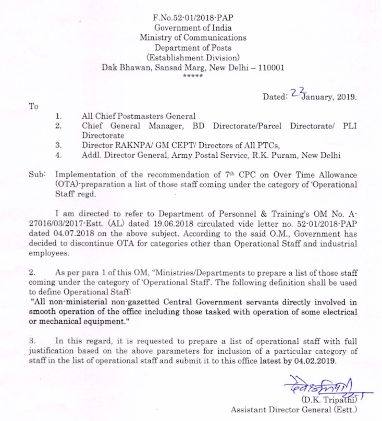

The recommendation of the 7th CPC for enhancement of ceiling of Deputation (Duty) Allowance for Civilians by 2.25 times has been accepted and this decision is effective from 1st July 2017.

Deputation Allowance Revised Rate

Accordingly, the President is pleased to decide that the rates Of Deputation (Duty) Allowance and certain Other Conditions relating to grant of Deputation (Duty) Allowance shall be as under: –

The Deputation (Duty) Allowance admissible in 7th Pay Commission shall be at the following rates:

a) In case of deputation within the same station the Deputation (Duty) Allowance will be payable at the rate of 5% of basic pay subject to a maximum of Rs.4500 p.m.

b) In case of deputation involving Change Of station, the Deputation (Duty) Allowance will be payable at the rate of 10% of the basic pay subject to a maximum of Rs.9000 p.m.

c) The ceilings will further rise by 25 percent each time Dearness Allowance increases by 50 percent.

d) Basic Pay, from time to time, plus Deputation (Duty) Allowance shall not exceed the basic pay in the apex level i.e. Rs. 2, 25,000/-. In the case of Government servants receiving Non Practising Allowance, their basic pay plus Non-Practising Allowance plus Deputation (Duty) Allowance shall not exceed the average of basic pay of the revised scale applicable to the Apex Level and the Level of the Cabinet Secretary i.e. Rs.2,37,500/-.

Deputation Duty Allowance Calculation

Note: 1 “Basic pay’ in the revised pay structure (the pay structure based on 7th Central Pay Commission recommendations) means the pay drawn by the deputationist, from time to time, in the prescribed Level, in Pay Matrix, of the post held by him Substantively in the parent Cadre, but does not include any other type Of pay like personal pay, etc.

Eligibility for Deputation Allowance

Note: 2 In cases where the basic pay in parent Cadre has been upgraded on account of non-functional upgradation (NFU), Modified Assured Career Progression Scheme (MACP), Non-Functional Selection Grade (NFSG), etc., the upgraded basic pay under Such upgradations shall not be taken into account for the purpose of Deputation (Duty) Allowance.

Proforma Promotion shall not be taken into account for Deputation (Duty) Allowance

Note 3 In the Case of a Proforma Promotion under Next Below Rule (NBR): If such a Proforma Promotion is in a Level of the Pay Matrix which is higher than that of the ex-Cadre post, the basic pay under such Proforma Promotion shall not be taken into account for the purpose of Deputation (Duty) Allowance. However, if such a Proforma Promotion under NBR is in a Level of the pay matrix which is equal to or below that of the ex-cadre post, Deputation (Duty) Allowance shall be admissible on the basic pay of the parent Cadre post allowed under the proforma promotion, if opted by the deputationist.

Note 4. In case of Reverse Foreign Service, if the appointment is made to post whose pay structure and/ or Dearness Allowance (DA) pattern is dissimilar to that in the parent Organization, the Option for electing to draw the basic pay in the parent cadre along with the Deputation (Duty) Allowance thereon and the personal pay, if any will not be available to such employee.

Deputation within the same station

Note: 5 The term ‘same station’ for the purpose will be determined with reference to the station where the person was on duty before proceeding on deputation.

Note: 6 Where there is no change in the headquarters with reference to the last post held, the transfer should be treated as within the same station and when there is change in headquarters it would be treated as not in the same station. So far as places falling within the same urban agglomeration of the Old headquarters are Concerned, they would be treated as transfer within the same station.

5. Para 6. 1 of DoPT OM No.6/8/2009 – Estt (Pay-II) dated 17.6.2010 stands amended to the above effect.

The above order is issued by DoPT vide its OM No.No.2/11/2017-Estt. (Pay-II) Dated the 24th November 2017

A question was raised in Parliament in respect of Deputation duty Allowance and its revised rates in 7th Pay Commission. The Question and Answer is given below

GOVERNMENT OF INDIA

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

LOK SABHA

UNSTARRED QUESTION NO: 3062

ANSWERED ON: 14.03.2018

Deputation Allowance

SUMEDHANAND SARASWATI

OM PRAKASH YADAV

RODMAL NAGAR

Will the Minister of PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS be pleased to state:-

(a) whether the Government proposes to increase the deputation allowance of the Central Government employees;

(b) if so, the amount of financial burden likely to be borne by the Government in this regard; and

(c) the number of the Central Government employees in various States likely to be benefitted therefrom, State-wise including Rajasthan, Bihar and Madhya Pradesh?

ANSWER

MINISTER OF STATE IN THE MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS AND MINISTER OF STATE IN THE PRIME MINISTER’S OFFICE

(DR. JITENDRA SINGH)

(a): Consequent upon acceptance of the recommendations of 7th Central Pay Commission(CPC) regarding revision of rates of Deputation (Duty) Allowance by Department of Expenditure vide Resolution No. 11-1/2016-IC dated 6th July, 2017, this Department has issued OM No. 2/11/2017-Estt.(Pay–II) dated 24th November, 2017 revising the rates of Deputation (Duty) Allowance.[ See the Finmin Order ]

Now, in case of deputation within the same station, the Deputation (Duty) Allowance is prescribed at the rate of 5% of basic pay subject to a maximum of Rs. 4500/- p.m. and in case of deputation involving change of station, the Deputation (Duty) Allowance is prescribed at the rate of 10% of basic pay subject to a maximum of Rs. 9000/- p.m. This is subject to certain other conditions.

(b): No separate financial implication in respect of Deputation (Duty) Allowance has been reported by the 7th CPC/Committee on Allowances.

(c): No such centralized data is being maintained in this regard.

Deputation Duty Allowance for personal staff of Ministers

According to the DoPT Order No. 2/8/20 18-Estt.(Pay-II) Dated: 7th February, 2019, the pay of employees who are appointed in the personal staff of Ministers will be regulated in the following manner :-

I. OFFICERS OF CENTRAL GOVERNMENT/AUTONOMOUS BODIES APPOINTED IN THE PERSONAL STAFF OF MINISTERS:

(i) When the officers of the Central Government/Autonomous bodies holding posts at lower levels, or those who are not cleared for appointments at levels at which the posts in the Personal Staff of Ministers exist, are appointed to higher posts, in addition to their basic pay in their parent cadre, they may be allowed Deputation (Duty) Allowance at the rate of 15 % of their basic pay, subject to a maximum of Rs.9000/- per month.

(ii) As regards the officers who go on deputation to equivalent or analogous posts in the Personal Staff of the Ministers, in addition to their basic pay, they may be allowed Deputation (Duty) Allowance in accordance with this Department’s OM No. 2/11/2017- Estt.(Pay-II) dated 24th November, 2017.

(iii) The officers of All India Services and Organized Group ‘A’ Central Services who are appointed in the Personal Staff of Ministers under the Central Staffing Scheme, may be allowed Central Secretariat (Deputation on Tenure) Allowance in accordance with this Department’s OM No.2/10/2017-Estt. Pay.II dated 24th April,2018.

II. OFFICERS FROM STATE GOVERNMENTS/PUBLIC SECTOR UNDERTAKINGS APPOINTED IN THE PERSONAL STAFF OF MINISTERS:

In the case of the officers from State Governments/Public Sector Undertakings, their terms of appointment may be governed by the orders contained in this Department’s OM No.6/8/2009-Estt.(Pay-II) dated 17th June, 2010. The rate of Deputation (Duty) allowance payable in their case will be in accordance with this Department’s OM No.2/11/2017- Estt. (Pay-Il) dated 24th November, 2017.

III. OFFICERS FROM PRIVATE SECTOR APPOINTED IN THE PERSONAL STAFF OF MINISTERS:

In the case of officers from Private Sector appointed in the Personal Staff of Ministers, their pay shall be fixed at the minimum pay or the first Cell in the Level applicable to the post to which such employees are appointed, as per Rule 8 of the CSS(RP) Rules, 2016. However, where it is proposed to fix their pay by granting advance increment (s), the approval of this Department will have to be obtained.

IV. APPOINTMENT OF RETIRED PENSIONERS IN MINISTER’s PERSONAL STAFF:-

In the case of persons retired from Defence Forces or Civilian Organizations and appointed in the personal Staff of Ministers, their pay shall be fixed in accordance with the provisions contained in OM No.3/3/2016-Estt.( Pay-IT) dated 01.05.2017.

Basic pay in the revised pay structure means the pay drawn in the prescribed Level of Pay Matrix. These orders shall come into effect w.e.f 01.07.2017.