay in the pre-revised scale (See SL-2, SL-3).

Revised basic pay of an employee who had drawn 28470 (SL-4) higher basic pay in the pre-revised scale is fixed at the same stage 74300 than the employees who have drawn basic pay in the pre-revised scale (See SL-I, SL-2, SL-3)

Revised basic pay of an employee whose revised basic comes to Rs.81238 (SL-5) in the revised scale is fixed at a stage (83300) equal to the employees whose revised basic comes to 81212 (See SL 7,8,9)

Revised basic pay of employees drawing grade pay of 4200, 4600, 4800, 7600 (SL-6,7,8,9) are fixed at the same stages from index Serial 9 to 20 (44900 to 62200) of Level — 6 (4200 GP), Stages from Index serial 1 to 12 (44900 to 62200) in Level — 7 (4600 GP) and stages from Index-2 to 10 (49000 to 62200) of Level — 8 (GP — 4800) are one and the same in the feeder cadre and promoted level. As a result officials who are promoted from Level 6 to 7 and from — Level 7 to 8 are the losers as their pay on promotion will be fixed in the cell which would be equal to the amount in the lower level after addition of one increment.

An employees who is drawing more pay in the pre-revised pay is being fixed less in the revised pay E.g: Revised Basic Pay drawing 21320 with GP 5400 will be fixed at 69000 on 01.01.2016 (Level 10) where as basic pay of an employee drawing 21300 with GP 5400 will be fixed at 69200 on 01.01.2016 (Level -9)

Similarly when an employee drawing 4600 grade pay (Level-7) is promoted under MACP to 4800 grade pay (Level — 7) is promoted under MACP to 4800 grade pay (Level — 8) there is no change in his revised basic pay as per pay matrix.

Construction of pay matric is done in such a way that on promotion in most of the cases the fixation falls at the same stage (even though pay level is lower and higher).thus the benefit on promotion works out to be mere one increment i.e. 3%, which the employee can get even without promotion as annual increment. If minimum benefit of two increments is not ensured on promotion, that will act as disincentive to the employees for accepting promotion.

The above anomalies are to be rectified.

Source :Confederation

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

Instead of grouping the 1400-2300 with higher scale, unfortunately the scale was grouped with 1350-2200 scale,a lower scale. This anamoly shd be taken up and resolved

Pre-1996 pensioners spending their last years of life,retired in the then 425-640 scale itself,due to absence of ACP and cadre restructuring. We retired as St ASMs,Head Clerks, Head to collectors, Head Booking Clerks etc. In the anomaly this may please be discussed and put in the GP 4200

Suggestion for 7th pay commission of Central

Government regarding Fitment Formula:

Pay on 1.1.2006 (before 6th P.C.) = 1.00

(For any catetory any person)

6th pay commission Fitment formula = 1.86

Total 1.86+1.00 = 2.86

From 2.86 + DA merged 125% = 2.86 + 3,58 = 6,44

Total salary before 7th P.C. 6,44

Plus 14.7% pay hike 0.95

Total fitment formula shoul be 6.44+0.95= 7.39

After this fitment formula completed on the basis of basic salary, the D.A and other allowances should be given as approved by cabinet recently.

But instead of 7.39 the Association of the Central Government Employees demanding the fitment formula is 3.68. Further it is decreased as 3.6 by them. But the Government is deceiving all Central Government Employees.

All of my friends are requested to share this message to all their friends.