Pay fixation for upgraded Scales and bunching benefits in 7th CPC

Entry Pay

5.1.31 The Commission has received numerous representations on the issue of fixation of entry pay for direct recruits at a level higher than those promoted into the same level from below. In the existing system, the entry pay for new or direct recruits takes into consideration the weightage given to qualifying service prescribed by DoPT, whereas for those reaching the grade through promotion from lower grade, the entry pay is fixed at the minimum of the pay band plus grade pay corresponding to the new grade. The entry pay therefore varies, and is different for those entering a level directly and those getting promoted into it. There have been demands for a uniform entry pay for all.

5.1.32 In the new pay matrix, it is proposed that direct recruits start at the minimum pay corresponding to the level to which recruitment is made, which will be the first cell of each level. For example a person entering service as a direct recruit at level 3 will get a pay of ₹21,700, at level 8 of ₹47,600, at level 10 of ₹56,100 and so on.

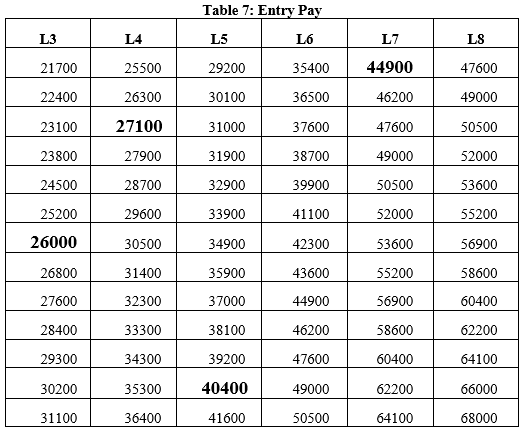

5.1.33 For those who have been promoted from the previous level, the fixation of pay in the new level will depend on the pay they were already drawing in the previous level. For instance, if a person who was drawing ₹26,000 in level 3 gets a promotion to level 4, his pay fixation will be as shown in Table 7:

Step 1: After grant of one increment in level 3 the pay increases to ₹26,800 in level 3 itself.

Report of the Seventh CPC

Step 2: Locate the equal or next higher amount in level 4 which in this case will be ₹27,100. Hence the new pay on promotion from level level 3 to level 4 will be fixed at ₹27,100.

5.1.34 In case of a direct recruit to level L4 the entry pay will be fixed at the start of the level L4 i.e., at ₹25,500.

5.1.35 To take another example, if a person drawing Basic Pay of, say, ₹40,400 in level L5 is promoted to L7, the steps to arriving at his pay on promotion will be to first add one increment within level L5 to arrive at ₹41,600, and then fix the pay at ₹44,900 in level L7 as ₹44,900 is the nearest, next higher figure to ₹41,600 in the column of figures for level L7.

5.1.36 Although the rationalisation has been done with utmost care to ensure minimum bunching at most levels, however if situation does arise whenever more than two stages are bunched together, one additional increment equal to 3 percent may be given for every two stages bunched, and pay fixed in the subsequent cell in the pay matrix.

5.1.37 For instance, if two persons drawing pay of ₹53,000 and ₹54,590 in the GP 10000 are to be fitted in the new pay matrix, the person drawing pay of ₹53,000 on multiplication by a factor of 2.57 will expect a pay corresponding to ₹1,36,210 and the person drawing pay of ₹54,590 on multiplication by a factor of 2.57 will expect a pay corresponding to ₹1,40,296. Revised pay of both should ideally be fixed in the first cell of level 15 in the pay of ₹1,44,200 but to avoid bunching the person drawing pay of ₹54,590 will get fixed in second cell of level 15 in the pay of ₹1,48,500

READ : Pay fixation for the Post where its Grade Pay Upgraded by Seventh CPC

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

Government may recover one month salary/pension instead of freezing 18monthsda/dr

Please let me know the SC ruling on freezing da

You got 2 Financial Up-gradations after your appointment and third MACP will be granted w.e.f September 2020. No issues in granting MACP. But more detail is required to check weather your pay fixation is correct or not

Sir, I am appointed in ITBP as NK/RO. (B/Pay-950/-) on sept. 1990.1st ACP scheme allotted me on Sept. 2002 with B/pay 5500/-& 2nd MACP on Sept 2010 (G/pay 4600)/- P/band-7).. Presently my pay is 64100/-.Request confirm my present pay is correct as per pay fixation or not.

I was retired as sr. Accounts officer on 30.11.2016. My basic pay as on 01.01.2016 was 32880 including grade pay 5400 in pay band 3 what will be my pay in bunching scheme as on 01.01.2016

Bunching benifit is a nightmare. Mr X and Mr Y Joined in August 2002 and August 2003 respectively in the scale of 6500. As on 31/12/2005 their pays were 7100 and 6900 respectively . Hence their 6th cpc pays were 13210 and 12840 respectively in PB2 with 4600 GP. Subsequently they were granted with 1st MACP inAugust2012 and August2013 respectively in PB2 and GP 4800.

As on 31/12/ 2015 Mr X was drawing 20120 +4800=24920 and Mr Y was drawing 19590+4800=24390.

As per 7th CPC both Mr X and Mr Y were granted 64100 in level 8.

All though Mr X has drawn one extra increment as he is senior by one year with respect to Mr Y ,both of them are in same stage.

More over the bunching benifit is also not allowable as the criteria of 3% difference is not met.

So 7 CPC is 2.57% for Mr X and 2.62% for Mr Y.

Is there any way out for Mr X to maintain his pay difference with Mr Y ?

Not accepting by DOPT

Pre 2016 Basic Rs.24130 in the Pay band 15600 -39100 Grade Pay 5400 is he allowed to draw pension Rs.32500 by bunching of fixation rule

Has bunching benefit being implemented any offices? In CAG office it is not implemented. Please tell me if anyone got the benefit of bunching circular.

When Govt will published crystal clear clarification on bunching benefits?

two employees were drawing pay(Pay Band+Pay Grade4600) 15780(including PG) and 17040 as on 1.1.16 and both were fixed in 7th pay commission on 44900/- as on 1.1.2016, now ministry of finance has issued circular on 7/9/2016 on bunching benefits/increment, my question is that “Is second employees (17040) will entitled for bunching benefits as per bunching circular dated 7/9/2016?”

My pay on 1.1.2016 is 21630/- (PB-3, GP:5400) where is my pay fixed. whether cadre and grade pay is essential to applying bunching effect.

I promoted to grade ii on April 2015 on 01.01.2016 my pay fixed on 44900 as per 7 cpc. Can I eligible for bunching benefits. As per order issued on sep 16. Plz clear my point

Why my comment has not been published. This is real fact. Govt has to rectify such anomaly at the earliest.

Promotion from 2800 g.p.to 4200g.p.in 7th pay commission is a blunder anomaly in 7th c.p.c….if an employee working 5 years in 2800g.p.when he promoted to 4200 g.p. he gain very less many….respect of 6th c.p.c…it is a great anomaly… This is India….Mathur was the chief of the pay commission…

Read a joke of pay fixation.

Mr A,B, C&D serving in one unit and same cadre whose Basic pay including grade pay of Rs4600 in PB-2 were Rs 22290, Rs 21830,, Rs 21370, &Rs 20890 respectively as on 31 Dec 2015..

All these employees has been appointed before 6th cpc and difference between their basic pay was one increments respectively.

In 7th cpc Mr A has been fixed in 10th cell of level 7 of pay matrix , Mr.B has been fixed in 9th cell of level 7 of pay matrix and Mr C&D both has been fixed in 8th cell of level 7 of pay matrix means both of them got bunched.

The difference of basic pay between A&B were Rs 460 /- and fixed in different cell of level 7 pay matrix and difference between C&D were Rs 480/- which was more as compare to A&B but Mr C&D both are now fixed in a same cell of pay matrix.

Difference between two senior succusive stages less and getting fixed in different cell of pay matrix and difference between two succusive stages more in same level is getting bunched and not getting bunching benefits due the criteria of 3 % difference in basic pay not met.

Govt has to do justice with all employees whether they have been appointed before 6th cpc or in the 6th cpc.

two employees were drawing pay(Pay Band+Pay Grade4600) 15780(including PG) and 17040 as on 1.1.16 and both were fixed in 7th pay commission on 44900/- as on 1.1.2016, now ministry of finance has issued circular on 7/9/2016 on bunching benefits/increment, my question is that “Is second employees (17040) will entitled for bunching benefits as per bunching circular dated 7/9/2016?”

Two employees were drawing pay(PB+4600) ₹15780 and₹17040 as on 1.1.2016 in 6 pay commission, now they have fixed ₹44900 in 7pay commission as on 1.1.16, my question is that “is second employees is entitled for bunching benefits” as finance ministry circular dt 7/9/16

Bunching benifit is a nightmare. Mr X and Mr Y Joined in August 2002 and August 2003 respectively in the scale of 6500. As on 31/12/2005 their pays were 7100 and 6900 respectively . Hence their 6th cpc pays were 13210 and 12840 respectively in PB2 with 4600 GP. Subsequently they were granted with 1st MACP inAugust2012 and August2013 respectively in PB2 and GP 4800.

As on 31/12/ 2015 Mr X was drawing 20120 +4800=24920 and Mr Y was drawing 19590+4800=24390.

As per 7th CPC both Mr X and Mr Y were granted 64100 in level 8.

All though Mr X has drawn one extra increment as he is senior by one year with respect to Mr Y ,both of them are in same stage.

More over the bunching benifit is also not allowable as the criteria of 3% difference is not met.

So 7 CPC is 2.57% for Mr X and 2.62% for Mr Y.

Is there any way out for Mr X to maintain his pay difference with Mr Y ?