There is a Mystery over effective date of implementation of revised 7th CPC Allowances

Three dates are currently being speculated for implementation of revised Allowances – January 1, 2016; August 1, 2016; and April 1, 2017

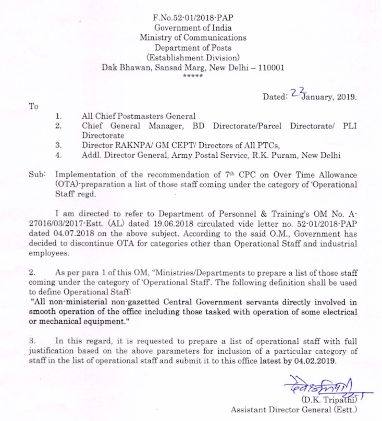

A high-level committee, under the chairmanship of Finance Secretary Ashok Lavasa was constituted by the Central Government to review the Seventh Pay Commission’s recommendations regarding the allowances being given to the Central Government employees. According to information, the committee had already submitted its report on February 22.

One could see that the 7th Pay Commission suggested either rationalization or simplification at many places. An example is the Pay Matrix Table, which has now brought the entire Pay Structure of more than 35 lakh employees under one Table. Although there are some anomalies, the system has dramatically simplified the process of annual increment calculation and also pay fixation on Promotion or MACP.

At present 196 different kinds of allowances are being given to the Central Government employees. Some modifications have been recommended in these too as part of the rationalization and simplification drive. The Seventh Pay Commission has recommended the abolition of 52 allowances. And another 36 allowances have been abolished as separate identities, but subsumed either in an existing allowance or in newly proposed allowances.

The Commission said that the entire range of allowances is administered in broadly four ways. Fully DA indexed Allowances, Partially or Semi DA indexed Allowances, No DA indexation Allowances and Percentage based Allowances. House Rent Allowance is being under the category of Percentage based Allowances. The Commission also said that the compensation towards the housing needs of Central Government employees is covered in many ways. The Commission finally suggested that the percentage based allowances by a factor of 0.8, the Commission recommends that HRA should be rationalized to 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively.

The big irritation, or rather disappointment to the Central Government employees was the recommendation to reduce the percentage of House Rent Allowance (HRA).

All trade unions have expressed their harsh opposition to the proposed cuts in HRA. The Central Government employees’ Federations also expressed their disappointment through various protest. Finally the Central Government accepted to constitute a high level committee to examine the recommendations of 7th Pay Commission regarding Allowances.

Now, sources claim that the committee has already submitted its report to the government.

The government can announce its final decision on the recommendations of the committee any day. But, many believe that there could be a delay in the announcements due to the state elections that are being held in various parts of the country and the election commission’s guidelines that are being enforced now.

Unconfirmed reports say that the committee has recommended the percentage rates of HRA as per 6th CPC and changes in the method of calculating Transport Allowances also.

The biggest mystery however is – will these recommendations be given retrospective effect and will arrears be given?

Three dates are currently being suggested – January 1, 2016; August 1, 2016; and April 1, 2017.

Only the Central Government has all the answers right now.

Get Free Email Updates

Follow us on Telegram Channel, Twitter & Facebook and Whatsapp Channel for all Latest News and Updates

This is only media speculation. As the three dates viz 1st Jan 16, 1st Aug 16 and 1st April 17 are having its own merits, it is easy to guess something. As far as Allowance Committee report is concerned, that is a confidential report and may be exposed soon after the completion of state election process.

And regarding the revision of allowances, committee hasn’t disclosed any possibilities. Even after the meeting with NJCA leaders, the committee only gathered feedback from them. Neither they assured nor expressed their desire. What does it mean? The committee doesn’t have the freedom to adjudicate their own regarding the allowances. They have to submit their findings to the government, that’s all.

Another thing is there was a favourable consideration and complete report with the 7th Pay Commission. But surprisingly, government extended its term by four months. And in the extended term, 7th CPC incorporated the every dictate of government. This Allowances Committee’s term also extended all of a sudden. The extended term also expired, but still there is more and more time, thanks to the election code of conduct, media has plenty of chances to speculate more and more…